Earnings Miss: United Breweries Limited Missed EPS By 20% And Analysts Are Revising Their Forecasts

United Breweries Limited (NSE:UBL) just released its latest annual report and things are not looking great. Results showed a clear earnings miss, with ₹41b revenue coming in 4.4% lower than what the analystsexpected. Statutory earnings per share (EPS) of ₹4.28 missed the mark badly, arriving some 20% below what was expected. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

View our latest analysis for United Breweries

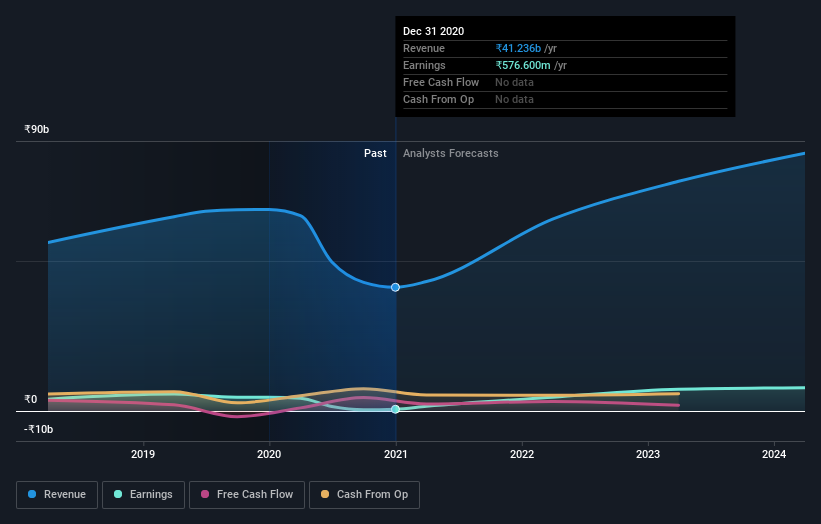

Taking into account the latest results, the most recent consensus for United Breweries from seven analysts is for revenues of ₹63.9b in 2022 which, if met, would be a sizeable 55% increase on its sales over the past 12 months. Per-share earnings are expected to leap 854% to ₹20.84. Before this earnings report, the analysts had been forecasting revenues of ₹68.6b and earnings per share (EPS) of ₹21.21 in 2022. The consensus seems maybe a little more pessimistic, trimming their revenue forecasts after the latest results even though there was no change to its EPS estimates.

The average price target was steady at ₹1,353even though revenue estimates declined; likely suggesting the analysts place a higher value on earnings. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic United Breweries analyst has a price target of ₹1,519 per share, while the most pessimistic values it at ₹968. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that United Breweries' rate of growth is expected to accelerate meaningfully, with the forecast 55% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 1.0% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 13% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect United Breweries to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple United Breweries analysts - going out to 2024, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for United Breweries that you need to be mindful of.

If you decide to trade United Breweries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:UBL

United Breweries

Engages in manufacture, purchase, and sale of beer and non-alcoholic beverages in India and internationally.

Excellent balance sheet with reasonable growth potential.