Should We Worry About VST Industries Limited's (NSE:VSTIND) P/E Ratio?

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll look at VST Industries Limited's (NSE:VSTIND) P/E ratio and reflect on what it tells us about the company's share price. Looking at earnings over the last twelve months, VST Industries has a P/E ratio of 27.53. That is equivalent to an earnings yield of about 3.6%.

See our latest analysis for VST Industries

How Do I Calculate VST Industries's Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for VST Industries:

P/E of 27.53 = INR4644.00 ÷ INR168.68 (Based on the year to September 2019.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That isn't a good or a bad thing on its own, but a high P/E means that buyers have a higher opinion of the business's prospects, relative to stocks with a lower P/E.

Does VST Industries Have A Relatively High Or Low P/E For Its Industry?

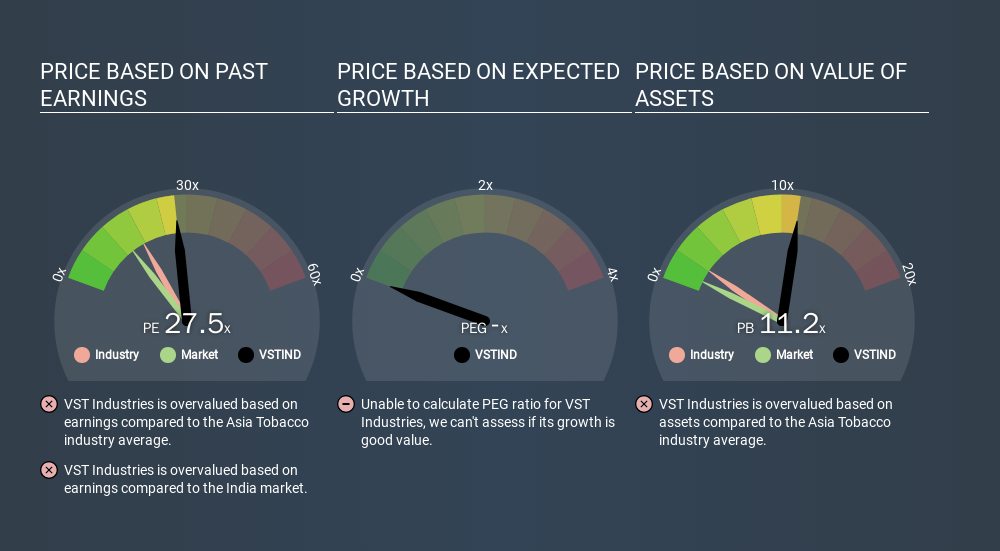

The P/E ratio essentially measures market expectations of a company. The image below shows that VST Industries has a higher P/E than the average (17.5) P/E for companies in the tobacco industry.

That means that the market expects VST Industries will outperform other companies in its industry. Shareholders are clearly optimistic, but the future is always uncertain. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. When earnings grow, the 'E' increases, over time. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Most would be impressed by VST Industries earnings growth of 20% in the last year. And earnings per share have improved by 8.7% annually, over the last five years. With that performance, you might expect an above average P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

How Does VST Industries's Debt Impact Its P/E Ratio?

Since VST Industries holds net cash of ₹5.6b, it can spend on growth, justifying a higher P/E ratio than otherwise.

The Bottom Line On VST Industries's P/E Ratio

VST Industries trades on a P/E ratio of 27.5, which is above its market average of 13.8. With cash in the bank the company has plenty of growth options -- and it is already on the right track. So it does not seem strange that the P/E is above average.

Investors should be looking to buy stocks that the market is wrong about. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:VSTIND

VST Industries

Engages in the manufacturing, trading, and marketing of cigarettes, tobacco, and tobacco products in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026