- India

- /

- Diversified Financial

- /

- NSEI:JSWHL

Exploring Undiscovered Gems in India for July 2024

Reviewed by Simply Wall St

In the past year, India's market has experienced a notable rise of 43%, despite a recent 1.3% drop over the last seven days. With earnings expected to grow by 16% annually, investors might find potential in lesser-known stocks that could thrive under these dynamic market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Goldiam International | NA | 10.09% | 16.51% | ★★★★★★ |

| Ingersoll-Rand (India) | NA | 14.12% | 26.31% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.07% | 13.43% | 5.94% | ★★★★★★ |

| Deep Industries | 10.38% | 10.66% | 28.71% | ★★★★★★ |

| Macpower CNC Machines | NA | 20.01% | 23.61% | ★★★★★★ |

| Alembic | 0.42% | 11.74% | -6.39% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.78% | 39.75% | ★★★★★☆ |

| Abans Holdings | 91.73% | -25.26% | 17.68% | ★★★★★☆ |

| Insolation Energy | 88.64% | 163.87% | 419.31% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.41% | 6.90% | 11.82% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Happy Forgings (NSEI:HAPPYFORGE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Happy Forgings Limited is an Indian company that manufactures and sells forgings and related components, serving both domestic and international markets, with a market capitalization of ₹113.49 billion.

Operations: The company specializes in forged and machined products, generating revenue of ₹13.58 billion as of the latest reporting period. It has observed a notable increase in gross profit, which reached ₹7.36 billion, reflecting a gross profit margin of 54.17%.

Happy Forgings, a lesser-known yet robust player in the machinery industry, reported impressive financials with a 24.06% forecasted annual earnings growth. Despite lagging behind the industry's 29.1% growth, its earnings have surged by 25.1% annually over five years. The company's debt management is sound with a net debt to equity ratio of just 1.6%, and its interest payments are well-covered by EBIT at 96.3 times coverage, illustrating strong fiscal health and potential for sustained growth.

- Click here and access our complete health analysis report to understand the dynamics of Happy Forgings.

Evaluate Happy Forgings' historical performance by accessing our past performance report.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited is a financial services company specializing in capital market activities in primary and secondary markets across India, with a market capitalization of ₹57.03 billion.

Operations: IIFL Securities generates the majority of its revenue from capital market activities, contributing ₹18.09 billion, complemented by insurance broking and ancillary services at ₹2.58 billion, and facilities and ancillary services at ₹405.23 million. The company's gross profit margin as of the latest reported period stands at 72.89%, reflecting its cost efficiency in generating revenue from these segments.

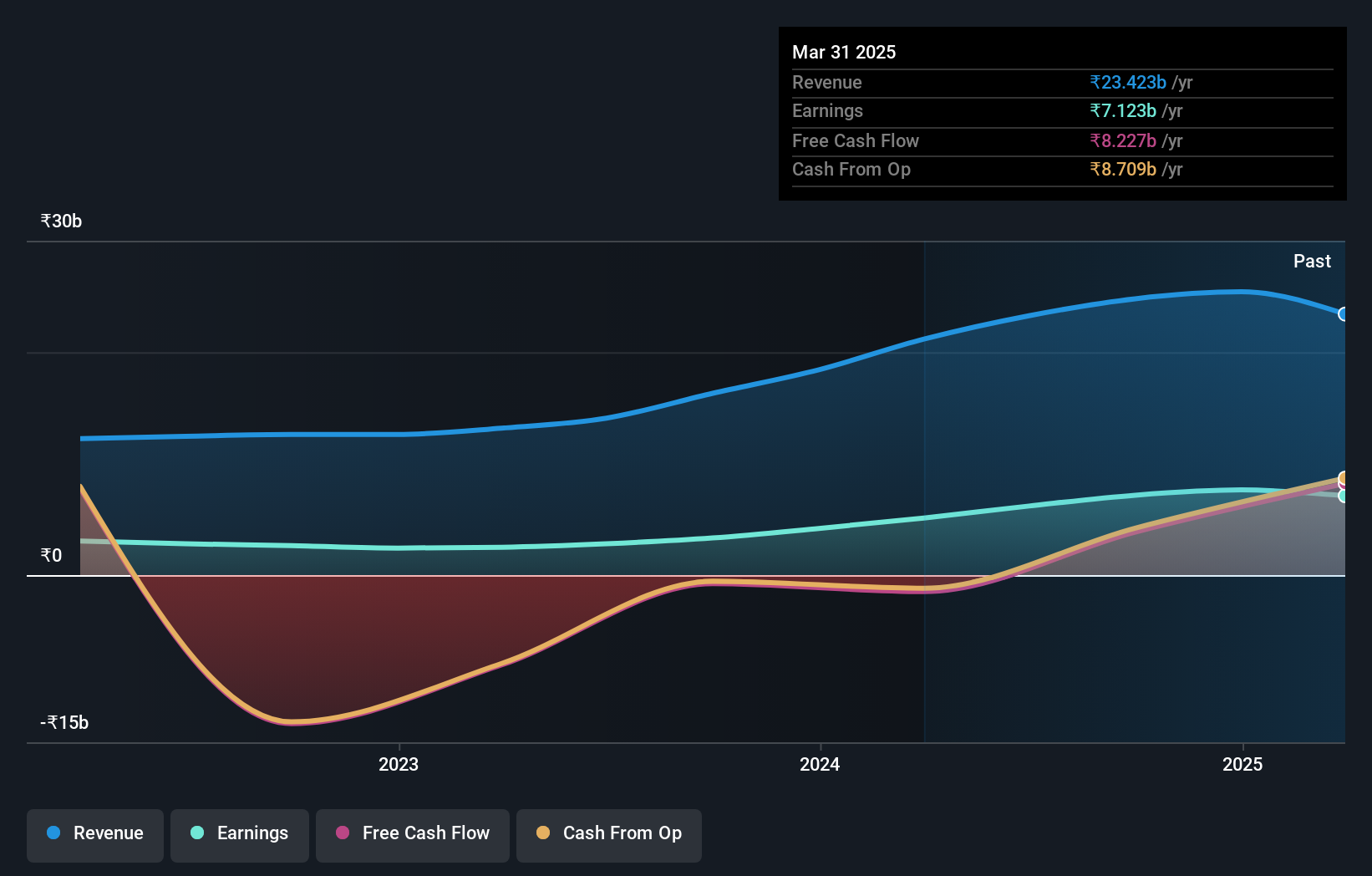

IIFL Securities, a notable player in the Indian capital markets, has demonstrated robust growth with a 105% increase in earnings over the past year, outpacing its industry's 55% growth. Its P/E ratio stands attractively at 11.1, well below the market average of 33.4. Additionally, IIFL Securities has significantly reduced its debt-to-equity ratio from 118% to 65% over five years, reflecting prudent financial management and enhancing its investment appeal amidst volatile market conditions.

- Take a closer look at IIFL Securities' potential here in our health report.

Review our historical performance report to gain insights into IIFL Securities''s past performance.

JSW Holdings (NSEI:JSWHL)

Simply Wall St Value Rating: ★★★★★☆

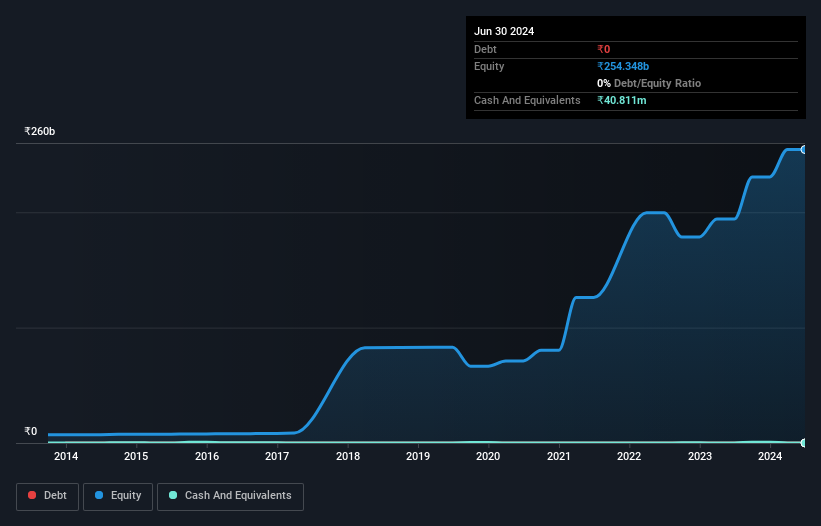

Overview: JSW Holdings Limited is a non-banking financial company in India, focusing on investing and financing activities, with a market capitalization of ₹75.98 billion.

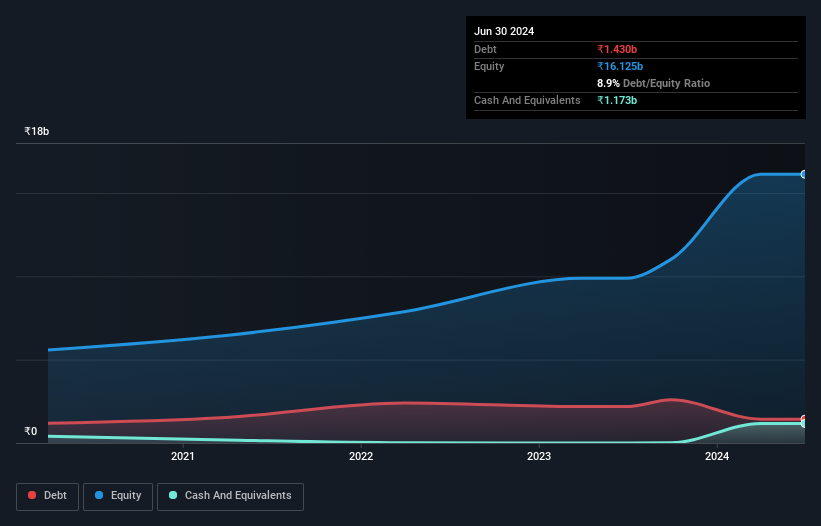

Operations: JSW Holdings generates revenue through its investing and financing activities, consistently achieving a high net income margin, which reached 98.03% in the latest quarter. The company has maintained a gross profit margin of 100% over several periods, indicating effective management of operating and non-operating expenses despite fluctuations in revenue.

JSW Holdings, navigating a challenging financial landscape, reported a notable shift in its fiscal metrics with revenue reaching INR 269.87 million in Q4 2024, up from INR 244.52 million the previous year. Despite this growth, net income dipped to INR 332.85 million from INR 414.63 million, reflecting a complex operational environment. The company's strategic appointment of Akshat Chechani as Company Secretary and Compliance Officer underscores its commitment to robust governance and compliance standards amidst these fluctuations.

- Click here to discover the nuances of JSW Holdings with our detailed analytical health report.

Gain insights into JSW Holdings' historical performance by reviewing our past performance report.

Next Steps

- Embark on your investment journey to our 454 Indian Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JSWHL

JSW Holdings

A non-banking financial company, primarily engages in investing and financing activities in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives