- India

- /

- Consumer Services

- /

- NSEI:NIITMTS

3 Indian Exchange Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In the last week, the Indian market has stayed flat, but over the past 12 months, it has risen by an impressive 44%, with earnings expected to grow by 17% per annum in the coming years. In this context, identifying stocks that are trading below their estimated value can offer potential opportunities for investors looking to capitalize on future growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹173.00 | ₹305.82 | 43.4% |

| Godfrey Phillips India (BSE:500163) | ₹5270.65 | ₹8904.96 | 40.8% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹687.10 | ₹1165.33 | 41% |

| Yatharth Hospital & Trauma Care Services (NSEI:YATHARTH) | ₹481.35 | ₹792.08 | 39.2% |

| Updater Services (NSEI:UDS) | ₹323.20 | ₹622.28 | 48.1% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹400.20 | ₹762.32 | 47.5% |

| Texmaco Rail & Engineering (NSEI:TEXRAIL) | ₹252.75 | ₹504.57 | 49.9% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹856.95 | ₹1509.79 | 43.2% |

| Patel Engineering (BSE:531120) | ₹55.67 | ₹91.16 | 38.9% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹501.75 | ₹998.07 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Mahindra Logistics (NSEI:MAHLOG)

Overview: Mahindra Logistics Limited offers integrated logistics and mobility solutions both in India and internationally, with a market cap of ₹36.15 billion.

Operations: The company's revenue segments include Supply Chain Management, generating ₹53.04 billion, and Enterprise Mobility Services, contributing ₹3.29 billion.

Estimated Discount To Fair Value: 49.7%

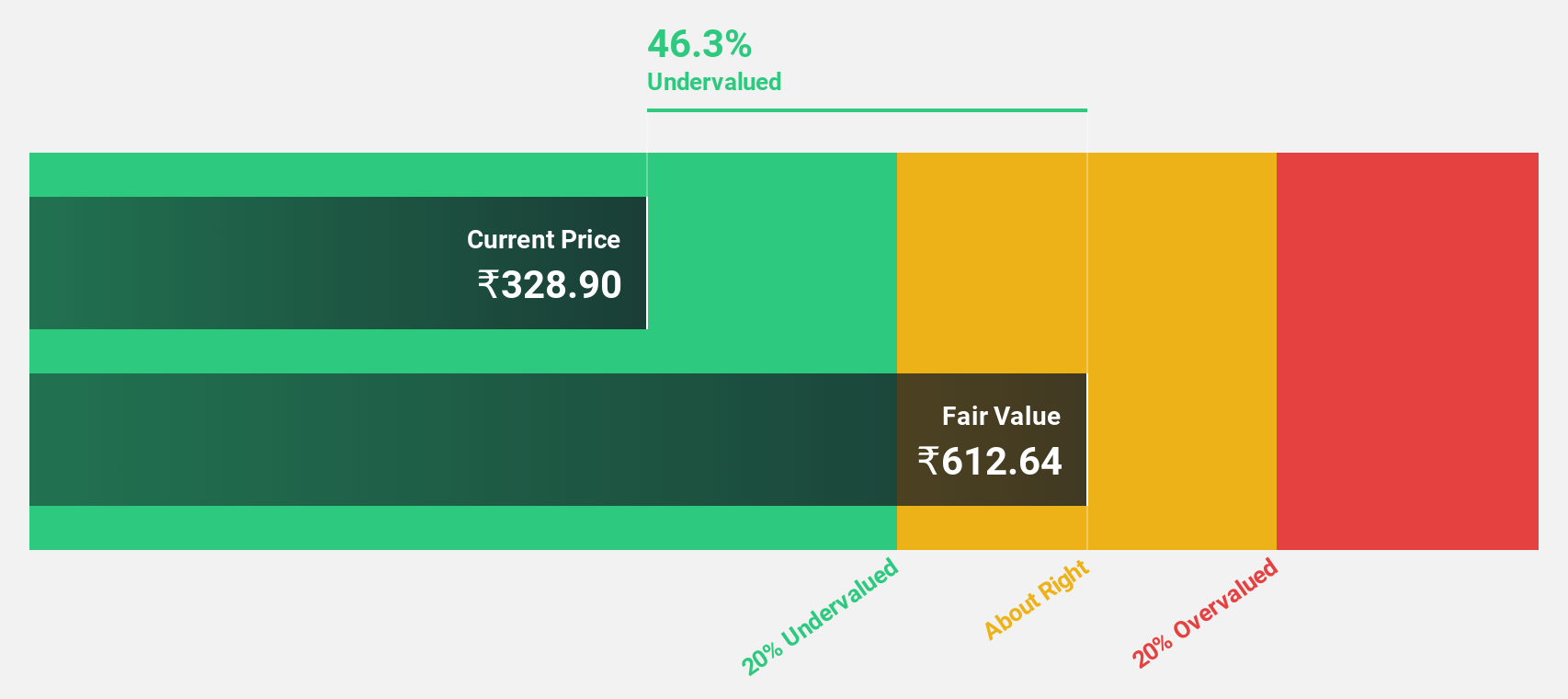

Mahindra Logistics appears undervalued based on cash flows, trading at ₹501.75, significantly below its estimated fair value of ₹998.07. Despite regulatory penalties and a recent net loss of INR 93.2 million for Q1 2024, the company's revenue is forecast to grow at 12% annually, outpacing the Indian market's growth rate. Additionally, Mahindra Logistics is expected to achieve profitability within three years with a high return on equity forecasted at 24.1%.

- The growth report we've compiled suggests that Mahindra Logistics' future prospects could be on the up.

- Take a closer look at Mahindra Logistics' balance sheet health here in our report.

NIIT Learning Systems (NSEI:NIITMTS)

Overview: NIIT Learning Systems Limited, operating as NIIT Managed Training Services, provides managed training services across North America, Europe, Asia, and Oceania with a market cap of ₹63.00 billion.

Operations: The company generates revenue primarily from Education & Training Services, amounting to ₹15.78 billion.

Estimated Discount To Fair Value: 34.9%

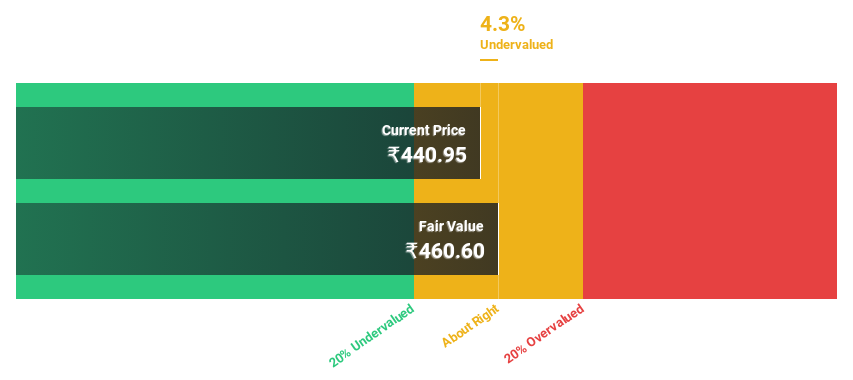

NIIT Learning Systems, trading at ₹464.10, is significantly undervalued with an estimated fair value of ₹712.74. Despite a history of unstable dividends and recent insider selling, the company’s earnings have grown 38% annually over the past five years and are forecast to grow 18.3% per year, outpacing the Indian market's growth rate. Recent board meetings and earnings calls indicate continued financial scrutiny and potential for sustained revenue growth at 13.9% per year.

- In light of our recent growth report, it seems possible that NIIT Learning Systems' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in NIIT Learning Systems' balance sheet health report.

Thangamayil Jewellery (NSEI:THANGAMAYL)

Overview: Thangamayil Jewellery Limited operates a chain of retail jewelry stores in India and has a market cap of ₹49.35 billion.

Operations: The company's revenue segments include Gold Jewellery, Diamond, and Silver Articles, amounting to ₹40.88 billion.

Estimated Discount To Fair Value: 13.5%

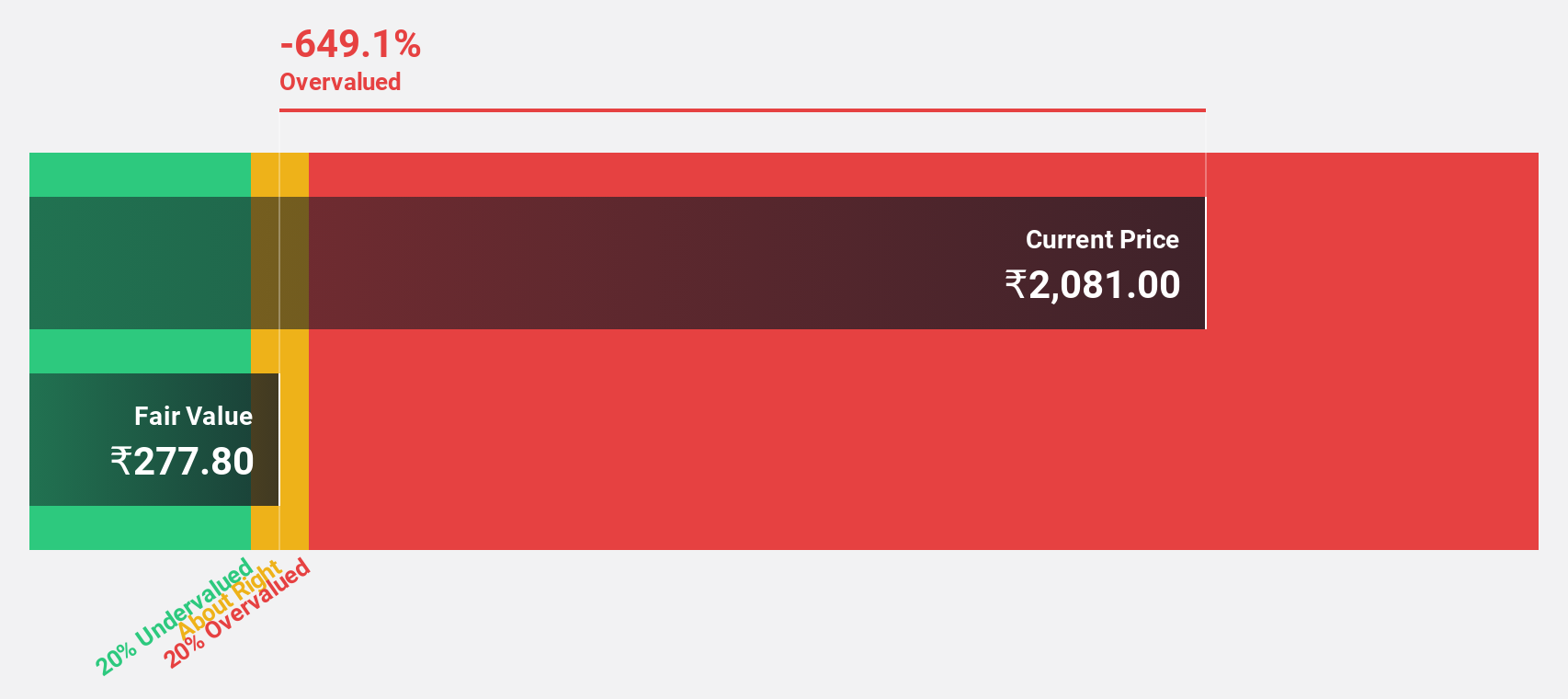

Thangamayil Jewellery, trading at ₹1798.5, is undervalued with a fair value estimate of ₹2078.2. Despite high debt levels, the company's earnings have grown 22.7% annually over the past five years and are expected to grow 24.78% per year, outpacing the Indian market's growth rate of 16.9%. Recent board changes and consistent dividend payments underscore its stable management and financial health, while revenue forecasts suggest robust future performance at 21.9% per year.

- Insights from our recent growth report point to a promising forecast for Thangamayil Jewellery's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Thangamayil Jewellery.

Next Steps

- Discover the full array of 32 Undervalued Indian Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NIIT Learning Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NIITMTS

NIIT Learning Systems

Provides managed training services in India, the United States, Europe, and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion