- India

- /

- Specialty Stores

- /

- NSEI:SENCO

Top Insider-Owned Growth Stocks On Indian Exchanges August 2024

Reviewed by Simply Wall St

In the last week, the Indian market has stayed flat, but it is up 45% over the past year with earnings expected to grow by 17% per annum over the next few years. In this promising environment, identifying growth companies with high insider ownership can be crucial as it often signals confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 36% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 35.5% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 31.9% | 20.7% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 20.9% | 31.8% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| KEI Industries (BSE:517569) | 19.1% | 20.3% |

Let's review some notable picks from our screened stocks.

MedPlus Health Services (NSEI:MEDPLUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MedPlus Health Services Limited operates in the retail trading of medicines and general items in India, with a market cap of ₹79.68 billion.

Operations: MedPlus Health Services Limited generates revenue primarily from retail at ₹57.43 billion and diagnostics at ₹852.29 million.

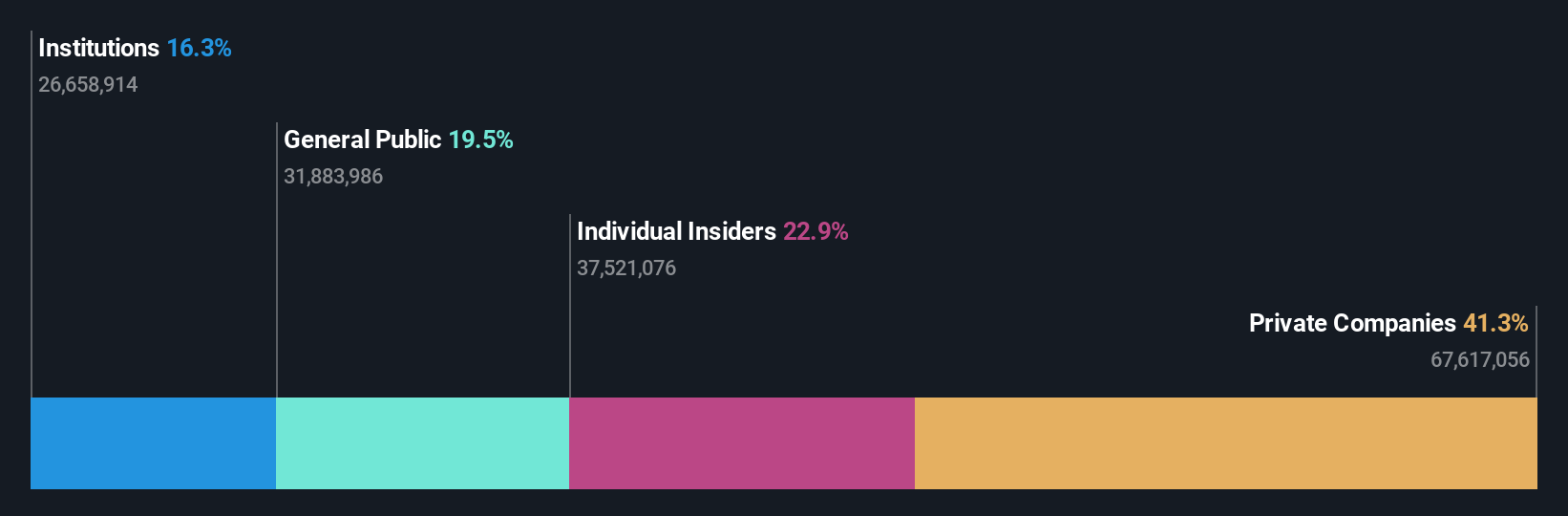

Insider Ownership: 14.0%

Earnings Growth Forecast: 41.7% p.a.

MedPlus Health Services demonstrates significant earnings growth, with a forecasted annual profit increase of 41.7%, outpacing the Indian market's 16.7%. Recent earnings reports show strong performance, with Q1 2024 net income rising to INR 143.63 million from INR 37.86 million a year ago. Despite lower projected Return on Equity at 11.2% in three years and insufficient interest coverage by earnings, analysts expect a stock price rise of 31.4%.

- Click here to discover the nuances of MedPlus Health Services with our detailed analytical future growth report.

- Our expertly prepared valuation report MedPlus Health Services implies its share price may be too high.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited operates in India, offering payment, commerce and cloud, and financial services to consumers and merchants, with a market cap of ₹317.76 billion.

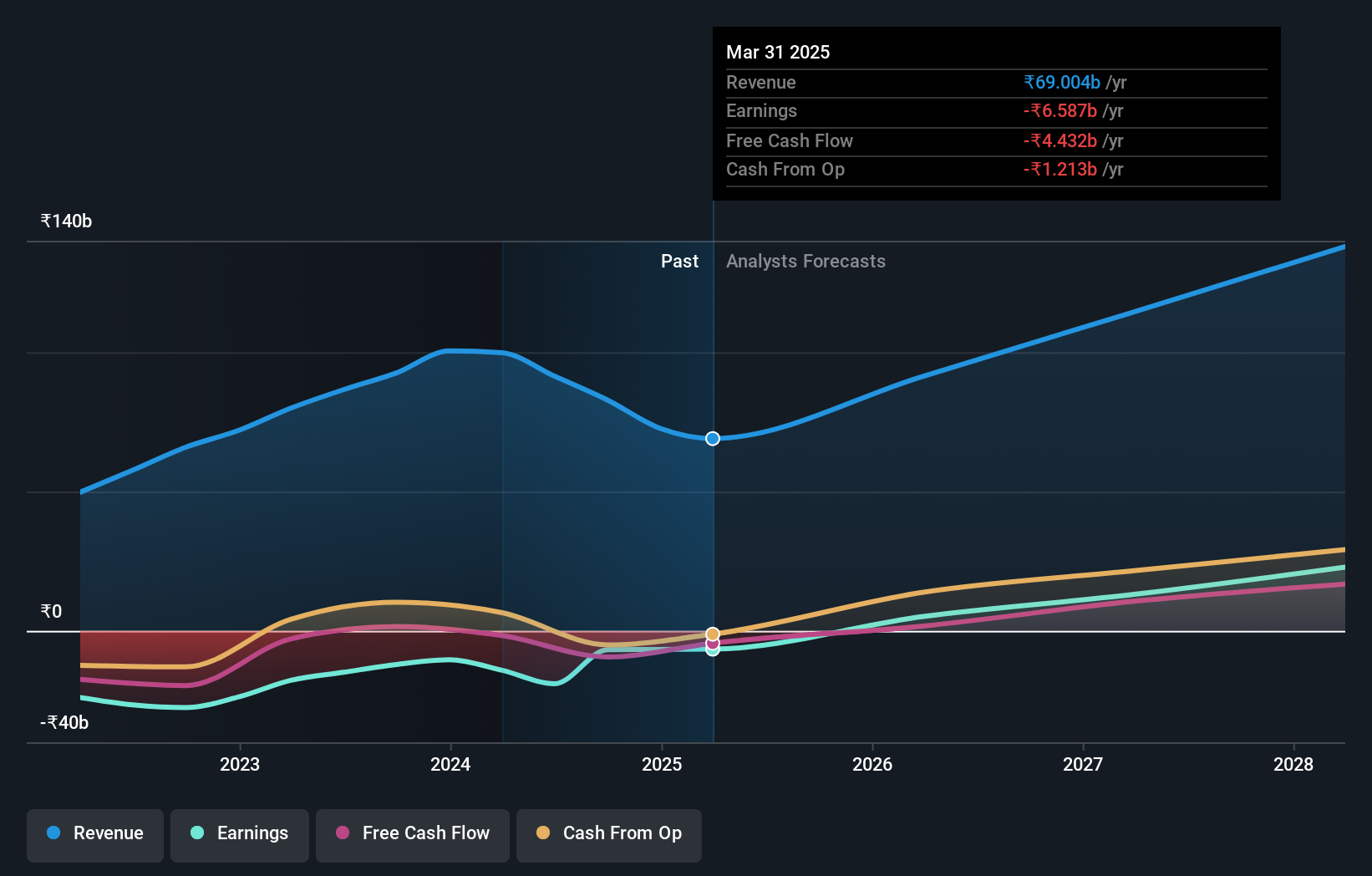

Operations: Revenue segments for One97 Communications Limited include Data Processing, which generated ₹91.38 billion.

Insider Ownership: 20.7%

Earnings Growth Forecast: 66.7% p.a.

One97 Communications, despite its recent regulatory penalty and widening losses (Q1 2024 net loss of INR 8.39 billion), remains a growth-focused company with high insider ownership. The strategic partnership with FlixBus enhances its travel offerings, while the launch of 'Paytm Health Saathi' supports merchant partners. Although revenue decreased to INR 16.39 billion from INR 24.64 billion year-on-year, Paytm's diverse initiatives and potential M&A activities indicate ongoing efforts to drive growth and value creation.

- Delve into the full analysis future growth report here for a deeper understanding of One97 Communications.

- Our valuation report unveils the possibility One97 Communications' shares may be trading at a discount.

Senco Gold (NSEI:SENCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Senco Gold Limited manufactures and trades jewelry and articles made of gold, silver, platinum, and other precious and semi-precious stones in India with a market cap of ₹76.50 billion.

Operations: Revenue from the sale of gold jewelry and other articles amounts to ₹52.41 billion.

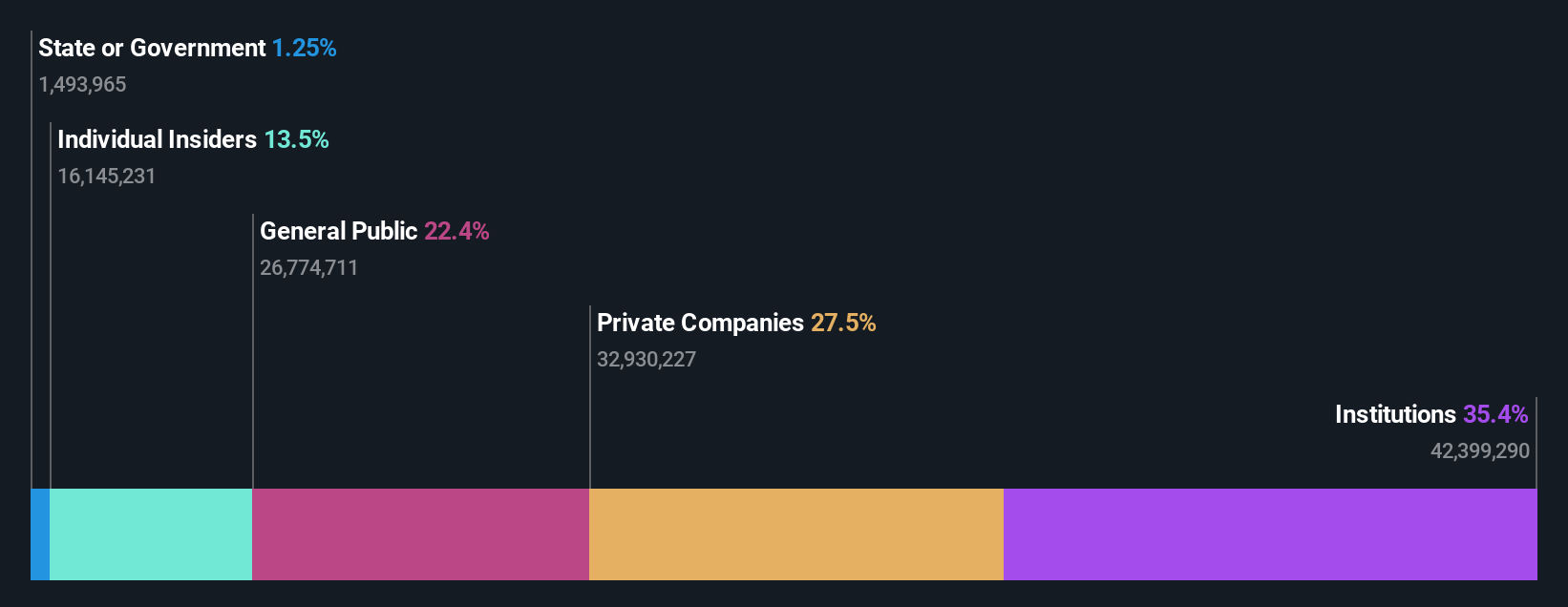

Insider Ownership: 24.1%

Earnings Growth Forecast: 21.4% p.a.

Senco Gold, a growth company with high insider ownership, has shown consistent earnings growth of 18.2% annually over the past five years. Recent earnings reports indicate strong revenue and net income increases, with Q4 2024 sales reaching ₹11.37 billion and net income at ₹321.73 million. Despite regulatory challenges including a recent service tax demand of ₹2.27 million, Senco's forecasted annual profit growth of 21.4% outpaces the Indian market average, highlighting its robust financial health and potential for future expansion.

- Unlock comprehensive insights into our analysis of Senco Gold stock in this growth report.

- The analysis detailed in our Senco Gold valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Dive into all 89 of the Fast Growing Indian Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SENCO

Senco Gold

Engages in the manufacture and trading of jewelry and articles made of gold, silver, platinum, and other precious and semi-precious stones in India.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives