- India

- /

- Capital Markets

- /

- NSEI:KEYFINSERV

The Market Lifts Keynote Financial Services Limited (NSE:KEYFINSERV) Shares 31% But It Can Do More

Keynote Financial Services Limited (NSE:KEYFINSERV) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.8% over the last year.

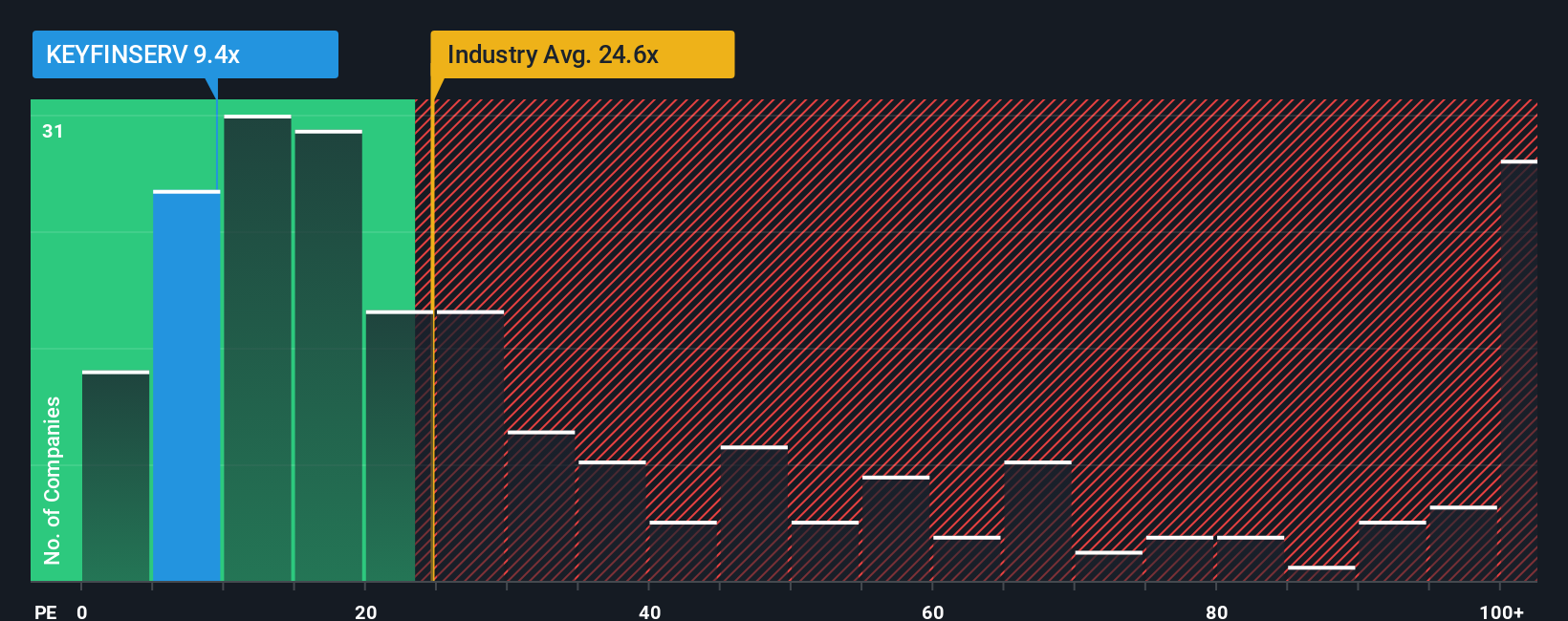

In spite of the firm bounce in price, Keynote Financial Services may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.4x, since almost half of all companies in India have P/E ratios greater than 28x and even P/E's higher than 54x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Keynote Financial Services' receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Keynote Financial Services

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Keynote Financial Services would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 166% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Keynote Financial Services is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Even after such a strong price move, Keynote Financial Services' P/E still trails the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Keynote Financial Services revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 4 warning signs for Keynote Financial Services that we have uncovered.

You might be able to find a better investment than Keynote Financial Services. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Keynote Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KEYFINSERV

Keynote Financial Services

Provides investment banking, corporate and ESOP advisory, and brokerage services in India and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives