- India

- /

- Capital Markets

- /

- NSEI:BLBLIMITED

BLB Limited's (NSE:BLBLIMITED) 27% Jump Shows Its Popularity With Investors

BLB Limited (NSE:BLBLIMITED) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 99% in the last year.

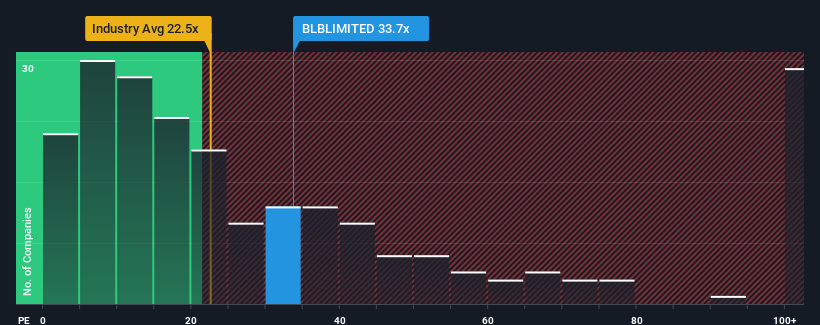

Since its price has surged higher, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 30x, you may consider BLB as a stock to potentially avoid with its 33.7x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for BLB as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for BLB

What Are Growth Metrics Telling Us About The High P/E?

BLB's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 45% last year. The strong recent performance means it was also able to grow EPS by 942% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that BLB's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

BLB's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of BLB revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with BLB (at least 1 which is potentially serious), and understanding them should be part of your investment process.

You might be able to find a better investment than BLB. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if BLB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BLBLIMITED

BLB

Engages in trading and investments in shares, and securities and commodities in India.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives