- India

- /

- Capital Markets

- /

- NSEI:SUMMITSEC

The five-year decline in earnings for Summit Securities NSE:SUMMITSEC) isn't encouraging, but shareholders are still up 279% over that period

Some Summit Securities Limited (NSE:SUMMITSEC) shareholders are probably rather concerned to see the share price fall 50% over the last three months. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 279% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Only time will tell if there is still too much optimism currently reflected in the share price.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Summit Securities

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Summit Securities actually saw its EPS drop 5.1% per year.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

On the other hand, Summit Securities' revenue is growing nicely, at a compound rate of 11% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

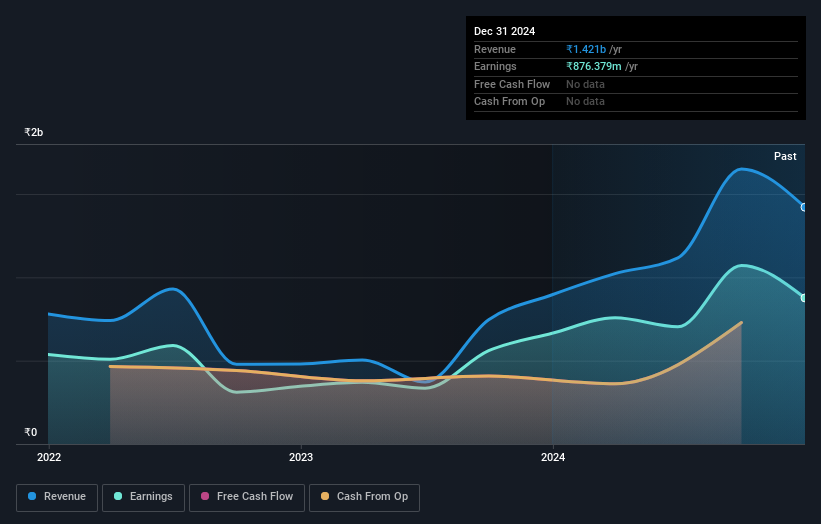

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Summit Securities' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Summit Securities shareholders have received a total shareholder return of 27% over the last year. Having said that, the five-year TSR of 31% a year, is even better. Before forming an opinion on Summit Securities you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SUMMITSEC

Summit Securities

A non-banking financial company, engages in investment and financial activities.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives