Over the last 7 days, the Indian market has remained flat, yet it boasts an impressive 45% increase over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying small-cap stocks with strong growth potential can be a rewarding strategy for investors looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| S J Logistics (India) | 11.71% | 90.19% | 60.29% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

E.I.D.- Parry (India) (NSEI:EIDPARRY)

Simply Wall St Value Rating: ★★★★★★

Overview: E.I.D.- Parry (India) Limited, together with its subsidiaries, engages in the manufacture and sale of sugar, nutraceuticals, and distillery products in India, North America, Europe, and internationally. Market Cap: ₹154.13 billion

Operations: E.I.D.- Parry (India) Limited generates revenue primarily from its Nutrient and Allied Business segment, contributing ₹187.88 billion, followed by Crop Protection at ₹24.61 billion and Distillery products at ₹8.54 billion. The net profit margin for the company is a key metric to observe in its financial performance.

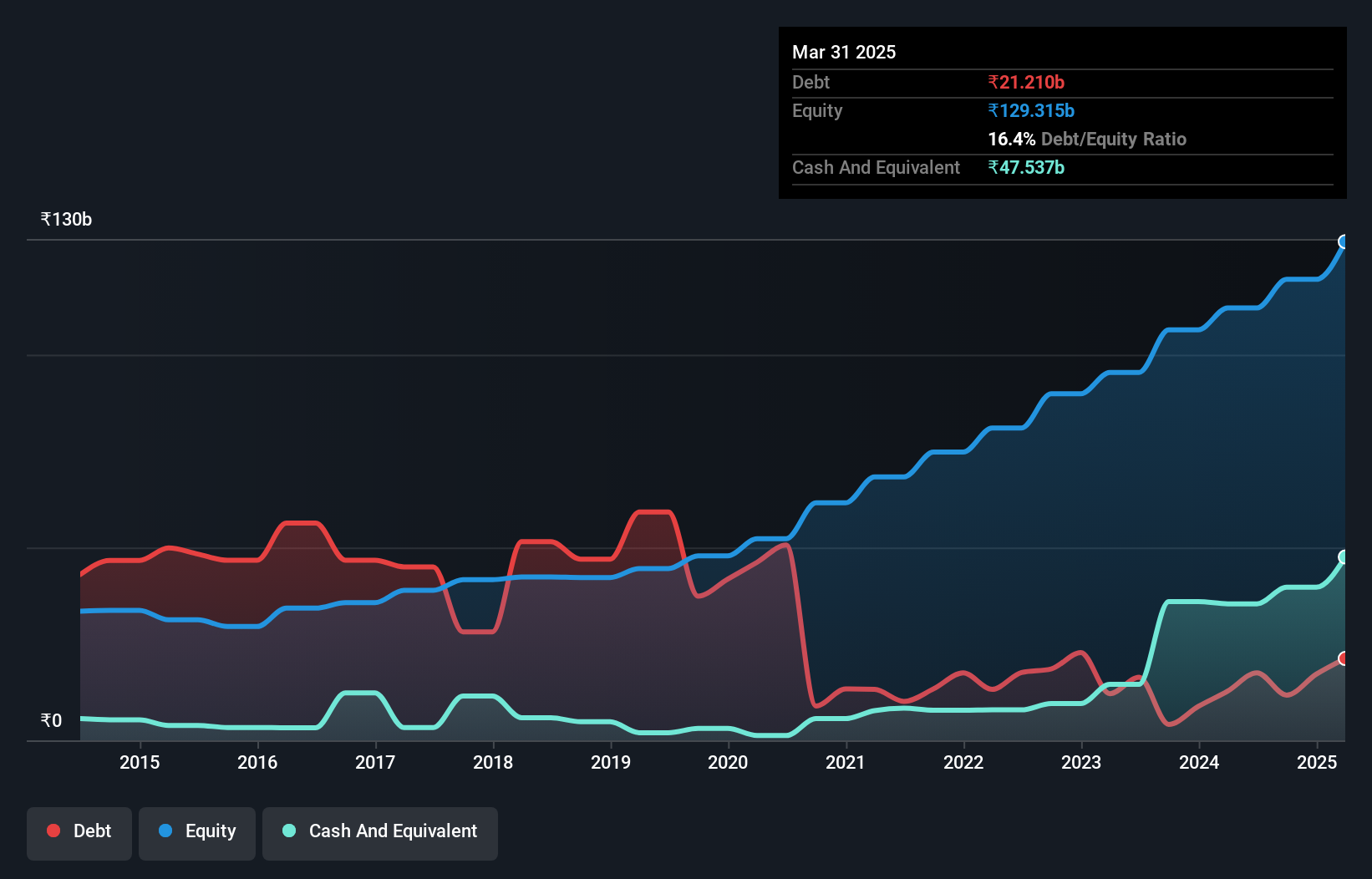

E.I.D.- Parry (India) Limited, a small cap in the chemicals sector, has shown notable financial resilience. Over the past year, earnings grew by 13.1%, outpacing the industry’s 10.7%. The debt-to-equity ratio impressively dropped from 132.9% to 15.6% over five years, and interest payments are well covered with an EBIT coverage of 31x. Despite a recent dip in quarterly revenue to INR 68 billion from INR 70 billion last year, its P/E ratio of 17.5x remains attractive compared to the Indian market's average of 34.3x.

- Click here to discover the nuances of E.I.D.- Parry (India) with our detailed analytical health report.

Evaluate E.I.D.- Parry (India)'s historical performance by accessing our past performance report.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited operates in the primary and secondary capital markets in India, with a market cap of ₹117.03 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion), followed by insurance broking and ancillary services (₹2.77 billion), and facilities and ancillary services (₹375.25 million).

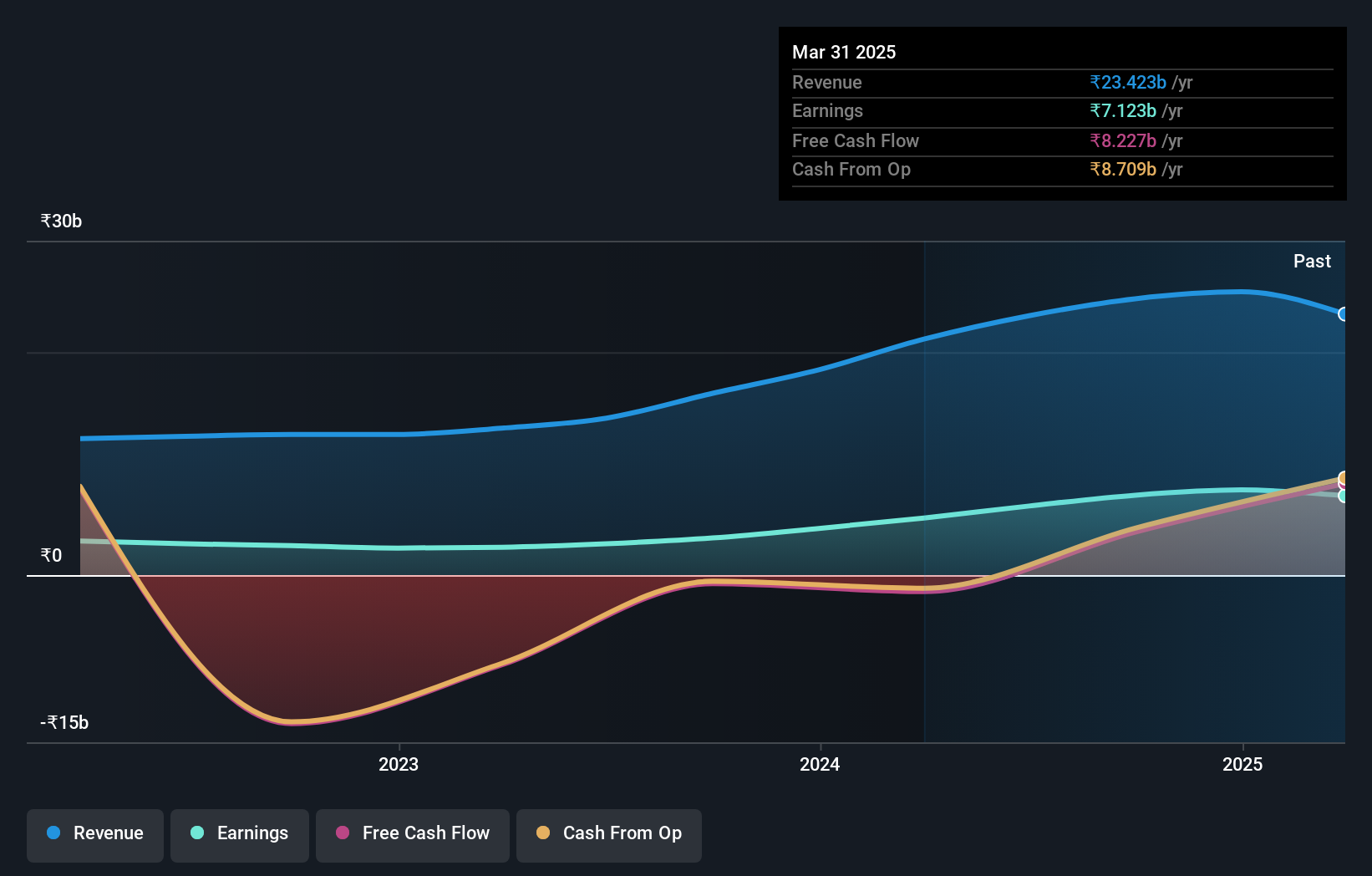

IIFL Securities, with a price-to-earnings ratio of 18.9x, offers good value compared to the Indian market's 34.3x. The company's net debt to equity ratio stands at a satisfactory 35.5%, reflecting prudent financial management. Over the past year, earnings surged by 120%, significantly outpacing the Capital Markets industry growth of 63%. Despite high volatility in its share price recently, IIFL has shown robust profit growth and reduced its debt to equity ratio from 117% to 67% over five years.

- Click to explore a detailed breakdown of our findings in IIFL Securities' health report.

Explore historical data to track IIFL Securities' performance over time in our Past section.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both domestically and internationally, with a market cap of ₹131.24 billion.

Operations: Jaiprakash Power Ventures Limited generates revenue primarily from its power segment, contributing ₹61.68 billion, and coal segment, adding ₹6.59 billion.

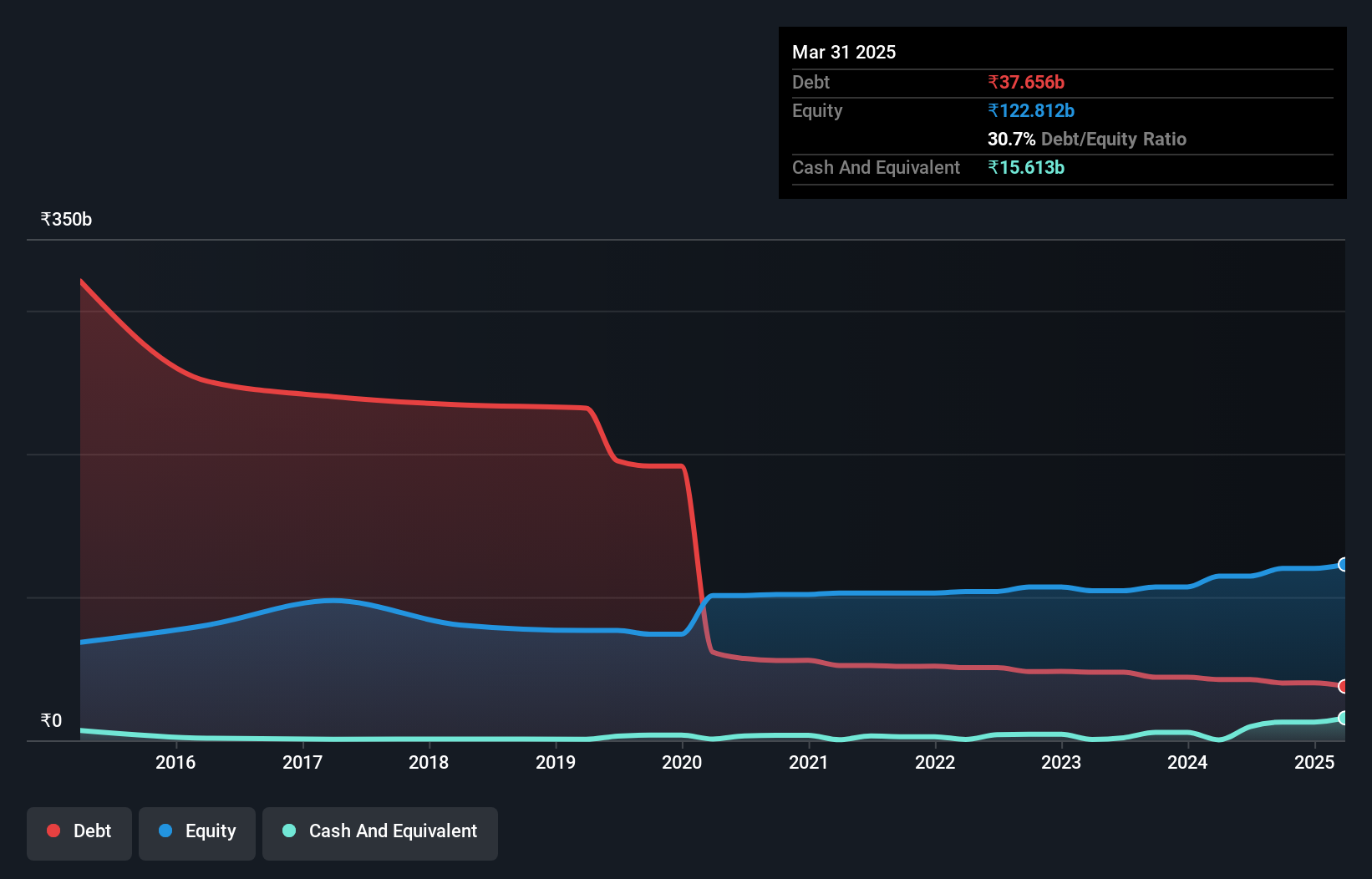

JP Power Ventures has demonstrated significant financial improvement, with its debt to equity ratio dropping from 254.1% to 37% over five years. The company trades at 68.4% below estimated fair value and reported a staggering earnings growth of 22969.3% last year, outperforming the industry average of 12%. Despite a one-off loss of ₹6.9B impacting recent results, JP Power's net debt to equity ratio stands satisfactorily at 28.7%, and EBIT covers interest payments by 5.2x.

- Dive into the specifics of Jaiprakash Power Ventures here with our thorough health report.

Gain insights into Jaiprakash Power Ventures' past trends and performance with our Past report.

Taking Advantage

- Discover the full array of 473 Indian Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E.I.D.- Parry (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:EIDPARRY

E.I.D.- Parry (India)

Engages in the manufacture and sale of sugar, nutraceuticals, and distillery products in India, North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives