- India

- /

- Capital Markets

- /

- NSEI:JPOLYINVST

Should You Be Adding Jindal Poly Investment and Finance (NSE:JPOLYINVST) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Jindal Poly Investment and Finance (NSE:JPOLYINVST). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Jindal Poly Investment and Finance with the means to add long-term value to shareholders.

Check out our latest analysis for Jindal Poly Investment and Finance

Jindal Poly Investment and Finance's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's no surprise that some investors are more inclined to invest in profitable businesses. In impressive fashion, Jindal Poly Investment and Finance's EPS grew from ₹177 to ₹509, over the previous 12 months. Year on year growth of 187% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Jindal Poly Investment and Finance's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While Jindal Poly Investment and Finance did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

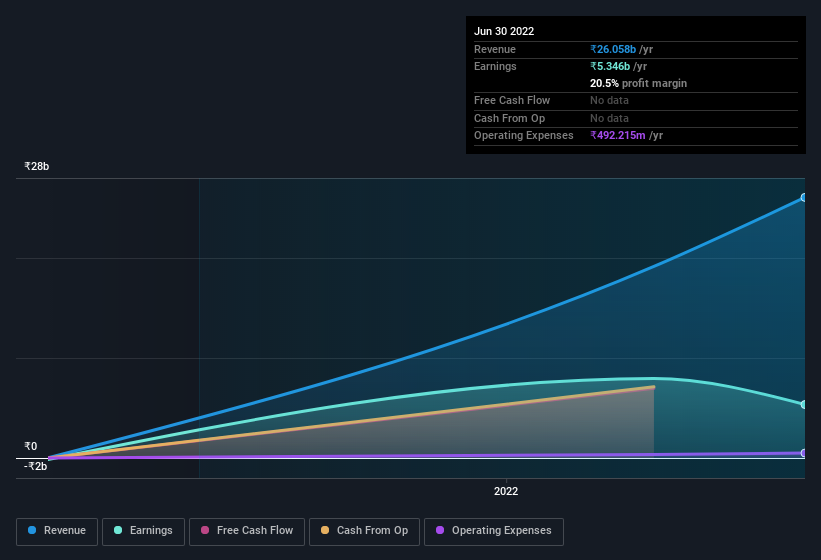

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Jindal Poly Investment and Finance is no giant, with a market capitalisation of ₹3.6b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Jindal Poly Investment and Finance Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Jindal Poly Investment and Finance will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 81% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹2.9b riding on the stock, at current prices. That's nothing to sneeze at!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Jindal Poly Investment and Finance, with market caps under ₹16b is around ₹3.0m.

Jindal Poly Investment and Finance's CEO only received compensation totalling ₹14k in the year to March 2021. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Jindal Poly Investment and Finance Deserve A Spot On Your Watchlist?

Jindal Poly Investment and Finance's earnings have taken off in quite an impressive fashion. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Big growth can make big winners, so the writing on the wall tells us that Jindal Poly Investment and Finance is worth considering carefully. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Jindal Poly Investment and Finance , and understanding them should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JPOLYINVST

Jindal Poly Investment and Finance

Engages in investment activities in India.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)