- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Undiscovered Gems In India Featuring 3 Promising Stocks With Strong Potential

Reviewed by Simply Wall St

The Indian market has experienced a flat week but has seen a remarkable 40% increase over the past year, with earnings expected to grow by 17% annually. In such a dynamic environment, identifying stocks with strong potential often involves looking for companies that demonstrate resilience and growth prospects amidst broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Avantel | 5.92% | 33.97% | 37.33% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in both primary and secondary markets in India, with a market capitalization of ₹128.51 billion.

Operations: IIFL Securities generates revenue primarily from capital market activities, contributing ₹20.25 billion, and insurance broking services, adding ₹2.77 billion.

IIFL Securities, a nimble player in India's financial landscape, showcases robust earnings growth of 120.4% over the past year, significantly outpacing its industry peers. With a price-to-earnings ratio of 20.7x, it presents an attractive valuation compared to the broader market's 33.7x. Despite some volatility in share price and recent regulatory hiccups resulting in penalties totaling INR 480,000 (US$5,800), its net debt to equity ratio is a satisfactory 35.5%, down from 117.6% five years ago—reflecting prudent financial management amidst dynamic market conditions.

- Delve into the full analysis health report here for a deeper understanding of IIFL Securities.

Gain insights into IIFL Securities' past trends and performance with our Past report.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both within India and internationally, with a market capitalization of ₹152.90 billion.

Operations: The company generates revenue primarily from its power segment, contributing ₹61.68 billion, and coal sales amounting to ₹6.59 billion. The net profit margin shows an interesting trend that could be explored further for insights into profitability dynamics.

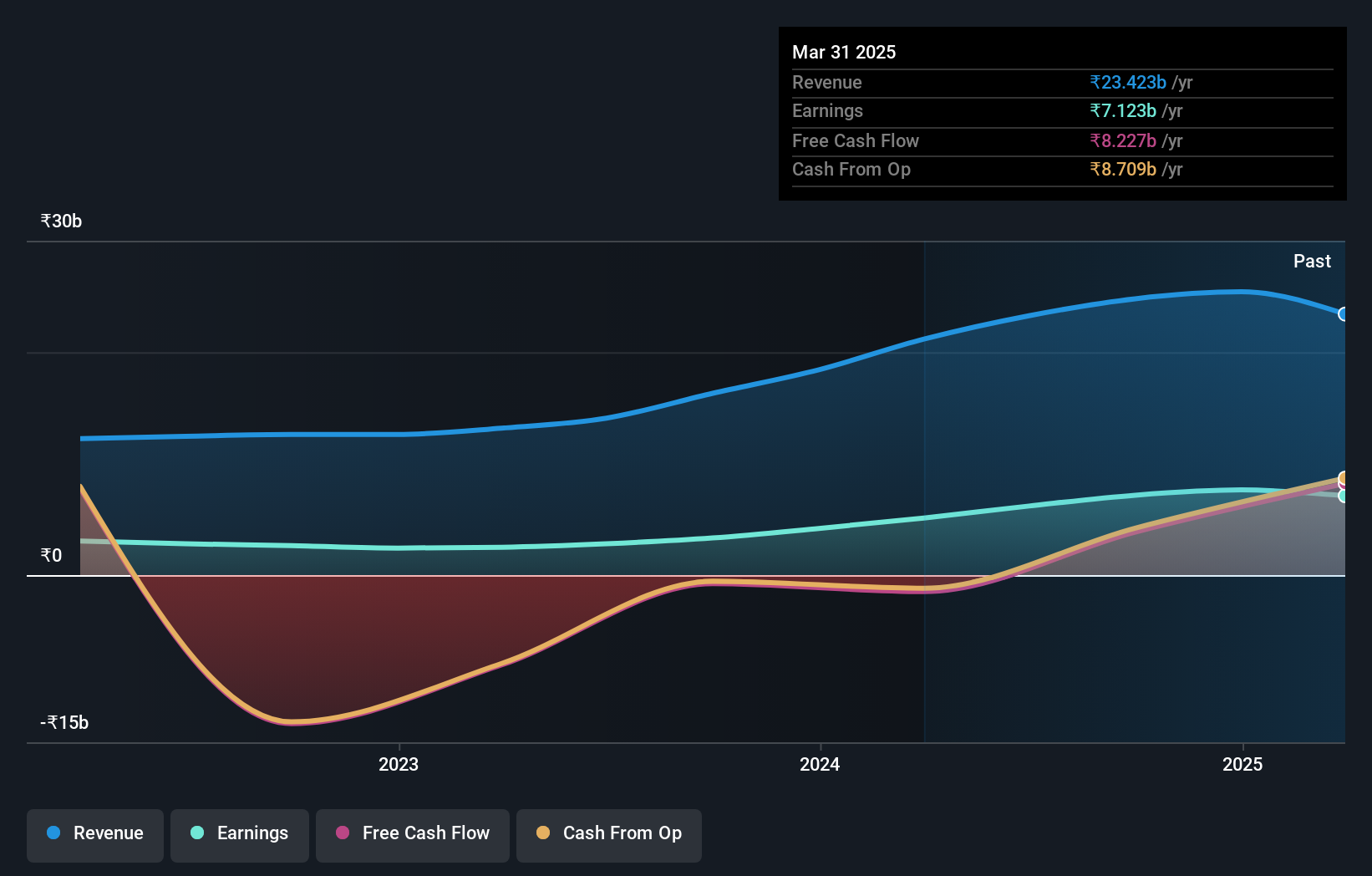

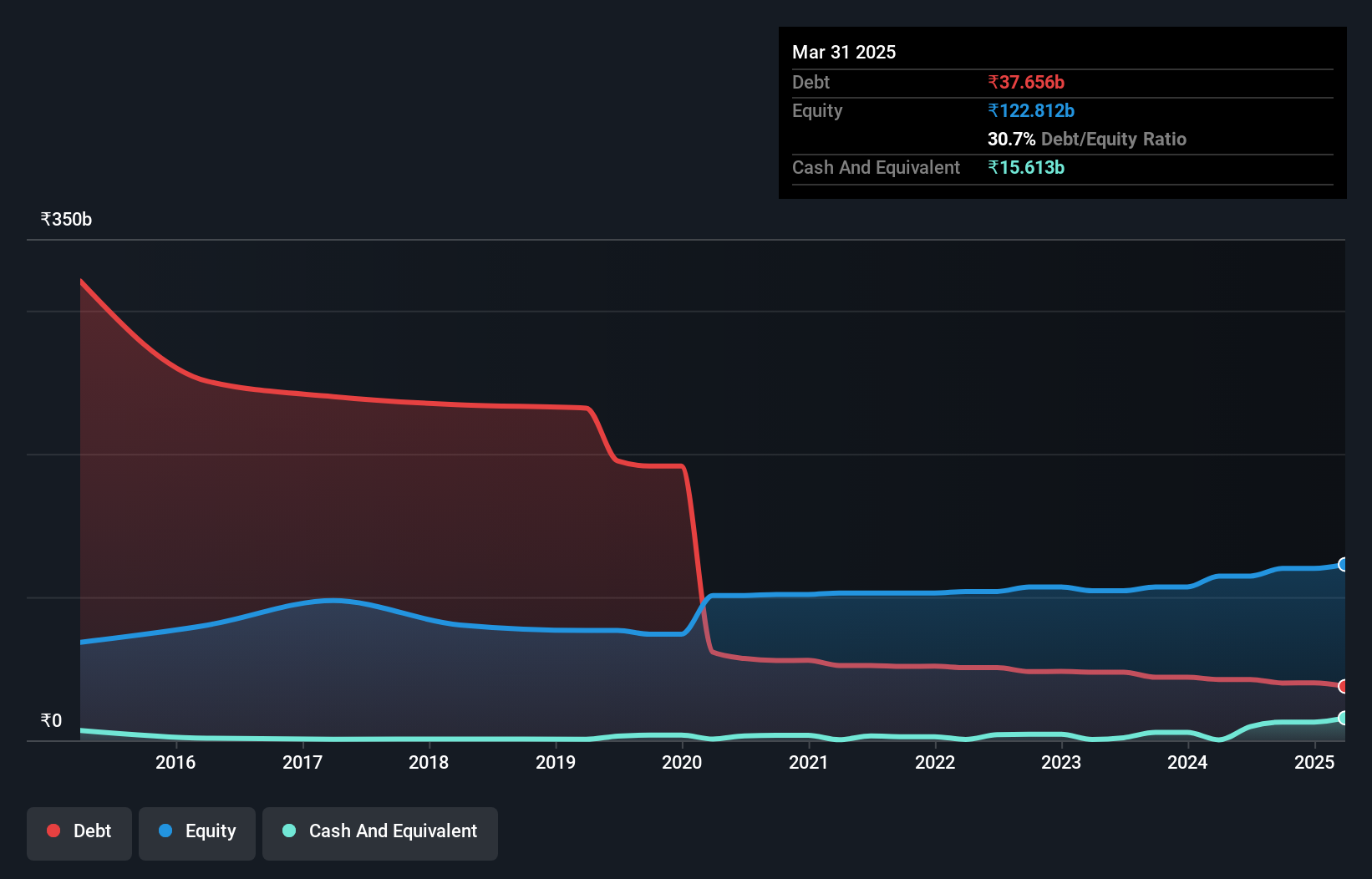

Jaiprakash Power Ventures, a player in the renewable energy sector, has delivered remarkable earnings growth of 22969% over the past year, outpacing industry peers. The company's net debt to equity ratio improved significantly from 254% to 37% in five years, indicating better financial health. Despite a substantial one-off loss of ₹6.9 billion affecting recent results, its interest payments are well-covered by EBIT at 5.2x coverage and it trades at a notable discount to estimated fair value.

- Take a closer look at Jaiprakash Power Ventures' potential here in our health report.

Assess Jaiprakash Power Ventures' past performance with our detailed historical performance reports.

Tips Music (NSEI:TIPSMUSIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Tips Music Limited focuses on acquiring and exploiting music rights both in India and internationally, with a market capitalization of ₹105.99 billion.

Operations: The primary revenue stream for Tips Music Limited is from music rights, generating ₹2.63 billion.

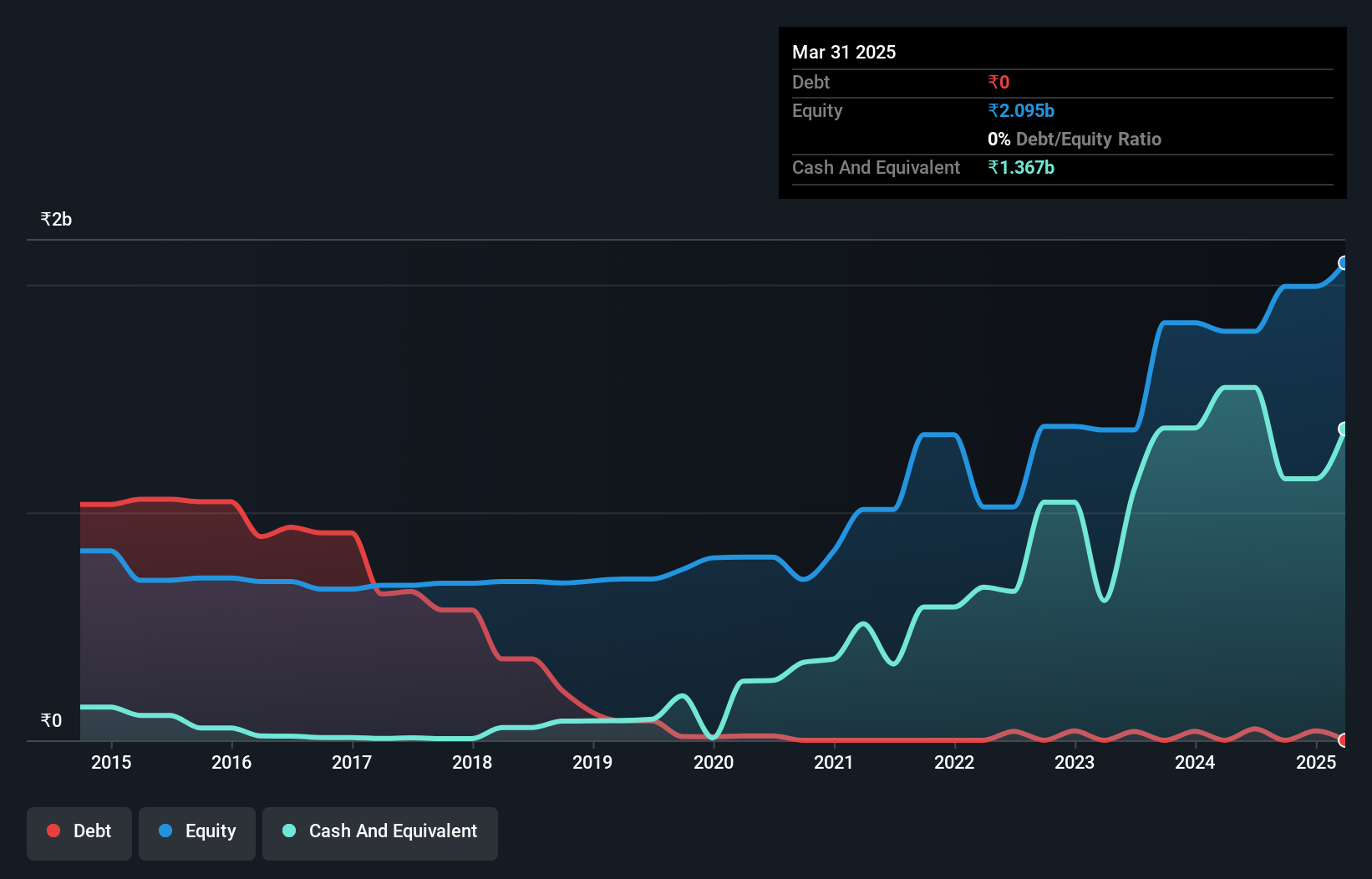

With a robust earnings growth of 66% last year, Tips Music is making waves in the entertainment sector, outpacing its industry peers. The company has effectively reduced its debt to equity from 12.1% to 2.8% over five years and boasts more cash than total debt, highlighting strong financial health. Recent quarterly results showed net income at ₹435 million, up from ₹271 million the previous year, further underscoring its profitability and potential for future growth.

- Click to explore a detailed breakdown of our findings in Tips Music's health report.

Understand Tips Music's track record by examining our Past report.

Key Takeaways

- Investigate our full lineup of 469 Indian Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives