- India

- /

- Energy Services

- /

- NSEI:GLOBALVECT

Market Might Still Lack Some Conviction On Global Vectra Helicorp Limited (NSE:GLOBALVECT) Even After 25% Share Price Boost

Global Vectra Helicorp Limited (NSE:GLOBALVECT) shares have continued their recent momentum with a 25% gain in the last month alone. The last month tops off a massive increase of 201% in the last year.

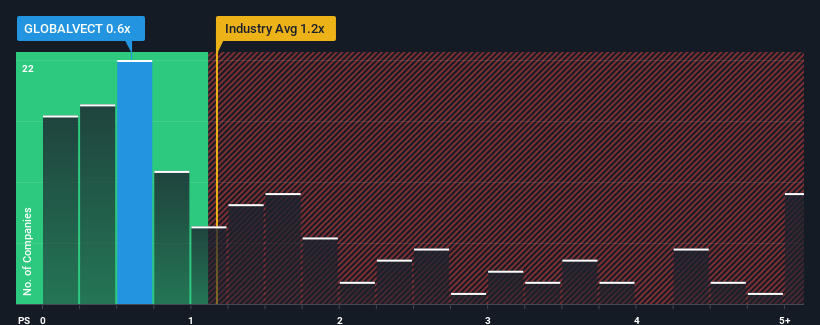

Although its price has surged higher, Global Vectra Helicorp's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a strong buy right now compared to the wider Energy Services industry in India, where around half of the companies have P/S ratios above 4.3x and even P/S above 7x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Global Vectra Helicorp

How Global Vectra Helicorp Has Been Performing

Global Vectra Helicorp has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Global Vectra Helicorp's earnings, revenue and cash flow.How Is Global Vectra Helicorp's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Global Vectra Helicorp's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. Pleasingly, revenue has also lifted 70% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this information, we find it odd that Global Vectra Helicorp is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Even after such a strong price move, Global Vectra Helicorp's P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Global Vectra Helicorp currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Global Vectra Helicorp (2 can't be ignored) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GLOBALVECT

Global Vectra Helicorp

Provides helicopter services for the oil and gas sector in India.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives