Stock Analysis

Indian Exchange Growth Stocks With High Insider Ownership And Up To 24% Revenue Growth

Reviewed by Simply Wall St

The Indian market has shown robust performance, with a 1.4% increase in the last week and an impressive 44% rise over the past year, alongside expectations of earnings growing by 16% annually. In this context, growth companies with high insider ownership are particularly compelling as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.7% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.2% |

Let's review some notable picks from our screened stocks.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dixon Technologies (India) Limited specializes in providing electronic manufacturing services across India, with a market capitalization of approximately ₹74.90 billion.

Operations: The company's revenue is generated from several key segments: Home Appliances (₹12.05 billion), Security Systems (₹6.33 billion), Lighting Products (₹7.87 billion), Mobile & EMS Division (₹109.19 billion), and Consumer Electronics & Appliances (₅41.48 billion).

Insider Ownership: 24.9%

Revenue Growth Forecast: 23.4% p.a.

Dixon Technologies in India showcases robust growth prospects with earnings expected to rise significantly, outpacing the broader Indian market. With a forecasted annual earnings growth of 33.7% and revenue growth of 23.4%, Dixon stands out in its sector. Recent strategic moves include a memorandum of understanding with Acerpure India for manufacturing consumer appliances, enhancing its production capabilities and potentially boosting future revenues. This aligns with their substantial year-over-year earnings increase, reflecting strong operational execution and market positioning.

- Unlock comprehensive insights into our analysis of Dixon Technologies (India) stock in this growth report.

- The valuation report we've compiled suggests that Dixon Technologies (India)'s current price could be inflated.

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

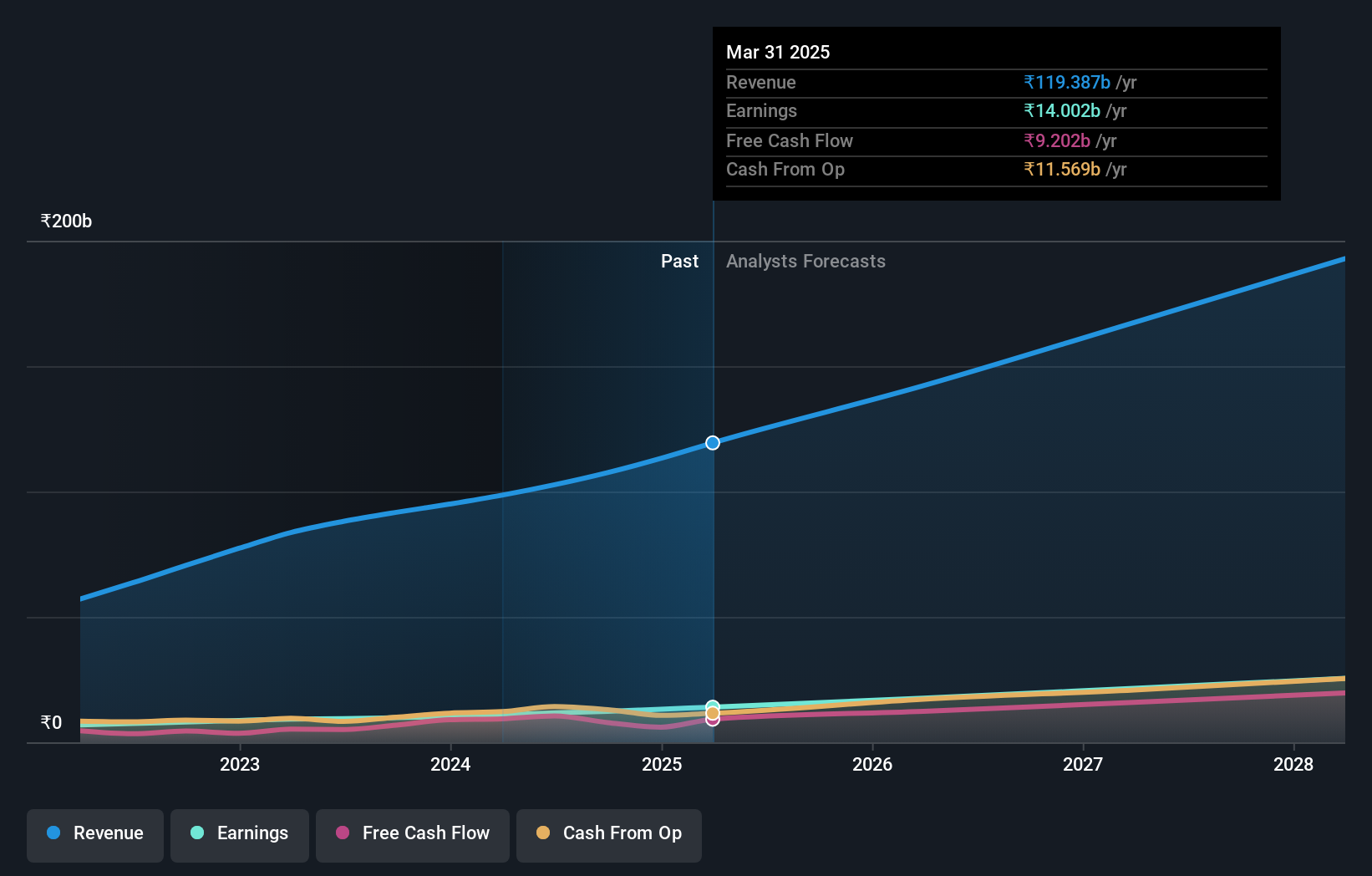

Overview: Persistent Systems Limited operates in the provision of software products, services, and technology solutions across India, North America, and other international markets, with a market capitalization of approximately ₹66.13 billion.

Operations: The company generates revenue from three primary segments: Healthcare & Life Sciences (₹20.88 billion), Software, Hi-Tech and Emerging Industries (₹45.95 billion), and Banking, Financial Services and Insurance (BFSI) at ₹31.39 billion.

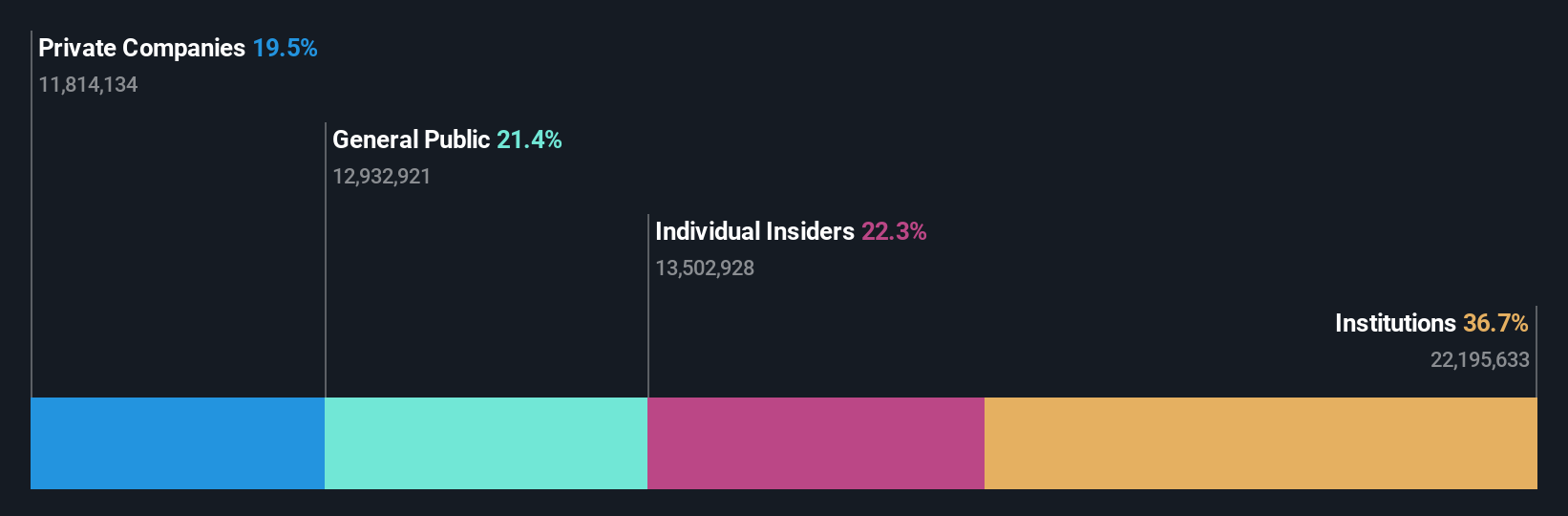

Insider Ownership: 34.3%

Revenue Growth Forecast: 13.4% p.a.

Persistent Systems, a key entity in India's tech sector, is poised for notable growth with earnings and revenue forecasted to outpace the broader market at 18.3% and 13.4% respectively. Despite a high return on equity projection of 26.3%, its growth is not considered significantly high as it falls below the 20% threshold. Recent developments include executive changes and the launch of GenAI Hub, enhancing its enterprise AI solutions but no substantial insider trading activity was noted in recent months, suggesting stable but cautious insider confidence.

- Click here and access our complete growth analysis report to understand the dynamics of Persistent Systems.

- Insights from our recent valuation report point to the potential overvaluation of Persistent Systems shares in the market.

Titagarh Rail Systems (NSEI:TITAGARH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Titagarh Rail Systems Limited, with a market capitalization of ₹243.03 billion, engages in the manufacturing and sale of freight and passenger rail systems both within India and globally.

Operations: The company generates revenue from two primary segments: Passenger Rail Systems at ₹4.36 billion and Freight Rail Systems, including shipbuilding, bridges, and defense, at ₹34.18 billion.

Insider Ownership: 24.3%

Revenue Growth Forecast: 24.2% p.a.

Titagarh Rail Systems, a growth-oriented company in India with high insider ownership, is expected to see its earnings and revenue grow at 29.9% and 24.2% annually, outstripping the broader Indian market's growth rates of 15.8% and 9.6%, respectively. Despite this robust forecast, shareholder dilution occurred over the past year, and insider trading volumes have not been substantial recently. The company has also inaugurated a new engineering center in Bangalore to bolster innovation in rail systems, reflecting its commitment to expanding capabilities and enhancing product offerings within the 'Make-in-India' framework.

- Click to explore a detailed breakdown of our findings in Titagarh Rail Systems' earnings growth report.

- Our valuation report here indicates Titagarh Rail Systems may be overvalued.

Next Steps

- Click here to access our complete index of 83 Fast Growing Indian Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Persistent Systems is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PERSISTENT

Persistent Systems

Provides software products, services, and technology solutions in India, North America, and internationally.

Solid track record with excellent balance sheet and pays a dividend.