Over the last 7 days, the Indian market has risen 2.5%, driven by gains in every sector, and over the past year, it has climbed 45%. In this thriving environment where earnings are forecast to grow by 16% annually, identifying undervalued stocks can provide significant opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹716.85 | ₹1041.17 | 31.1% |

| HEG (NSEI:HEG) | ₹2195.85 | ₹3310.12 | 33.7% |

| Updater Services (NSEI:UDS) | ₹317.55 | ₹537.05 | 40.9% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2250.85 | ₹3598.27 | 37.4% |

| Vedanta (NSEI:VEDL) | ₹447.20 | ₹722.69 | 38.1% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹315.70 | ₹508.03 | 37.9% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹524.00 | ₹854.67 | 38.7% |

| Piramal Pharma (NSEI:PPLPHARMA) | ₹173.82 | ₹246.83 | 29.6% |

| Delhivery (NSEI:DELHIVERY) | ₹406.15 | ₹751.07 | 45.9% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3181.05 | ₹5542.84 | 42.6% |

Let's uncover some gems from our specialized screener.

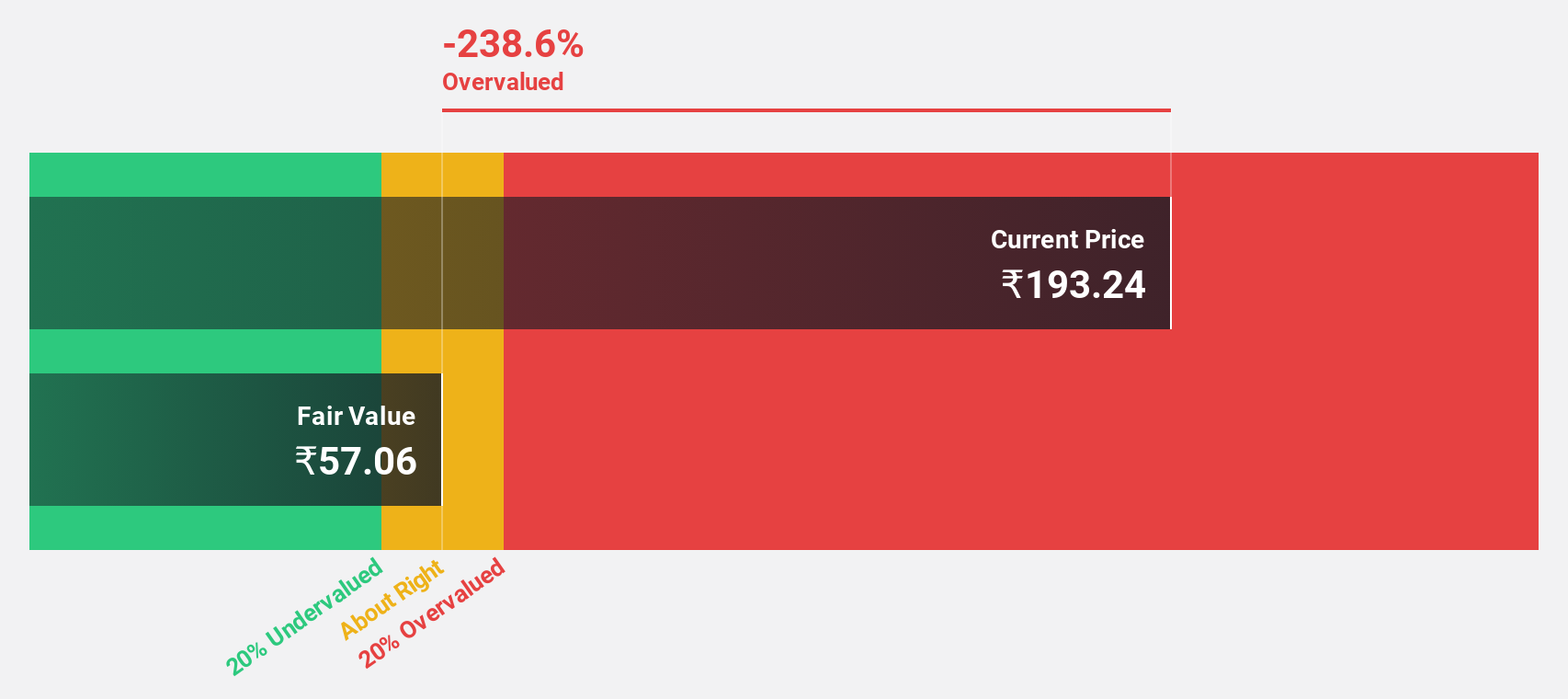

Fusion Finance (NSEI:FUSION)

Overview: Fusion Finance Limited, a non-banking financial company with a market cap of ₹43.42 billion, provides microfinance lending services to women entrepreneurs in rural and semi-urban areas in India.

Operations: Revenue from micro financing activities amounts to ₹12.57 billion.

Estimated Discount To Fair Value: 12.5%

Fusion Finance, trading at ₹431.55, is undervalued compared to its estimated fair value of ₹493.46 and peers in the industry. Despite recent regulatory challenges, including income tax and GST show cause notices, the company’s earnings have grown 41.6% annually over the past five years and are forecasted to grow 18.23% per year moving forward. With revenue expected to increase by 24.8% annually, Fusion Finance demonstrates strong cash flow potential amidst market uncertainties.

- Upon reviewing our latest growth report, Fusion Finance's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Fusion Finance with our detailed financial health report.

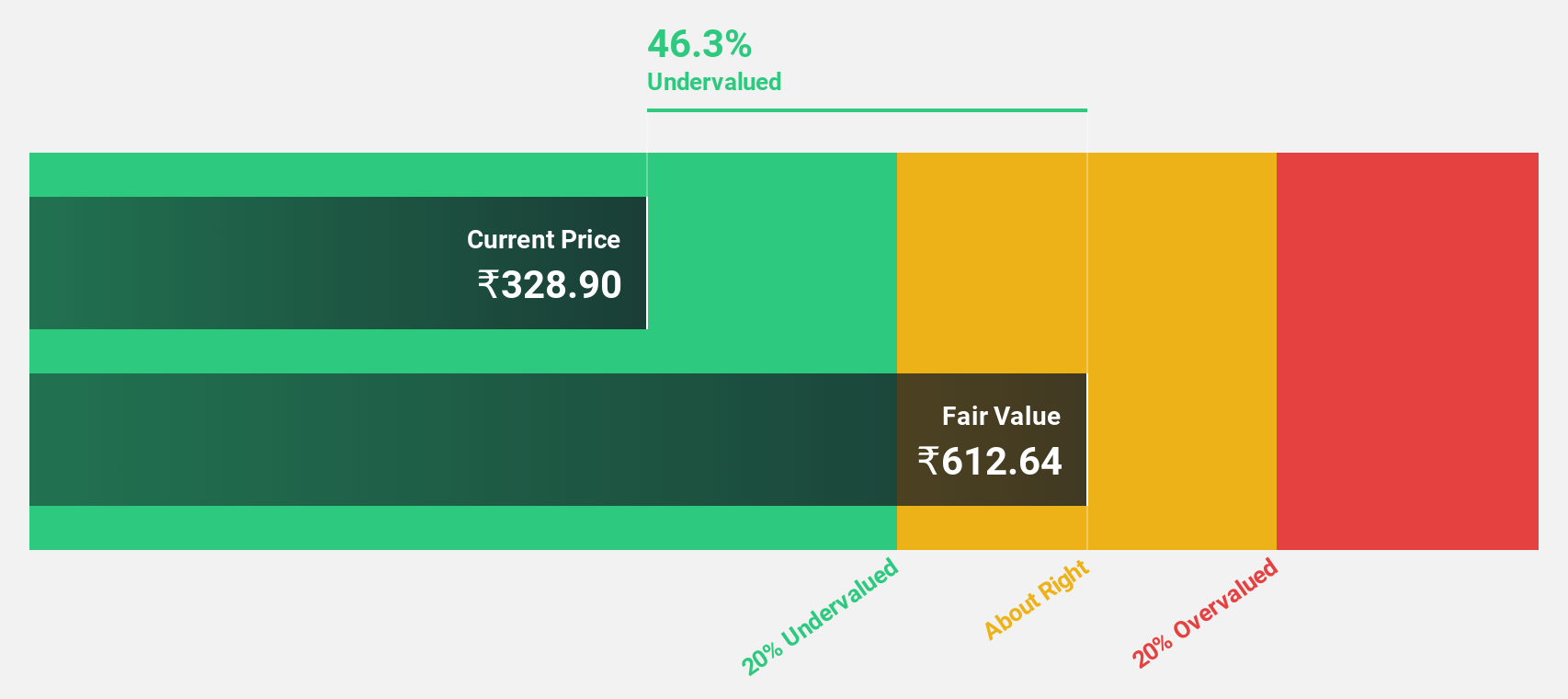

Mahindra Logistics (NSEI:MAHLOG)

Overview: Mahindra Logistics Limited offers integrated logistics and mobility solutions in India and internationally, with a market cap of ₹37.75 billion.

Operations: Revenue from the company's operations is derived primarily from Supply Chain Management, contributing ₹53.04 billion, and Enterprise Mobility Services, which adds ₹3.29 billion.

Estimated Discount To Fair Value: 38.7%

Mahindra Logistics, trading at ₹524, is significantly undervalued with a fair value estimate of ₹854.67. The company is forecasted to grow revenue by 12% annually and become profitable within three years. Despite recent losses and regulatory penalties, its earnings are expected to rise by 65.06% per year. However, interest payments are not well covered by earnings, and the dividend yield of 0.48% is unsustainable based on current profits.

- Our comprehensive growth report raises the possibility that Mahindra Logistics is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Mahindra Logistics stock in this financial health report.

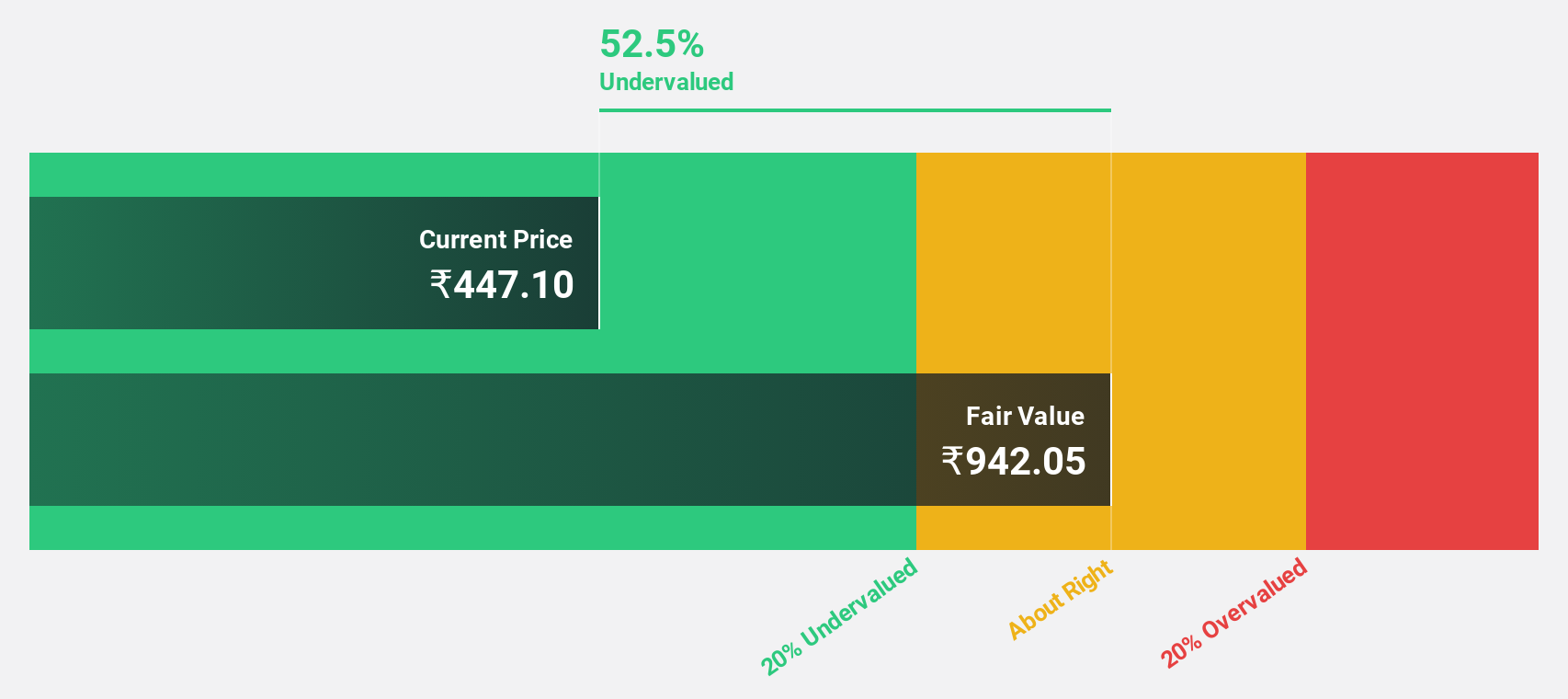

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited, with a market cap of ₹1.75 trillion, is a diversified natural resources company engaged in exploring, extracting, and processing minerals and oil and gas across India and internationally.

Operations: Vedanta Limited's revenue segments include Power (₹61.53 billion), Copper (₹197.30 billion), Iron Ore (₹90.69 billion), Aluminium (₹483.71 billion), Oil and Gas (₹178.37 billion), Zinc - India (₹279.25 billion), and Zinc - International (₹35.56 billion).

Estimated Discount To Fair Value: 38.1%

Vedanta, trading at ₹447.2, is significantly undervalued with a fair value estimate of ₹722.69. Despite a high debt level and recent regulatory challenges, its earnings are forecasted to grow 43.25% annually over the next three years, outpacing the Indian market's growth rate of 16.2%. However, its dividend yield of 4.92% is not well covered by earnings, and shareholders have faced dilution in the past year due to equity offerings totaling ₹85 billion.

- According our earnings growth report, there's an indication that Vedanta might be ready to expand.

- Navigate through the intricacies of Vedanta with our comprehensive financial health report here.

Next Steps

- Access the full spectrum of 16 Undervalued Indian Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MAHLOG

Mahindra Logistics

Provides integrated logistics and mobility solutions in India and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives