- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

Undiscovered Gems In India To Watch This August 2024

Reviewed by Simply Wall St

The Indian market is up 1.8% over the last week and has climbed 46% in the past year, with earnings forecast to grow by 17% annually. In such a thriving environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Bengal & Assam | 4.48% | 1.54% | 51.11% | ★★★★★☆ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.68% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in the primary and secondary markets in India, with a market cap of ₹85.13 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion), with additional income from facilities and ancillary services (₹375.25 million) and insurance broking and ancillary services (₹2.77 billion).

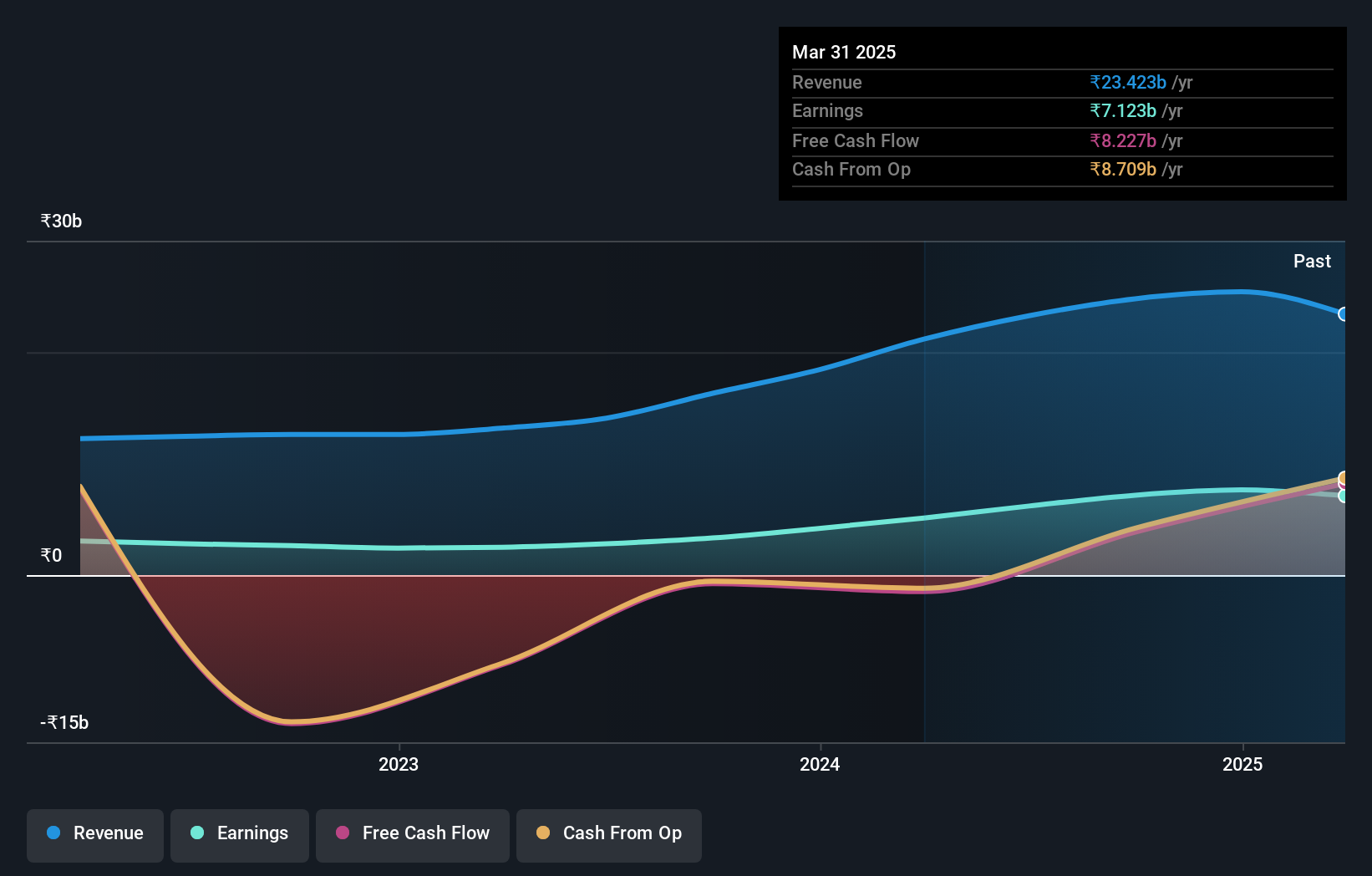

IIFL Securities, a notable player in India's capital markets, has seen its earnings soar by 120.4% over the past year, outpacing the industry growth of 63.6%. The company reported Q1 revenue of INR 6.44 billion and net income of INR 1.82 billion, showcasing robust performance with basic EPS at INR 5.94 compared to last year's INR 2.45. Despite a volatile share price recently and a penalty from SEBI for regulatory lapses, IIFL's P/E ratio stands attractively low at 13.7x against the market's 33.9x while its debt-to-equity ratio has improved significantly from five years ago (117% to now around half).

- Click here to discover the nuances of IIFL Securities with our detailed analytical health report.

Evaluate IIFL Securities' historical performance by accessing our past performance report.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India and has a market cap of ₹142.35 billion.

Operations: Netweb Technologies India Limited generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion.

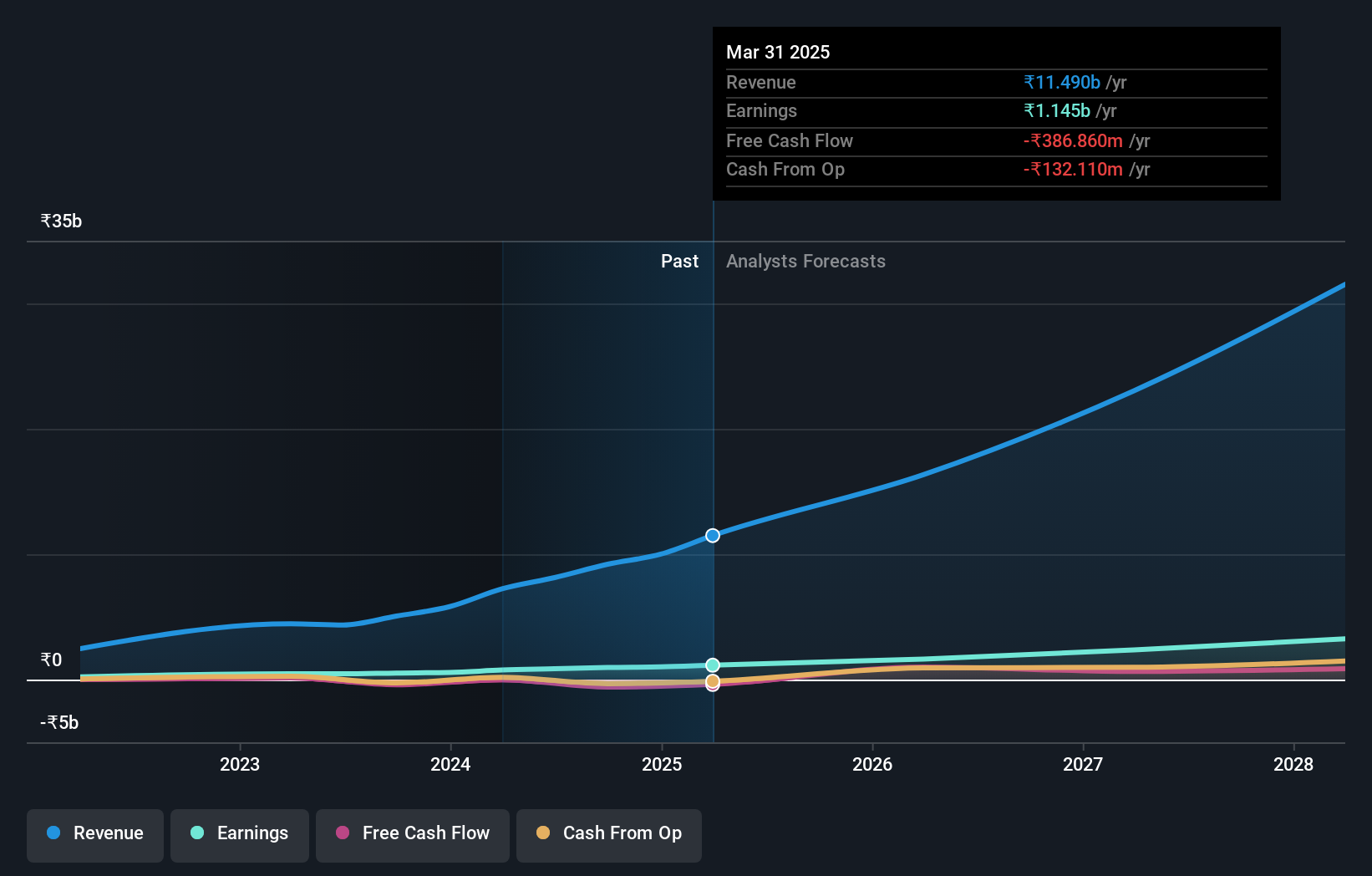

Netweb Technologies India has demonstrated impressive financial health, with earnings growing 85.8% over the past year and surpassing the tech industry’s 11%. The company’s debt-to-equity ratio improved significantly from 108% to 2.3% in five years, reflecting strong balance sheet management. Recent quarterly results showed revenue at INR 1,532 million and net income of INR 154 million. Additionally, Netweb's interest payments are well covered by EBIT (17.7x), indicating robust operational efficiency.

- Navigate through the intricacies of Netweb Technologies India with our comprehensive health report here.

Understand Netweb Technologies India's track record by examining our Past report.

Raymond (NSEI:RAYMOND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Raymond Limited operates as a textile, lifestyle, and branded apparel company in India and internationally with a market cap of ₹137.25 billion.

Operations: Raymond Limited generates revenue primarily from real estate and property development (₹18.47 billion), auto components (₹4.42 billion), and tools & hardware (₹4.09 billion). The financial data excludes inter-segment adjustments and other segments for clarity.

Raymond, a notable player in India's textile and apparel sector, has shown impressive growth with earnings increasing 60.1% annually over the past five years. The company's net debt to equity ratio stands at 55.5%, which is high, but interest payments are well covered by EBIT at 3.7x coverage. Recent developments include significant insider selling over the last three months and a forecasted revenue growth of 11.46% per year despite expected earnings decline of 12.8% annually for the next three years.

- Unlock comprehensive insights into our analysis of Raymond stock in this health report.

Assess Raymond's past performance with our detailed historical performance reports.

Next Steps

- Embark on your investment journey to our 466 Indian Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives