Do Proventus Agrocom's (NSE:PROV) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Proventus Agrocom (NSE:PROV). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Proventus Agrocom

How Fast Is Proventus Agrocom Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Recognition must be given to the that Proventus Agrocom has grown EPS by 41% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

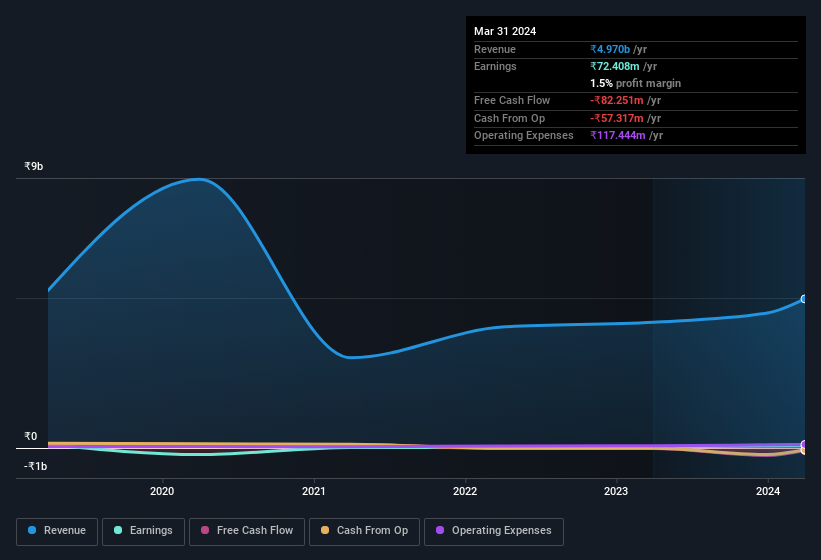

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Proventus Agrocom maintained stable EBIT margins over the last year, all while growing revenue 19% to ₹5.0b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Proventus Agrocom isn't a huge company, given its market capitalisation of ₹5.3b. That makes it extra important to check on its balance sheet strength.

Are Proventus Agrocom Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the company insider, Jitendra Jain, paid ₹4.5m to buy shares at an average price of ₹1,411. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Is Proventus Agrocom Worth Keeping An Eye On?

Proventus Agrocom's earnings per share growth have been climbing higher at an appreciable rate. Growth-minded people will be intrigued by the incredible movement in EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If this is the case, then keeping a watch over Proventus Agrocom could be in your best interest. What about risks? Every company has them, and we've spotted 2 warning signs for Proventus Agrocom (of which 1 is concerning!) you should know about.

Keen growth investors love to see insider activity. Thankfully, Proventus Agrocom isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PROV

Proventus Agrocom

Engages in the processing, distributing, and retail of health food in India.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives