Shareholders have faith in loss-making Shree Renuka Sugars (NSE:RENUKA) as stock climbs 10% in past week, taking five-year gain to 675%

It hasn't been the best quarter for Shree Renuka Sugars Limited (NSE:RENUKA) shareholders, since the share price has fallen 24% in that time. But that does not change the realty that the stock's performance has been terrific, over five years. In fact, during that period, the share price climbed 675%. Impressive! So it might be that some shareholders are taking profits after good performance. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the stock has added ₹6.1b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Shree Renuka Sugars wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Shree Renuka Sugars saw its revenue grow at 21% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 51% per year in that time. It's never too late to start following a top notch stock like Shree Renuka Sugars, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

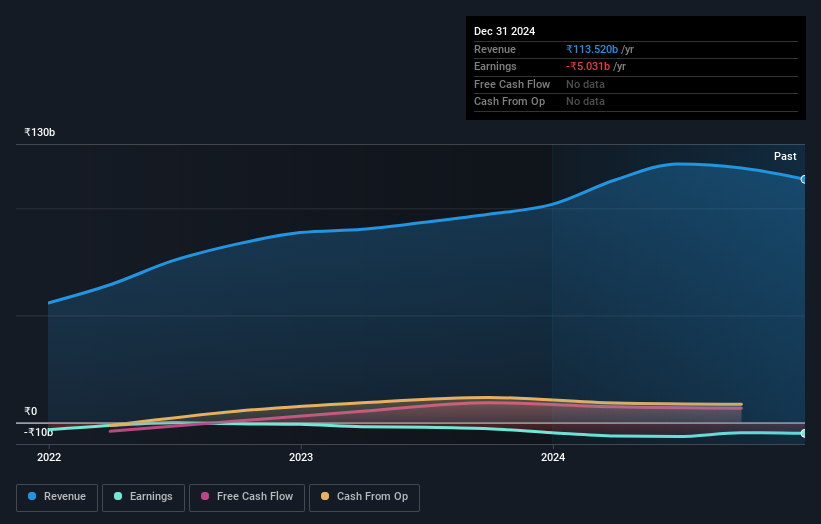

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Shree Renuka Sugars stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Shree Renuka Sugars had a tough year, with a total loss of 27%, against a market gain of about 5.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 51% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Shree Renuka Sugars you should be aware of.

But note: Shree Renuka Sugars may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RENUKA

Shree Renuka Sugars

Manufactures and refines sugar in India and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026