- India

- /

- Professional Services

- /

- NSEI:QUESS

Godrej Consumer Products And Two More Indian Exchange Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Indian stock market has experienced a notable uptrend over the past year, increasing by 43%, despite a recent dip of 1.3% in the last week. Given these conditions, stocks like Godrej Consumer Products that combine strong insider ownership with robust growth prospects are particularly compelling.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Pitti Engineering (BSE:513519) | 30.3% | 28.0% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Here we highlight a subset of our preferred stocks from the screener.

Godrej Consumer Products (NSEI:GODREJCP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Godrej Consumer Products Limited is a fast-moving consumer goods company that manufactures and markets personal care and home care products across India, Africa, Indonesia, the Middle East, the USA, and other international markets, with a market capitalization of approximately ₹1.49 trillion.

Operations: The company generates ₹140.96 billion from its manufacturing of personal, household, and hair care products.

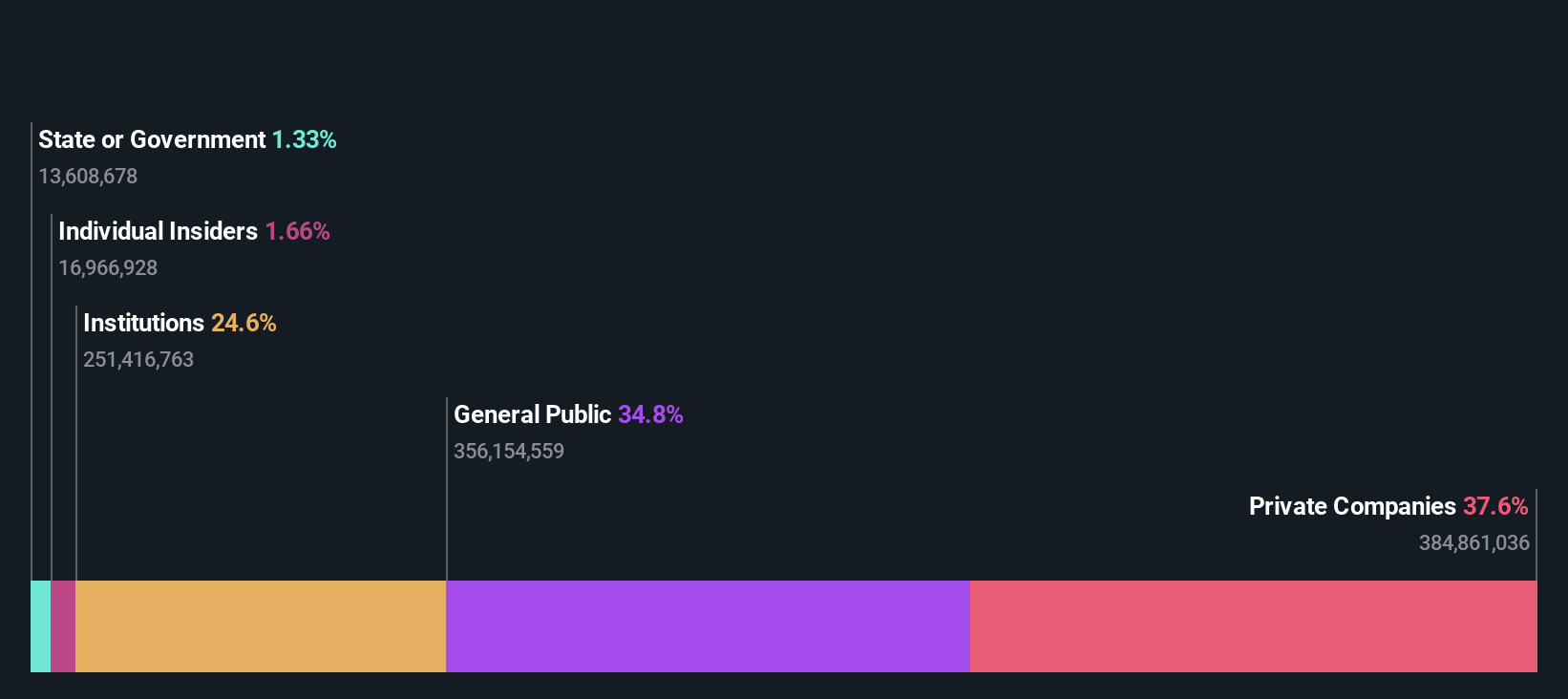

Insider Ownership: 13.3%

Godrej Consumer Products, despite its recent financial struggles with a reported net loss and decreased earnings per share, shows potential for recovery. The company is expected to become profitable in the next three years, with an above-average forecasted annual profit growth. Additionally, it maintains a high forecasted return on equity of 20.5%. However, its revenue growth at 9.4% per year is slightly below the Indian market average of 9.5%, and its modest dividend yield is poorly covered by earnings. Recent executive changes and strategic appointments suggest an internal restructuring that might influence future performance positively.

- Dive into the specifics of Godrej Consumer Products here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Godrej Consumer Products shares in the market.

Quess (NSEI:QUESS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quess Corp Limited is a business services provider operating in India, South East Asia, the Middle East, and North America, with a market capitalization of approximately ₹102.02 billion.

Operations: The company generates revenue through three primary segments: Workforce Management (₹134.42 billion), Operating Asset Management (₹28.01 billion), and Global Technology Solutions excluding Product Led Business (₹23.40 billion).

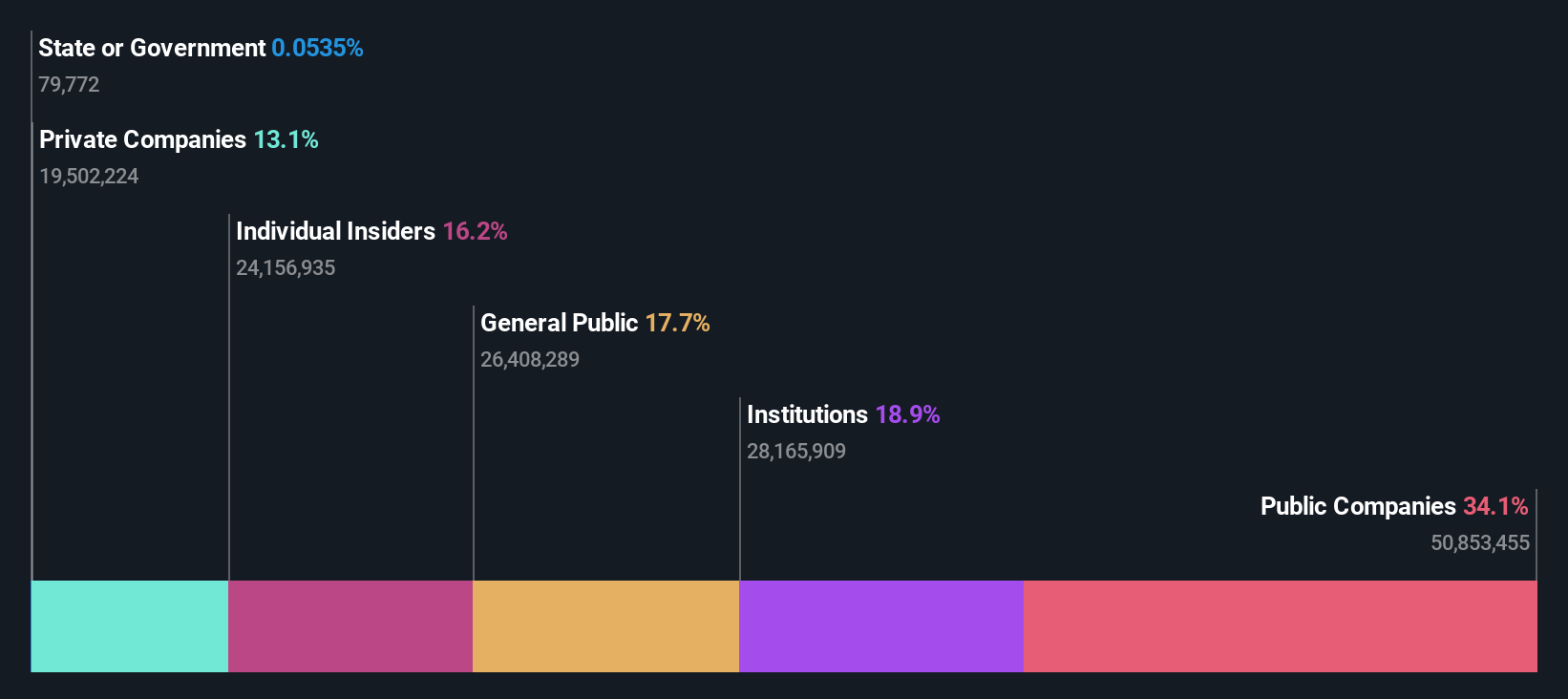

Insider Ownership: 15.8%

Quess Corp, a company with substantial insider ownership, has shown robust financial performance with a significant increase in net income and earnings per share as reported in its recent quarterly results. Despite the absence of major insider buying over the last three months, the firm is undergoing strategic shifts including appointing a new CEO for its demerging technology solutions sector. This move is expected to enhance its capabilities in AI and digital services, catering especially to healthcare and financial sectors. However, it's important to note that Quess's revenue growth rate is forecasted to be slower compared to some market benchmarks.

- Unlock comprehensive insights into our analysis of Quess stock in this growth report.

- Our valuation report unveils the possibility Quess' shares may be trading at a premium.

Varun Beverages (NSEI:VBL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited operates as a franchisee of PepsiCo, producing and distributing carbonated soft drinks and non-carbonated beverages, with a market cap of approximately ₹2.09 trillion.

Operations: The company generates ₹164.67 billion from the manufacturing and sale of beverages.

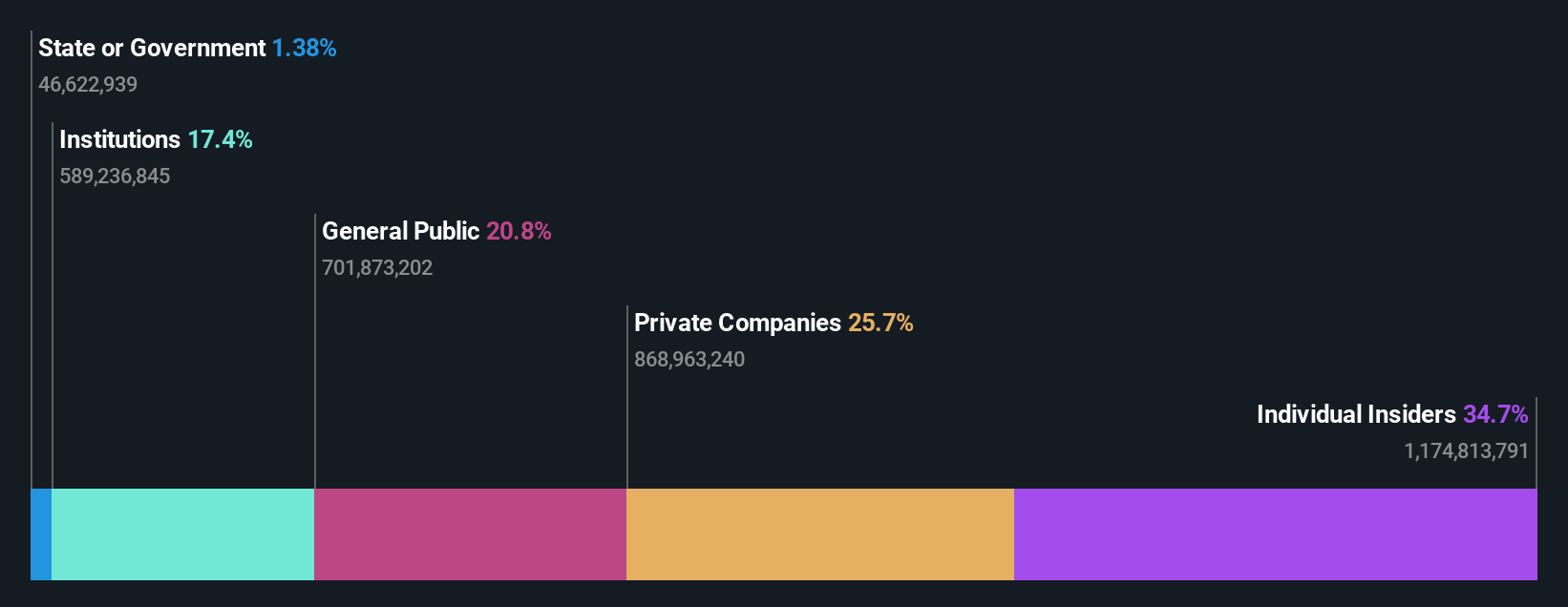

Insider Ownership: 36.4%

Varun Beverages, marked by high insider ownership, is expanding its operations into Zimbabwe with new subsidiaries and product lines. Recent financials show a 16.5% revenue growth year-over-year, reaching INR 44.06 billion with a net income increase to INR 5.37 billion. Despite carrying a high level of debt, the company's earnings are expected to grow significantly at an annual rate of 24.48%, outpacing the Indian market forecast of 16%. The firm's strategic appointments and expansions indicate robust internal confidence and growth trajectory.

- Get an in-depth perspective on Varun Beverages' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Varun Beverages' share price might be on the expensive side.

Taking Advantage

- Dive into all 83 of the Fast Growing Indian Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Quess might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:QUESS

Quess

Operates as a business services provider in India, South East Asia, the Middle East, and North America.

Flawless balance sheet, undervalued and pays a dividend.