Stock Analysis

- India

- /

- Hospitality

- /

- NSEI:MHRIL

Would Shareholders Who Purchased Mahindra Holidays & Resorts India's (NSE:MHRIL) Stock Three Years Be Happy With The Share price Today?

It is a pleasure to report that the Mahindra Holidays & Resorts India Limited (NSE:MHRIL) is up 39% in the last quarter. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 20% in the last three years, falling well short of the market return.

See our latest analysis for Mahindra Holidays & Resorts India

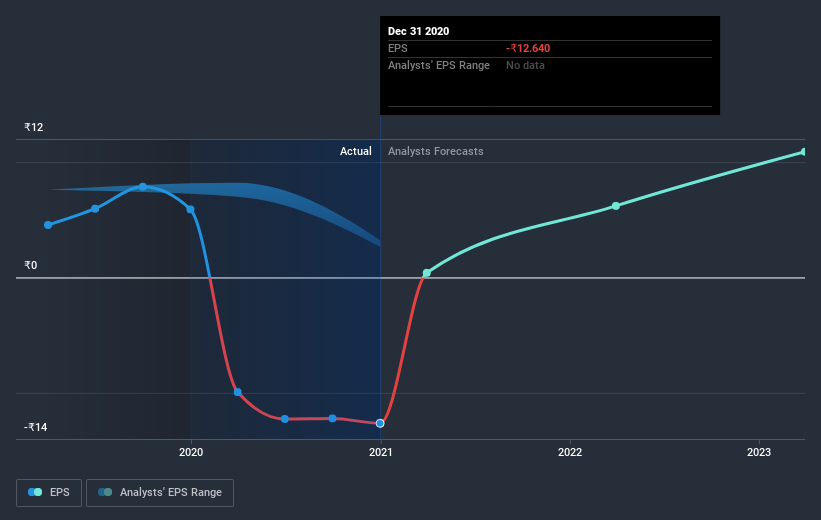

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Mahindra Holidays & Resorts India saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Mahindra Holidays & Resorts India's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Mahindra Holidays & Resorts India shareholders are up 6.2% for the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 0.3% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Mahindra Holidays & Resorts India (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

We will like Mahindra Holidays & Resorts India better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Mahindra Holidays & Resorts India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Mahindra Holidays & Resorts India is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:MHRIL

Mahindra Holidays & Resorts India

Operates in the leisure hospitality sector.

Adequate balance sheet with moderate growth potential.