Should You Be Adding Hatsun Agro Product (NSE:HATSUN) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Hatsun Agro Product (NSE:HATSUN). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Hatsun Agro Product

How Quickly Is Hatsun Agro Product Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Hatsun Agro Product managed to grow EPS by 12% per year, over three years. That's a pretty good rate, if the company can sustain it.

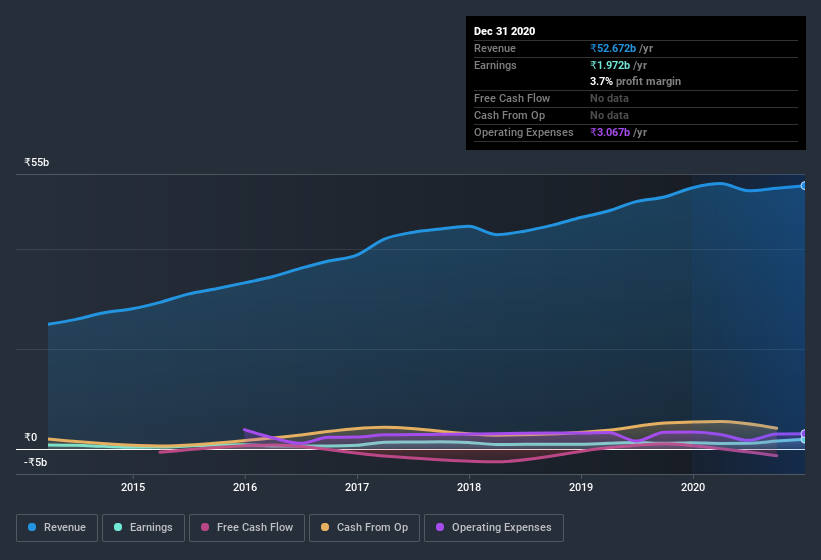

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. This approach makes Hatsun Agro Product look pretty good, on balance; although revenue is flattish, EBIT margins improved from 5.2% to 7.6% in the last year. That's something to smile about.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Hatsun Agro Product's balance sheet strength, before getting too excited.

Are Hatsun Agro Product Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold -₹79m worth of shares. But that's far less than the ₹533m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the Hatsun Agro Product's future. We also note that it was the MD & Executive Director, C. Sathyan, who made the biggest single acquisition, paying ₹516m for shares at about ₹619 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Hatsun Agro Product insiders own more than a third of the company. Indeed, with a collective holding of 78%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping ₹123b. That means they have plenty of their own capital riding on the performance of the business!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, C. Sathyan is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between ₹73b and ₹233b, like Hatsun Agro Product, the median CEO pay is around ₹37m.

The Hatsun Agro Product CEO received total compensation of just ₹8.2m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Hatsun Agro Product To Your Watchlist?

As I already mentioned, Hatsun Agro Product is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. You should always think about risks though. Case in point, we've spotted 3 warning signs for Hatsun Agro Product you should be aware of.

The good news is that Hatsun Agro Product is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Hatsun Agro Product, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hatsun Agro Product might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HATSUN

Hatsun Agro Product

Engages in manufacturing and marketing of milk, milk products, and cattle feed in India and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives