Three High Growth Indian Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

The Indian market has gained 2.8% recently and climbed 48% over the past year, with earnings forecast to grow by 16% annually. In this thriving environment, stocks with high insider ownership often signal strong confidence from those closest to the company's operations, making them particularly attractive for growth-focused investors.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 29.0% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 31.9% | 20.7% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 35.9% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 20.9% | 31.8% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 36% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33% |

Let's take a closer look at a couple of our picks from the screened companies.

Five-Star Business Finance (NSEI:FIVESTAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five-Star Business Finance Limited operates as a non-banking financial company in India with a market cap of ₹223.56 billion.

Operations: Five-Star Business Finance Limited generates revenue primarily from MSME Loans, Housing Loans, and Property Loans amounting to ₹17.79 billion.

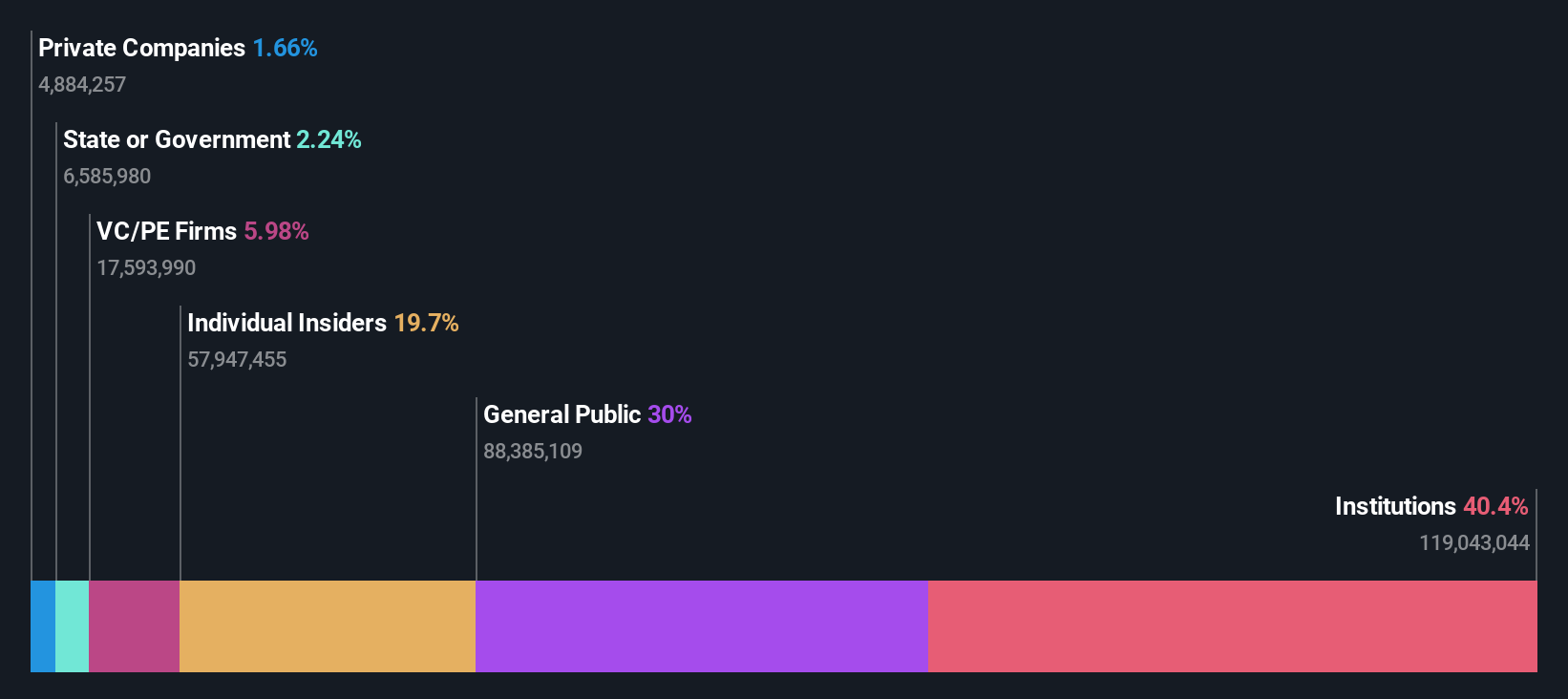

Insider Ownership: 19.7%

Five-Star Business Finance Limited demonstrates strong growth potential with revenue forecasted to grow at 23% per year, outpacing the Indian market's 9.7%. Recent earnings results show significant improvement, with Q1 revenue rising to ₹6.69 billion and net income increasing to ₹2.52 billion. The company's P/E ratio of 24.7x is attractive compared to the market average of 34.9x, making it a compelling option among growth companies with high insider ownership in India despite its low forecasted ROE of 19.6%.

- Get an in-depth perspective on Five-Star Business Finance's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Five-Star Business Finance's share price might be on the expensive side.

Suryoday Small Finance Bank (NSEI:SURYODAY)

Simply Wall St Growth Rating: ★★★★★☆

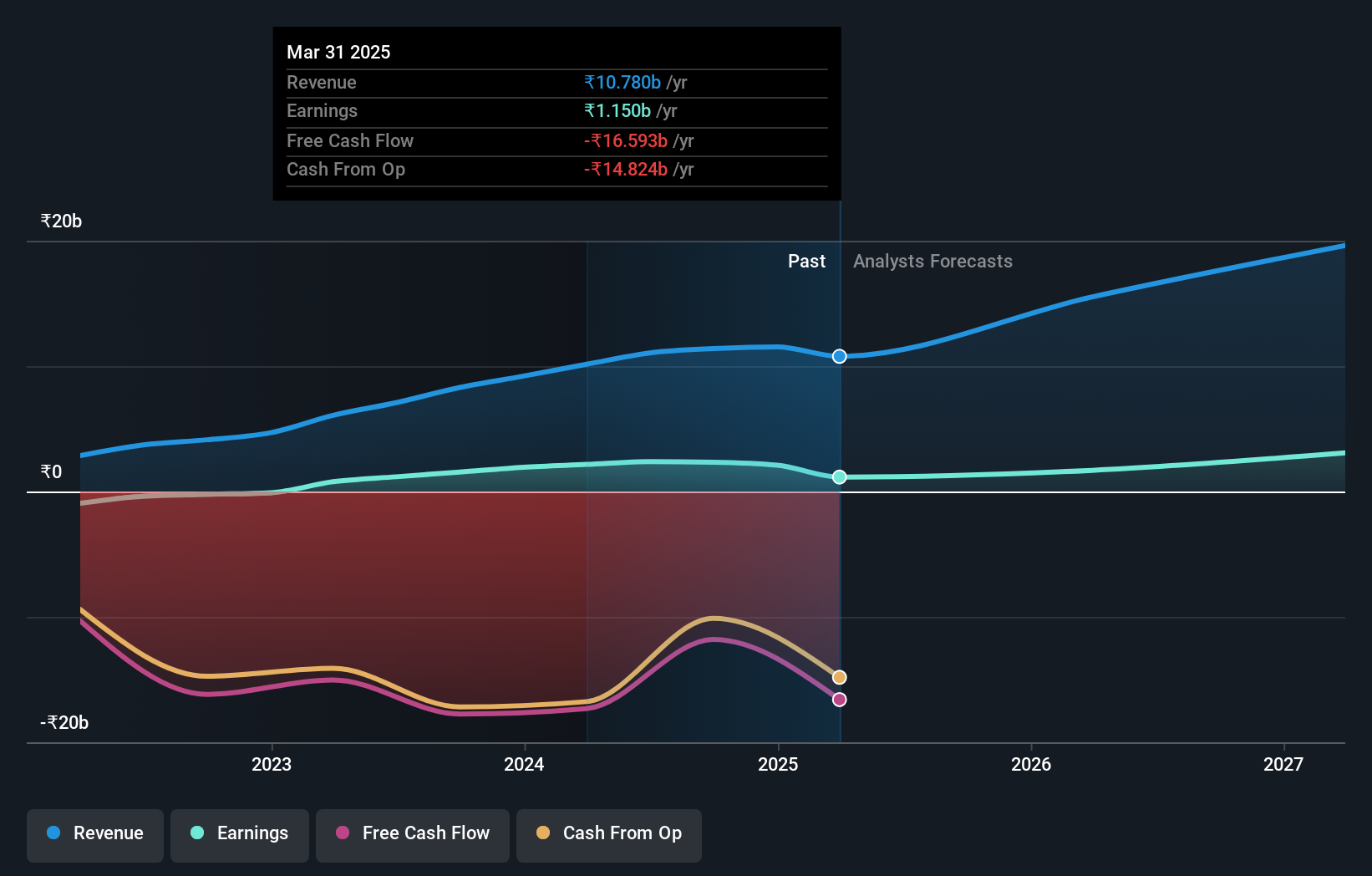

Overview: Suryoday Small Finance Bank Limited operates as a small finance bank in India, focusing on financial inclusion for the unserved and underserved, with a market cap of ₹20.96 billion.

Operations: The company's revenue segments include Treasury at ₹2.07 billion, Corporate at ₹1.00 billion, Retail Banking at ₹17.05 billion, and Other Banking Operations at ₹317.30 million.

Insider Ownership: 25.6%

Suryoday Small Finance Bank shows promising growth potential with revenue expected to grow at 29.8% annually, significantly above the Indian market's 9.7%. Despite a high level of non-performing loans (3%), its P/E ratio of 9.7x suggests good value compared to the market average of 34.9x. Recent earnings results reflect strong performance, with net income for Q1 rising to ₹700.6 million from ₹476 million a year ago, indicating robust profitability and growth prospects despite insider selling in recent months.

- Click here to discover the nuances of Suryoday Small Finance Bank with our detailed analytical future growth report.

- Our expertly prepared valuation report Suryoday Small Finance Bank implies its share price may be lower than expected.

Triveni Engineering & Industries (NSEI:TRIVENI)

Simply Wall St Growth Rating: ★★★★☆☆

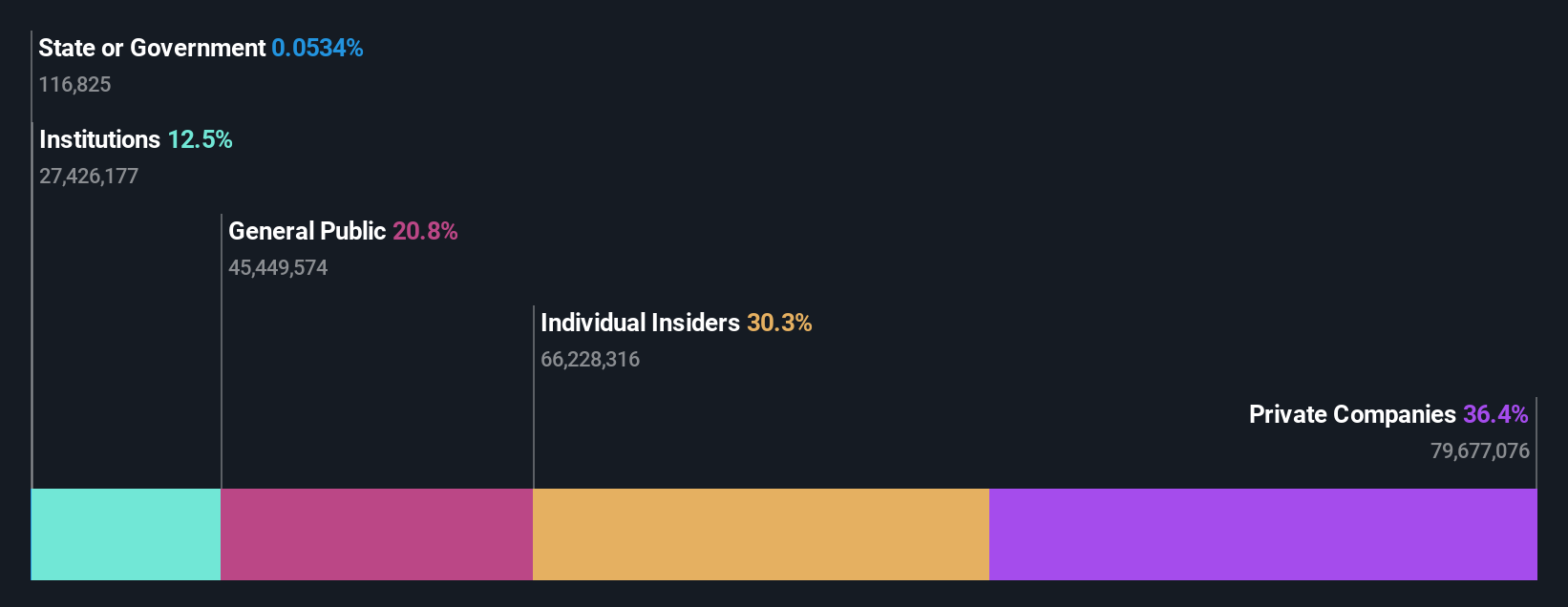

Overview: Triveni Engineering & Industries Limited operates in the sugar and engineering sectors both in India and internationally, with a market cap of ₹92.55 billion.

Operations: The company's revenue segments include ₹38.58 billion from Sugar & Allied Business - Sugar (Incl. Co-Generation), ₹22.05 billion from Sugar & Allied Business - Distillery, ₹2.92 billion from Engineering Businesses - Power Transmission, and ₹2.46 billion from Engineering Businesses - Water.

Insider Ownership: 30.1%

Triveni Engineering & Industries showcases growth potential with earnings forecasted to grow 21.63% annually, outpacing the Indian market's 16.4%. Despite a recent dip in net income for Q1 FY2025 (₹312.7 million vs. ₹676.1 million last year), the company trades at a favorable P/E ratio of 23x compared to the market average of 34.9x, indicating good relative value. Additionally, its new IMFL business launch and high insider ownership signal confidence in future prospects despite lower profit margins and dividend sustainability concerns.

- Click here and access our complete growth analysis report to understand the dynamics of Triveni Engineering & Industries.

- The valuation report we've compiled suggests that Triveni Engineering & Industries' current price could be quite moderate.

Key Takeaways

- Get an in-depth perspective on all 89 Fast Growing Indian Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Triveni Engineering & Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TRIVENI

Triveni Engineering & Industries

Engages in the sugar and allied businesses, and engineering businesses in India and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives