- India

- /

- Capital Markets

- /

- NSEI:TEAMGTY

I Ran A Stock Scan For Earnings Growth And Times Guaranty (NSE:TIMESGTY) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Times Guaranty (NSE:TIMESGTY). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Times Guaranty

How Fast Is Times Guaranty Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Times Guaranty's stratospheric annual EPS growth of 50%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Times Guaranty's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Times Guaranty shareholders can take confidence from the fact that EBIT margins are up from 82% to 90%, and revenue is growing. That's great to see, on both counts.

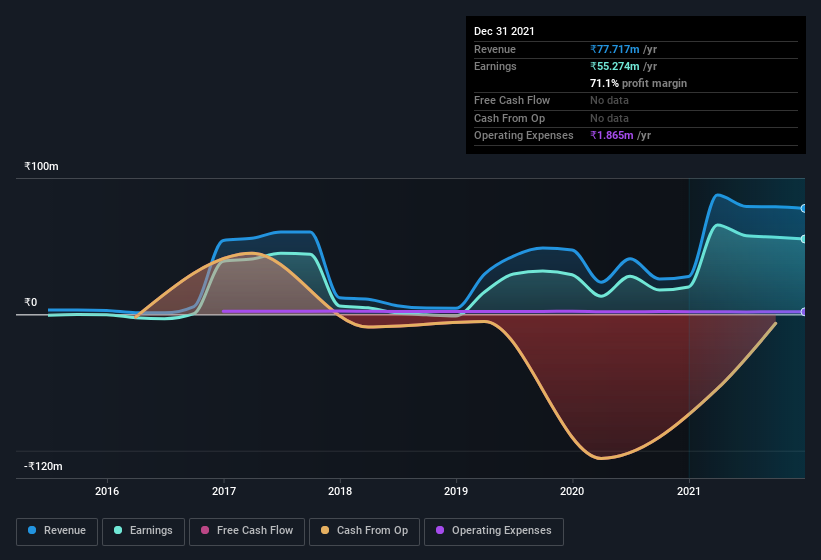

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Times Guaranty isn't a huge company, given its market capitalization of ₹566m. That makes it extra important to check on its balance sheet strength.

Are Times Guaranty Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations under ₹15b, like Times Guaranty, the median CEO pay is around ₹2.9m.

The CEO of Times Guaranty was paid just ₹1.1m in total compensation for the year ending . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Times Guaranty Deserve A Spot On Your Watchlist?

Times Guaranty's earnings have taken off like any random crypto-currency did, back in 2017. Such fast EPS growth makes me wonder if the business has hit an inflection point (and I mean the good kind.) At the same time the reasonable CEO compensation reflects well on the board of directors. So Times Guaranty looks like it could be a good quality growth stock, at first glance. That's worth watching. You still need to take note of risks, for example - Times Guaranty has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Team India Guaranty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEAMGTY

Team India Guaranty

A non-deposit accepting non-banking financial company, provides investment services in India.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives