Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Radico Khaitan Limited (NSE:RADICO) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Radico Khaitan

What Is Radico Khaitan's Net Debt?

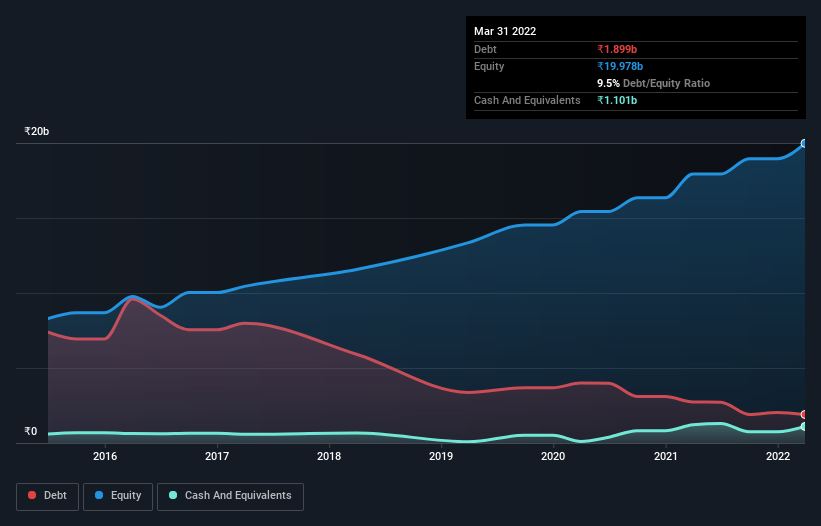

You can click the graphic below for the historical numbers, but it shows that Radico Khaitan had ₹1.90b of debt in March 2022, down from ₹2.73b, one year before. However, it also had ₹1.10b in cash, and so its net debt is ₹797.7m.

How Healthy Is Radico Khaitan's Balance Sheet?

According to the last reported balance sheet, Radico Khaitan had liabilities of ₹6.54b due within 12 months, and liabilities of ₹1.01b due beyond 12 months. Offsetting these obligations, it had cash of ₹1.10b as well as receivables valued at ₹7.86b due within 12 months. So it actually has ₹1.42b more liquid assets than total liabilities.

This state of affairs indicates that Radico Khaitan's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₹115.0b company is short on cash, but still worth keeping an eye on the balance sheet. Carrying virtually no net debt, Radico Khaitan has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Radico Khaitan's net debt is only 0.20 times its EBITDA. And its EBIT covers its interest expense a whopping 25.7 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On the other hand, Radico Khaitan saw its EBIT drop by 5.0% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Radico Khaitan will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Radico Khaitan's free cash flow amounted to 33% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Radico Khaitan's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its EBIT growth rate does undermine this impression a bit. Looking at all the aforementioned factors together, it strikes us that Radico Khaitan can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Radico Khaitan insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RADICO

Radico Khaitan

Engages in the manufacture and trading of Indian made foreign liquor (IMFL) and country liquor in India, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives