- India

- /

- Capital Markets

- /

- NSEI:SMCGLOBAL

We Ran A Stock Scan For Earnings Growth And SMC Global Securities (NSE:SMCGLOBAL) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like SMC Global Securities (NSE:SMCGLOBAL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for SMC Global Securities

SMC Global Securities' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Over the last three years, SMC Global Securities has grown EPS by 15% per year. That's a good rate of growth, if it can be sustained.

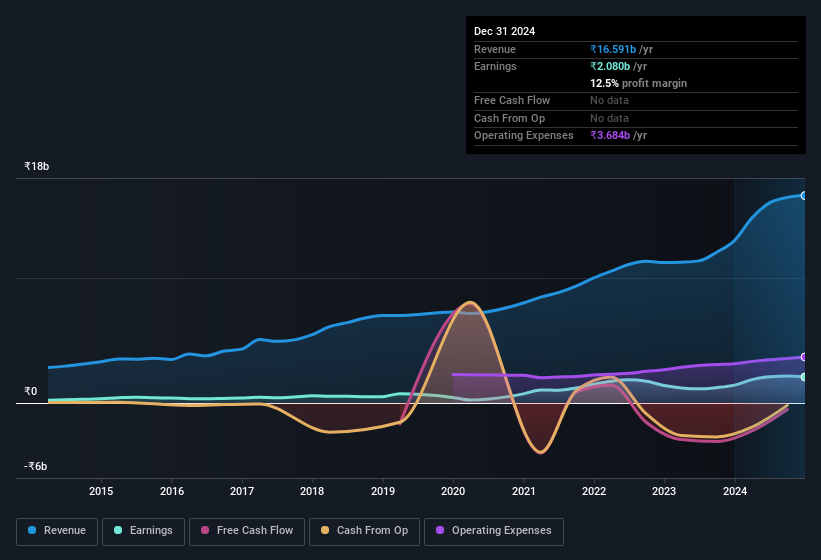

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that SMC Global Securities' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note SMC Global Securities achieved similar EBIT margins to last year, revenue grew by a solid 28% to ₹17b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since SMC Global Securities is no giant, with a market capitalisation of ₹12b, you should definitely check its cash and debt before getting too excited about its prospects.

Are SMC Global Securities Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Insiders both bought and sold SMC Global Securities shares in the last year, but the good news is they spent ₹3.2m more buying than they netted selling. At face value we can consider this a fairly encouraging sign for the company. We also note that it was the Chairman & Whole-Time Director of SMC Insurance Brokers Private Limited, Pravin Agarwal, who made the biggest single acquisition, paying ₹4.1m for shares at about ₹136 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for SMC Global Securities will reveal that insiders own a significant piece of the pie. Owning 39% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at ₹4.9b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is SMC Global Securities Worth Keeping An Eye On?

One positive for SMC Global Securities is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. You should always think about risks though. Case in point, we've spotted 1 warning sign for SMC Global Securities you should be aware of.

Keen growth investors love to see insider activity. Thankfully, SMC Global Securities isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SMCGLOBAL

SMC Global Securities

Engages in the provision of various financial services in India and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success