- India

- /

- Hospitality

- /

- NSEI:WONDERLA

Fewer Investors Than Expected Jumping On Wonderla Holidays Limited (NSE:WONDERLA)

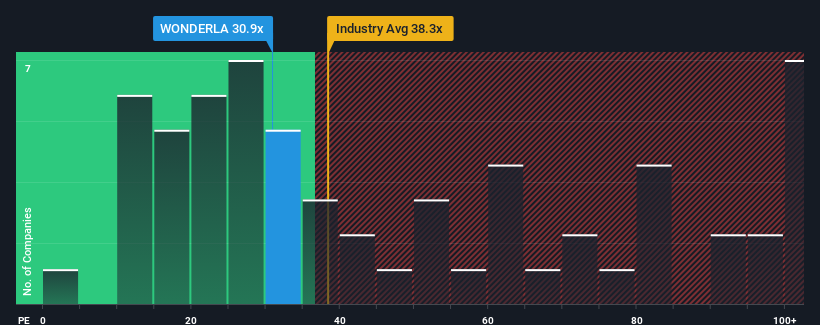

With a median price-to-earnings (or "P/E") ratio of close to 32x in India, you could be forgiven for feeling indifferent about Wonderla Holidays Limited's (NSE:WONDERLA) P/E ratio of 30.9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Wonderla Holidays could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Wonderla Holidays

How Is Wonderla Holidays' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Wonderla Holidays' to be considered reasonable.

Retrospectively, the last year delivered a decent 6.1% gain to the company's bottom line. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 25% per annum over the next three years. With the market only predicted to deliver 21% per year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Wonderla Holidays is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Wonderla Holidays currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Wonderla Holidays (1 makes us a bit uncomfortable!) that we have uncovered.

Of course, you might also be able to find a better stock than Wonderla Holidays. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wonderla Holidays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WONDERLA

High growth potential with excellent balance sheet.

Market Insights

Community Narratives