- India

- /

- Oil and Gas

- /

- NSEI:SHUBHSHREE

With EPS Growth And More, Shubhshree Biofuels Energy (NSE:SHUBHSHREE) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Shubhshree Biofuels Energy (NSE:SHUBHSHREE), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Shubhshree Biofuels Energy with the means to add long-term value to shareholders.

How Fast Is Shubhshree Biofuels Energy Growing Its Earnings Per Share?

Over the last three years, Shubhshree Biofuels Energy has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Shubhshree Biofuels Energy's EPS shot from ₹8.60 to ₹15.44, over the last year. It's a rarity to see 79% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

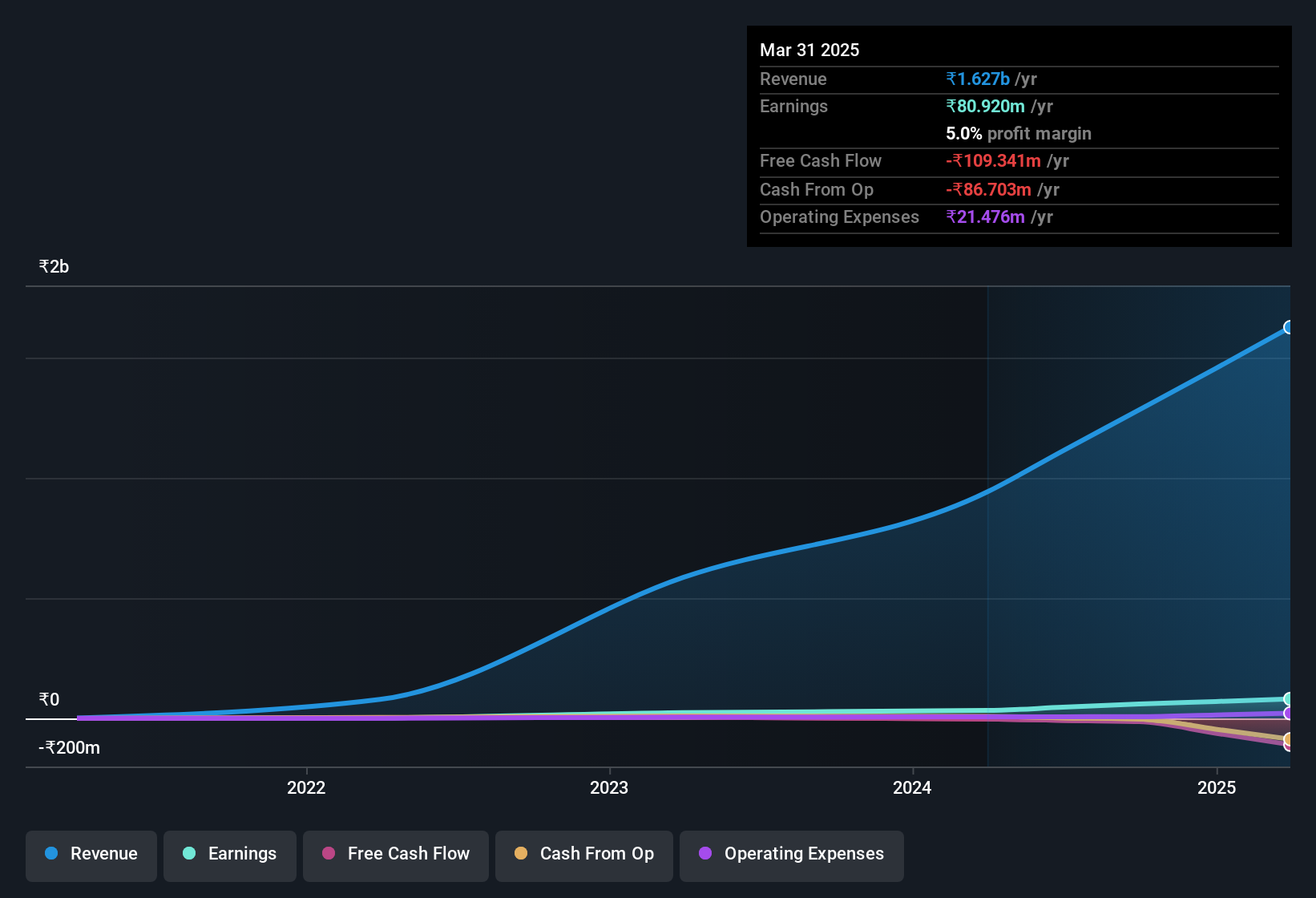

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Shubhshree Biofuels Energy achieved similar EBIT margins to last year, revenue grew by a solid 73% to ₹1.6b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

View our latest analysis for Shubhshree Biofuels Energy

Since Shubhshree Biofuels Energy is no giant, with a market capitalisation of ₹2.0b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Shubhshree Biofuels Energy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in Shubhshree Biofuels Energy in the previous 12 months. With that in mind, it's heartening that Anurag Agarwal, the Whole Time Director of the company, paid ₹2.3m for shares at around ₹322 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

On top of the insider buying, we can also see that Shubhshree Biofuels Energy insiders own a large chunk of the company. To be exact, company insiders hold 63% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, Shubhshree Biofuels Energy is a very small company, with a market cap of only ₹2.0b. So this large proportion of shares owned by insiders only amounts to ₹1.3b. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Shubhshree Biofuels Energy's CEO, Sagar Agrawal, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Shubhshree Biofuels Energy, with market caps under ₹18b is around ₹4.1m.

The Shubhshree Biofuels Energy CEO received total compensation of only ₹1.8m in the year to March 2025. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Shubhshree Biofuels Energy To Your Watchlist?

Shubhshree Biofuels Energy's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Shubhshree Biofuels Energy deserves timely attention. Still, you should learn about the 2 warning signs we've spotted with Shubhshree Biofuels Energy (including 1 which shouldn't be ignored).

The good news is that Shubhshree Biofuels Energy is not the only stock with insider buying. Here's a list of small cap, undervalued companies in IN with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHUBHSHREE

Shubhshree Biofuels Energy

Engages in the manufacturing and trading of biomass pellets, briquettes, coal, and wood chips products in India.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives