- India

- /

- Diversified Financial

- /

- NSEI:IRFC

Here's Why I Think Indian Railway Finance (NSE:IRFC) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Indian Railway Finance (NSE:IRFC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Indian Railway Finance

Indian Railway Finance's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Indian Railway Finance managed to grow EPS by 9.9% per year, over three years. That's a pretty good rate, if the company can sustain it.

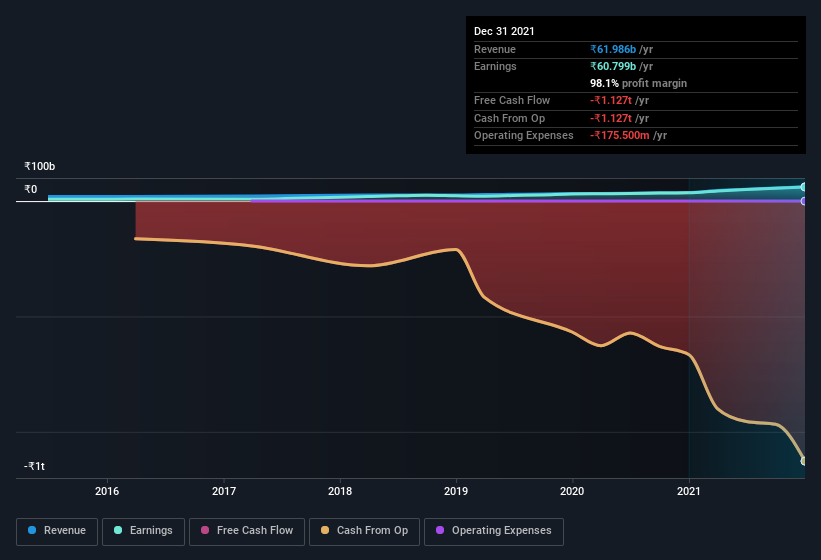

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Indian Railway Finance maintained stable EBIT margins over the last year, all while growing revenue 67% to ₹62b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Indian Railway Finance's balance sheet strength, before getting too excited.

Are Indian Railway Finance Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between ₹152b and ₹486b, like Indian Railway Finance, the median CEO pay is around ₹46m.

The CEO of Indian Railway Finance only received ₹7.0m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Indian Railway Finance Deserve A Spot On Your Watchlist?

One important encouraging feature of Indian Railway Finance is that it is growing profits. On top of that, my faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So all in all I think it's worth at least considering for your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Indian Railway Finance you should be aware of, and 2 of them make us uncomfortable.

Although Indian Railway Finance certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRFC

Indian Railway Finance

Engages in leasing of rolling stock assets, railway infrastructure assets in India.

Acceptable track record second-rate dividend payer.