- India

- /

- Oil and Gas

- /

- NSEI:PETRONET

Petronet LNG Limited's (NSE:PETRONET) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- Petronet LNG to hold its Annual General Meeting on 6th of September

- Salary of ₹22.4m is part of CEO Akshay Singh's total remuneration

- Total compensation is similar to the industry average

- Petronet LNG's total shareholder return over the past three years was 84% while its EPS grew by 8.2% over the past three years

Performance at Petronet LNG Limited (NSE:PETRONET) has been reasonably good and CEO Akshay Singh has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 6th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Petronet LNG

How Does Total Compensation For Akshay Singh Compare With Other Companies In The Industry?

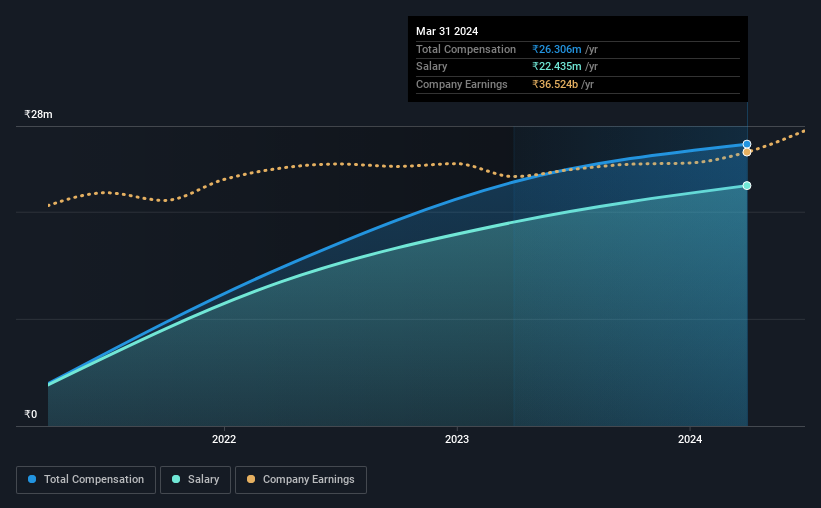

Our data indicates that Petronet LNG Limited has a market capitalization of ₹551b, and total annual CEO compensation was reported as ₹26m for the year to March 2024. We note that's an increase of 16% above last year. In particular, the salary of ₹22.4m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the Indian Oil and Gas industry with market caps ranging from ₹335b to ₹1.0t, we found that the median CEO total compensation was ₹21m. So it looks like Petronet LNG compensates Akshay Singh in line with the median for the industry. Furthermore, Akshay Singh directly owns ₹1.5m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹22m | ₹19m | 85% |

| Other | ₹3.9m | ₹3.7m | 15% |

| Total Compensation | ₹26m | ₹23m | 100% |

Talking in terms of the industry, salary represented approximately 81% of total compensation out of all the companies we analyzed, while other remuneration made up 19% of the pie. There isn't a significant difference between Petronet LNG and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Petronet LNG Limited's Growth

Petronet LNG Limited's earnings per share (EPS) grew 8.2% per year over the last three years. It saw its revenue drop 4.9% over the last year.

We would prefer it if there was revenue growth, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Petronet LNG Limited Been A Good Investment?

Most shareholders would probably be pleased with Petronet LNG Limited for providing a total return of 84% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Petronet LNG that investors should think about before committing capital to this stock.

Switching gears from Petronet LNG, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PETRONET

Petronet LNG

Engages in the import, storage, regasification, and supply of liquefied natural gas (LNG) in India.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success