Apex Frozen Foods'(NSE:APEX) Share Price Is Down 60% Over The Past Three Years.

Apex Frozen Foods Limited (NSE:APEX) shareholders should be happy to see the share price up 10% in the last quarter. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 60% in the last three years. Some might say the recent bounce is to be expected after such a bad drop. Perhaps the company has turned over a new leaf.

See our latest analysis for Apex Frozen Foods

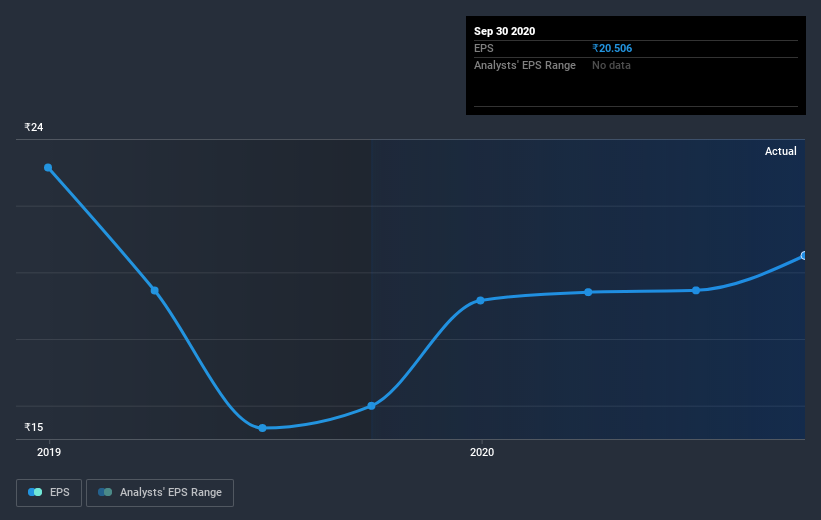

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, Apex Frozen Foods' earnings per share (EPS) dropped by 7.4% each year. The share price decline of 26% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Over the last year, Apex Frozen Foods shareholders took a loss of 28%, including dividends. In contrast the market gained about 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 17% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Apex Frozen Foods better, we need to consider many other factors. Even so, be aware that Apex Frozen Foods is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Apex Frozen Foods, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:APEX

Apex Frozen Foods

Engages in the farming, processing, production, and sale of shrimps in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives