- India

- /

- Oil and Gas

- /

- NSEI:KOTYARK

With EPS Growth And More, Kotyark Industries (NSE:KOTYARK) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kotyark Industries (NSE:KOTYARK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kotyark Industries with the means to add long-term value to shareholders.

Check out our latest analysis for Kotyark Industries

Kotyark Industries' Improving Profits

In the last three years Kotyark Industries' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Kotyark Industries' EPS has risen over the last 12 months, growing from ₹11.83 to ₹14.22. That's a 20% gain; respectable growth in the broader scheme of things.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Despite the relatively flat revenue figures, shareholders will be pleased to see EBIT margins have grown from 6.2% to 13% in the last 12 months. That's something to smile about.

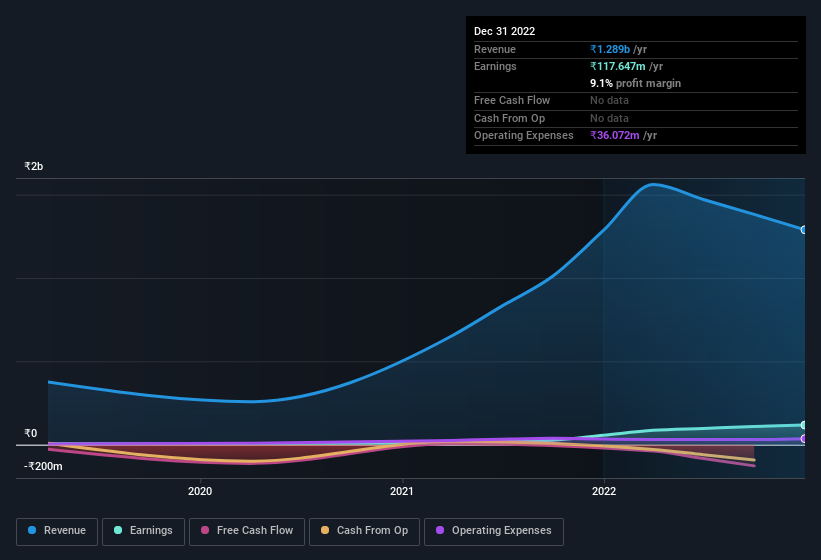

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Kotyark Industries is no giant, with a market capitalisation of ₹2.6b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Kotyark Industries Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the company insider, Nevil Savjani, paid ₹4.5m to buy shares at an average price of ₹450. Strong buying like that could be a sign of opportunity.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Kotyark Industries will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 72%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have ₹1.9b invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Kotyark Industries Worth Keeping An Eye On?

One important encouraging feature of Kotyark Industries is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Still, you should learn about the 3 warning signs we've spotted with Kotyark Industries.

Keen growth investors love to see insider buying. Thankfully, Kotyark Industries isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kotyark Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KOTYARK

Kotyark Industries

Engages in the manufacture and sale of biodiesel and other by products in India.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives