- India

- /

- Diversified Financial

- /

- NSEI:JSWHL

If You Had Bought JSW Holdings (NSE:JSWHL) Shares Five Years Ago You'd Have Earned 313% Returns

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held JSW Holdings Limited (NSE:JSWHL) shares for the last five years, while they gained 313%. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 76% gain in the last three months.

Check out our latest analysis for JSW Holdings

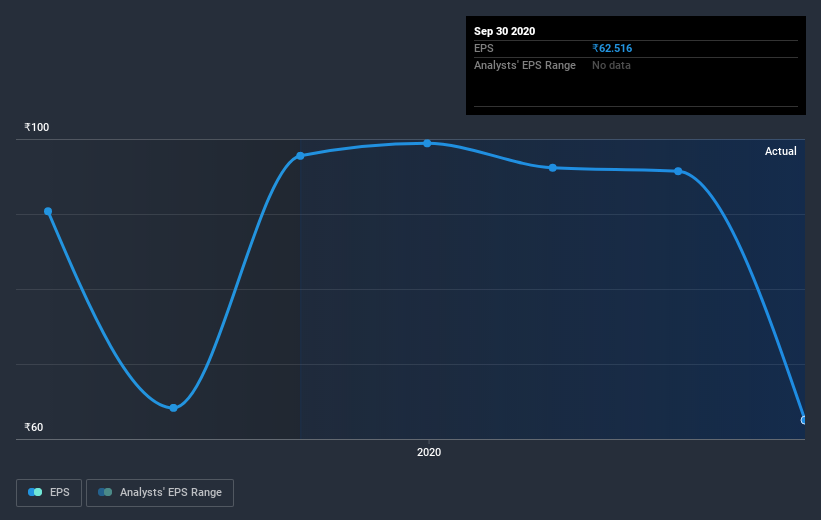

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, JSW Holdings achieved compound earnings per share (EPS) growth of 14% per year. This EPS growth is lower than the 33% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This optimism is visible in its fairly high P/E ratio of 65.52.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on JSW Holdings' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that JSW Holdings shareholders have received a total shareholder return of 86% over the last year. That's better than the annualised return of 33% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand JSW Holdings better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for JSW Holdings you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading JSW Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:JSWHL

JSW Holdings

A non-banking financial company, primarily engages in investing and financing activities in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026