- India

- /

- Capital Markets

- /

- NSEI:VLSFINANCE

Even With A 27% Surge, Cautious Investors Are Not Rewarding VLS Finance Limited's (NSE:VLSFINANCE) Performance Completely

Despite an already strong run, VLS Finance Limited (NSE:VLSFINANCE) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

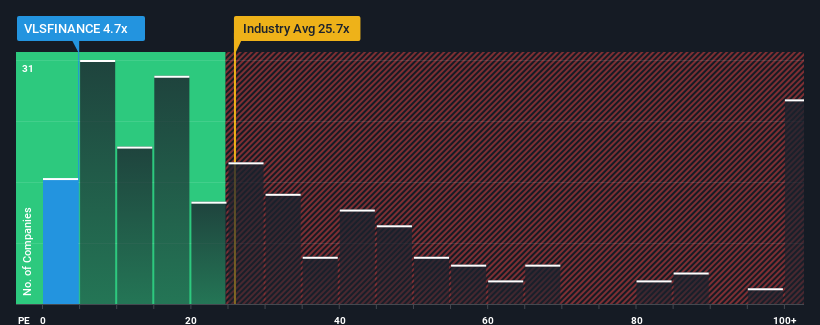

Although its price has surged higher, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 32x, you may still consider VLS Finance as a highly attractive investment with its 4.7x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

VLS Finance certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for VLS Finance

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as VLS Finance's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 173%. The strong recent performance means it was also able to grow EPS by 104% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

It's interesting to note that the rest of the market is similarly expected to grow by 25% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that VLS Finance's P/E sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

VLS Finance's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that VLS Finance currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for VLS Finance you should be aware of.

If these risks are making you reconsider your opinion on VLS Finance, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VLSFINANCE

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success