Venky's (India) Limited's (NSE:VENKEYS) Stock is Soaring But Financials Seem Inconsistent: Will The Uptrend Continue?

Venky's (India)'s (NSE:VENKEYS) stock is up by a considerable 6.0% over the past month. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Specifically, we decided to study Venky's (India)'s ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Venky's (India)

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Venky's (India) is:

10% = ₹931m ÷ ₹9.2b (Based on the trailing twelve months to December 2020).

The 'return' is the yearly profit. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.10 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Venky's (India)'s Earnings Growth And 10% ROE

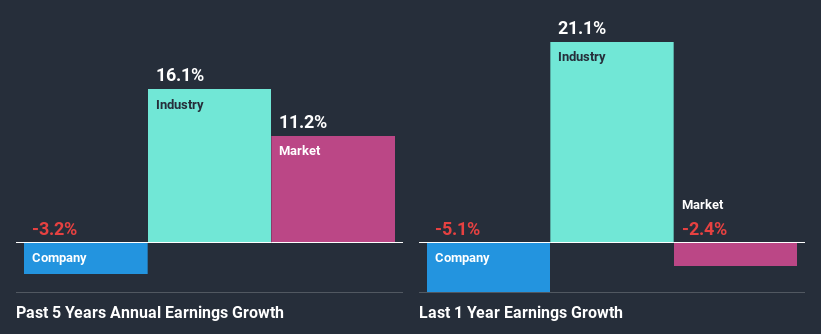

When you first look at it, Venky's (India)'s ROE doesn't look that attractive. However, its ROE is similar to the industry average of 11%, so we won't completely dismiss the company. But then again, Venky's (India)'s five year net income shrunk at a rate of 3.2%. Remember, the company's ROE is a bit low to begin with. So that's what might be causing earnings growth to shrink.

So, as a next step, we compared Venky's (India)'s performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 16% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Venky's (India) is trading on a high P/E or a low P/E, relative to its industry.

Is Venky's (India) Making Efficient Use Of Its Profits?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Summary

On the whole, we feel that the performance shown by Venky's (India) can be open to many interpretations. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 1 risk we have identified for Venky's (India) visit our risks dashboard for free.

If you decide to trade Venky's (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:VENKEYS

Venky's (India)

Primarily engages in the production and sale of poultry products in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives