- India

- /

- Diversified Financial

- /

- NSEI:NPST

Is Now The Time To Put Network People Services Technologies (NSE:NPST) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Network People Services Technologies (NSE:NPST). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Network People Services Technologies

How Fast Is Network People Services Technologies Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Network People Services Technologies grew its EPS from ₹1.74 to ₹10.59, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

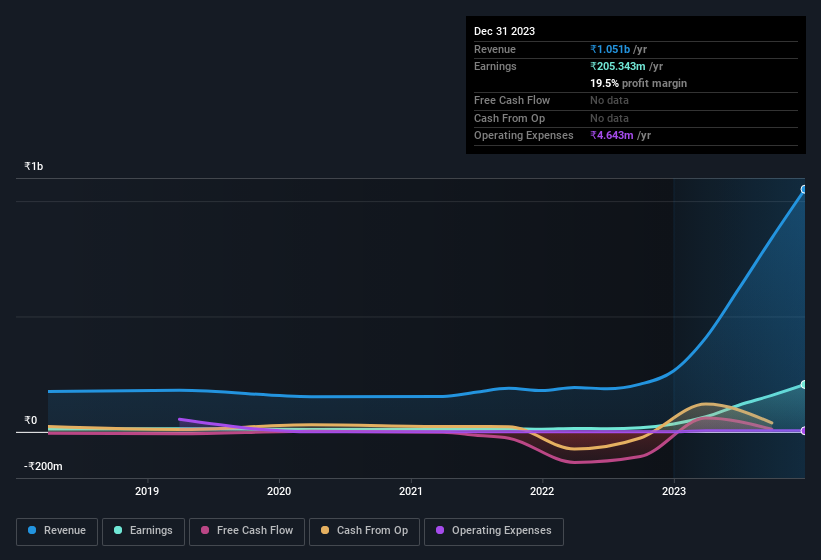

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Network People Services Technologies shareholders can take confidence from the fact that EBIT margins are up from 15% to 25%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Network People Services Technologies is no giant, with a market capitalisation of ₹21b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Network People Services Technologies Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Network People Services Technologies insiders own a meaningful share of the business. Indeed, with a collective holding of 68%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about ₹14b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Network People Services Technologies, with market caps between ₹8.3b and ₹33b, is around ₹16m.

Network People Services Technologies' CEO took home a total compensation package of ₹5.8m in the year prior to March 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Network People Services Technologies To Your Watchlist?

Network People Services Technologies' earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so the writing on the wall tells us that Network People Services Technologies is worth considering carefully. What about risks? Every company has them, and we've spotted 1 warning sign for Network People Services Technologies you should know about.

Although Network People Services Technologies certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Network People Services Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NPST

Network People Services Technologies

Develops payments infrastructure for banks, payment aggregators, and merchants in India.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives