November 2024's Top Growth Picks With High Insider Confidence

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with major benchmarks like the S&P 500 and Nasdaq Composite reaching record highs amid expectations of growth-friendly policies. As investors navigate these evolving conditions, companies with high insider ownership often signal strong internal confidence and alignment with shareholder interests, making them compelling considerations for those seeking growth opportunities in today's market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

TBO Tek (NSEI:TBOTEK)

Simply Wall St Growth Rating: ★★★★★☆

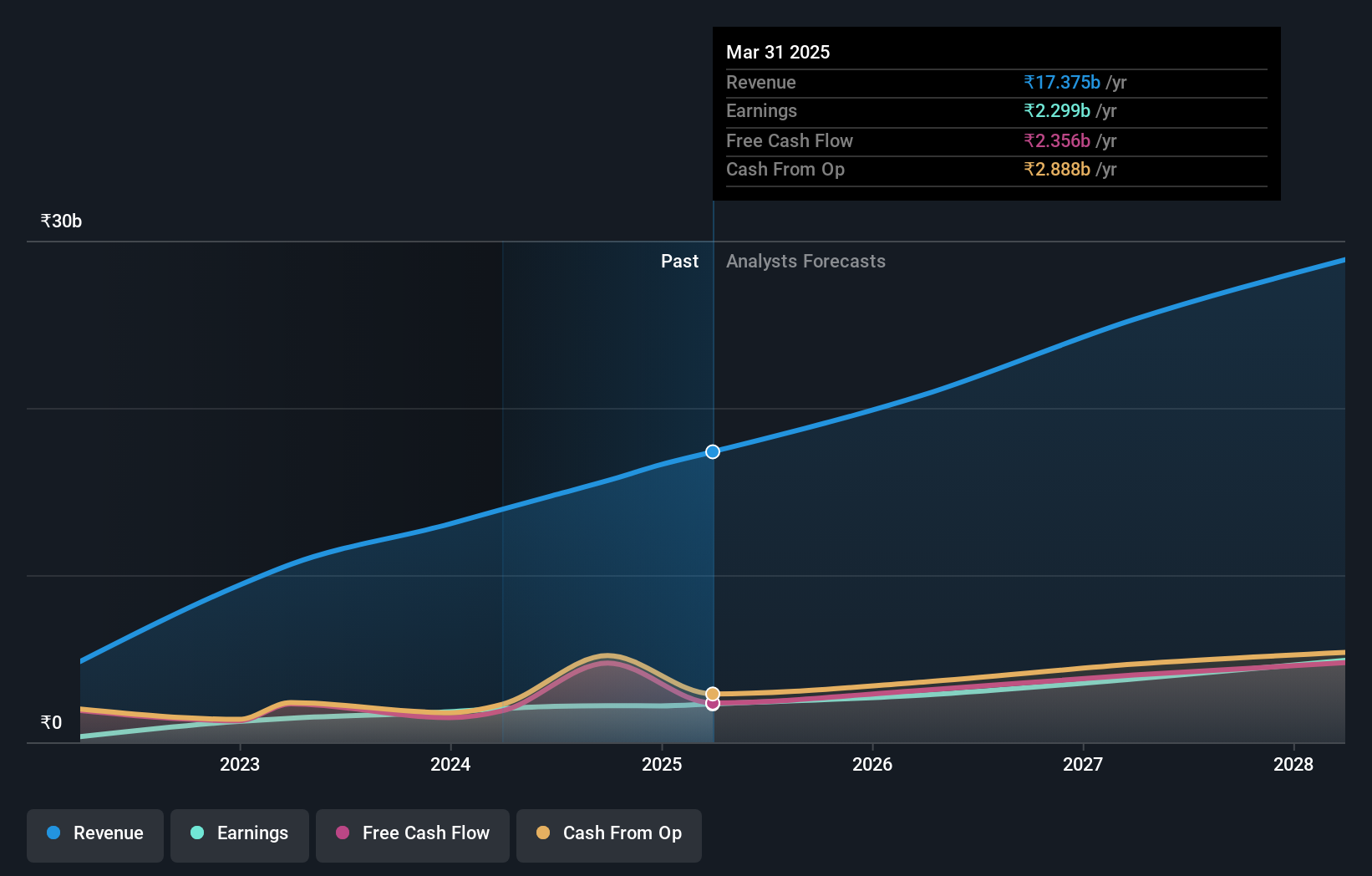

Overview: TBO Tek Limited operates travel distribution platforms in India and internationally, with a market cap of ₹178.08 billion.

Operations: The company's revenue segments include Air Ticketing at ₹3.44 billion and Hotels and Packages at ₹10.88 billion.

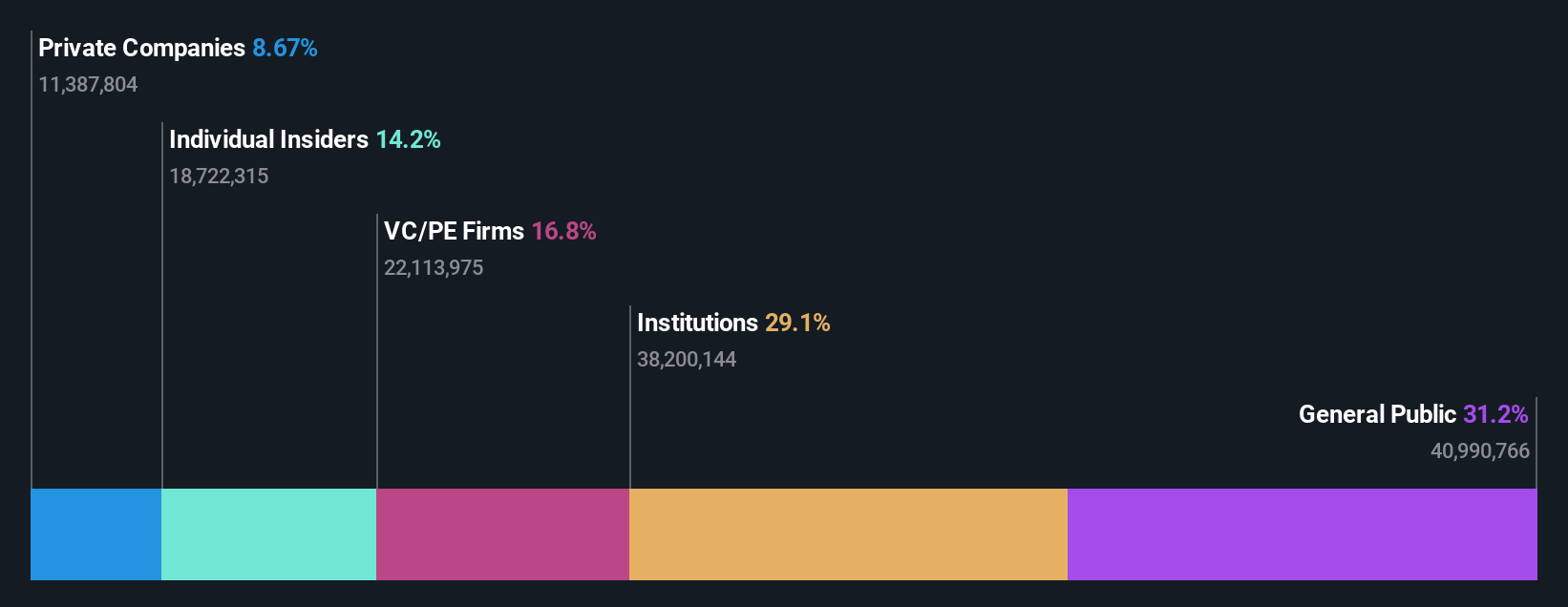

Insider Ownership: 23.3%

TBO Tek shows promising growth potential, with earnings forecasted to grow significantly at 29.5% annually, outpacing the Indian market's average. Recent earnings reports highlight strong performance, with net income reaching INR 600.88 million for Q2 2024. Revenue growth is expected at a robust rate of 19.2% per year, surpassing the market average of 10.5%. Insider ownership remains stable without recent substantial buying or selling activity noted in the past three months.

- Click to explore a detailed breakdown of our findings in TBO Tek's earnings growth report.

- The analysis detailed in our TBO Tek valuation report hints at an inflated share price compared to its estimated value.

Asia Aviation (SET:AAV)

Simply Wall St Growth Rating: ★★★★★☆

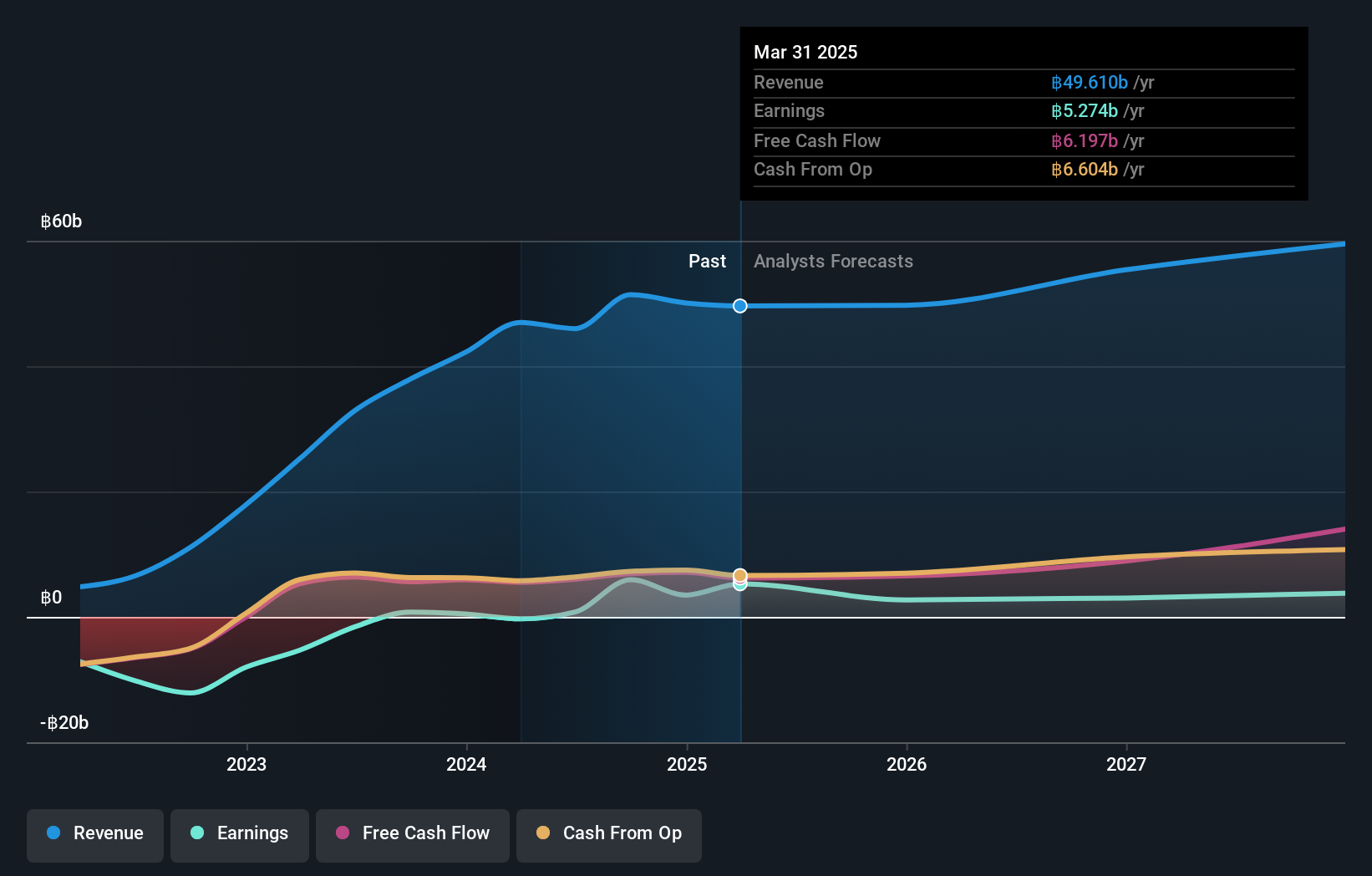

Overview: Asia Aviation Public Company Limited operates airline services in Thailand with a market cap of THB35.98 billion.

Operations: The company's revenue is primarily derived from Scheduled Flight Operations, amounting to THB47.29 billion, and Charter Flight Operations, contributing THB110.68 million.

Insider Ownership: 17.9%

Asia Aviation's recent profitability marks a turnaround, with net income of THB 84.07 million in Q2 2024 compared to a loss last year. Earnings are forecasted to grow significantly at 34.7% annually, outpacing the Thai market's average growth rate. However, revenue is expected to increase at a slower pace of 7% per year. The stock trades below its estimated fair value, but interest payments remain inadequately covered by earnings, indicating potential financial constraints.

- Delve into the full analysis future growth report here for a deeper understanding of Asia Aviation.

- Insights from our recent valuation report point to the potential overvaluation of Asia Aviation shares in the market.

3Peak (SHSE:688536)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3Peak Incorporated is a fabless semiconductor company that specializes in providing various analog products and technologies, with a market cap of CN¥15.37 billion.

Operations: The company's revenue is primarily derived from the Integrated Circuit Industry, totaling CN¥1.13 billion.

Insider Ownership: 14.8%

3Peak's insider ownership may align management with shareholder interests, yet recent financial performance shows challenges. The company reported a net loss of CNY 98.73 million for the first nine months of 2024, despite revenue growth to CNY 848.22 million from the previous year. While earnings are projected to grow by 73.52% annually and profitability is expected within three years, the share price remains highly volatile, reflecting market uncertainties amidst its ambitious growth forecasts.

- Get an in-depth perspective on 3Peak's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility 3Peak's shares may be trading at a premium.

Make It Happen

- Get an in-depth perspective on all 1522 Fast Growing Companies With High Insider Ownership by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:AAV

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives