DLF And 2 High Growth Stocks With Significant Insider Ownership On The Indian Exchange

Reviewed by Simply Wall St

The Indian market has been flat over the last week but has risen 44% in the past 12 months, with earnings expected to grow by 17% per annum over the next few years. In this robust environment, stocks with high insider ownership and strong growth potential, such as DLF and two others discussed here, can be particularly appealing to investors.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 36.6% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| PTC Industries (BSE:539006) | 26.3% | 65.3% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| DLF (NSEI:DLF) | 26.4% | 22.9% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

Underneath we present a selection of stocks filtered out by our screen.

DLF (NSEI:DLF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: DLF Limited, along with its subsidiaries, operates in the colonization and real estate development sector in India, with a market cap of ₹2.10 trillion.

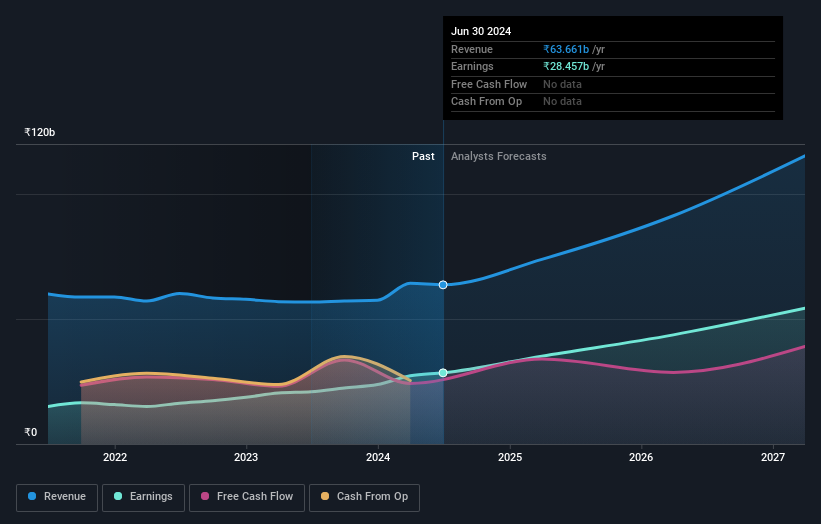

Operations: DLF's revenue primarily comes from real estate development and related activities, amounting to ₹63.66 billion.

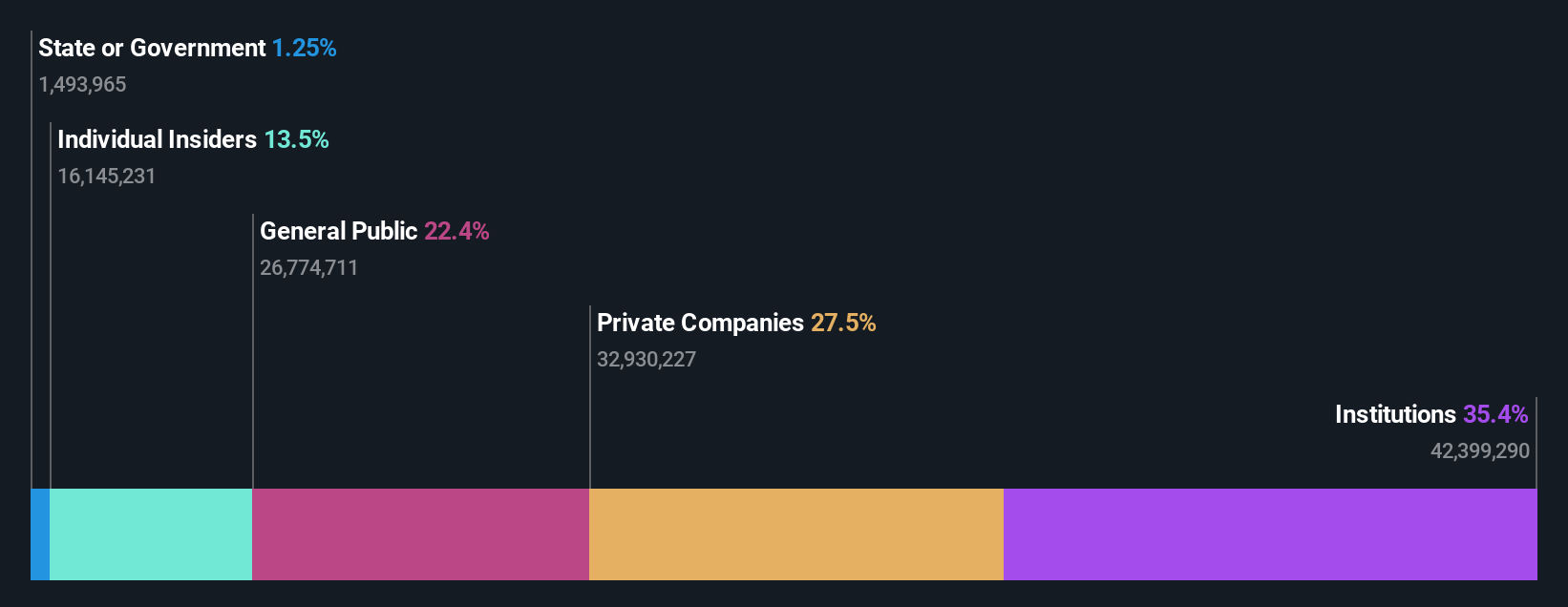

Insider Ownership: 26.4%

Earnings Growth Forecast: 22.9% p.a.

DLF's earnings and revenue are forecast to grow significantly, with earnings expected to rise 22.9% annually, outpacing the Indian market. Revenue is projected to increase by 21.5% per year, also exceeding market growth rates. Despite substantial insider ownership, recent months have seen minimal insider buying or selling activity. Recent news includes the cessation of Lt. Gen. Aditya Singh (Retd.) as an Independent Director and positive Q1 financial results with increased net income and EPS compared to last year.

- Delve into the full analysis future growth report here for a deeper understanding of DLF.

- In light of our recent valuation report, it seems possible that DLF is trading beyond its estimated value.

MedPlus Health Services (NSEI:MEDPLUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MedPlus Health Services Limited operates in the retail trading of medicines and general items in India, with a market cap of ₹83.53 billion.

Operations: MedPlus Health Services Limited generates revenue primarily from its retail segment at ₹57.43 billion and diagnostics segment at ₹852.29 million.

Insider Ownership: 14.0%

Earnings Growth Forecast: 40.9% p.a.

MedPlus Health Services has demonstrated robust growth with Q1 2024 earnings showing a net income of ₹143.63 million, up from ₹37.86 million the previous year, and EPS rising to ₹1.2 from ₹0.32. Despite a forecasted return on equity of 11%, which is below benchmark expectations, its revenue and earnings are projected to grow faster than the Indian market at 16.6% and 40.9% per year respectively, indicating strong future prospects for this high insider ownership company.

- Click here to discover the nuances of MedPlus Health Services with our detailed analytical future growth report.

- The analysis detailed in our MedPlus Health Services valuation report hints at an inflated share price compared to its estimated value.

Solara Active Pharma Sciences (NSEI:SOLARA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Solara Active Pharma Sciences Limited is engaged in the manufacturing, production, processing, formulation, and distribution of active pharmaceutical ingredients (API) across India and various international markets with a market cap of ₹35.42 billion.

Operations: The company's revenue from active pharmaceutical ingredients (API) amounts to ₹13.00 billion.

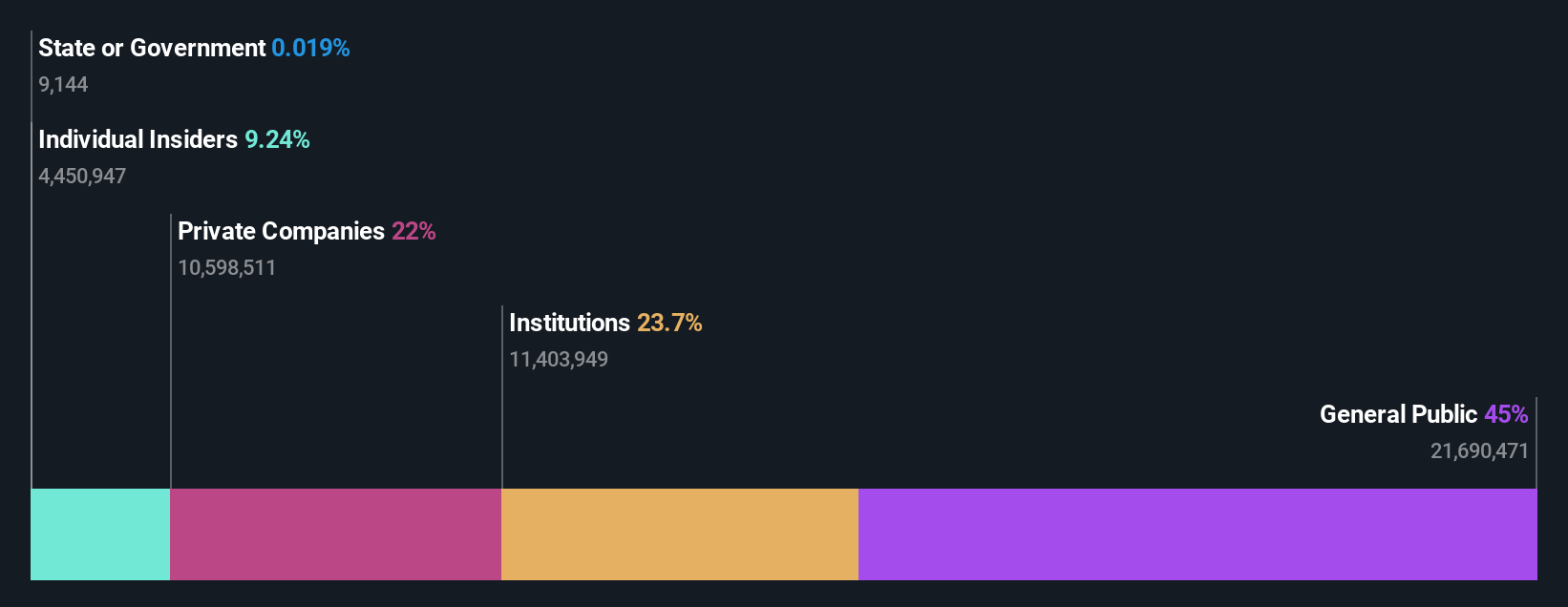

Insider Ownership: 10.4%

Earnings Growth Forecast: 107.1% p.a.

Solara Active Pharma Sciences is forecast to become profitable within three years, with revenue expected to grow at 12.6% annually, outpacing the Indian market. Despite recent shareholder dilution and a low future return on equity of 8.5%, Q1 2024 results showed improved net loss figures and reaffirmed FY2025 revenue guidance between ₹14 billion and ₹15 billion. The company has high insider ownership but recently saw the resignation of a non-executive director.

- Dive into the specifics of Solara Active Pharma Sciences here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Solara Active Pharma Sciences' current price could be quite moderate.

Make It Happen

- Click here to access our complete index of 95 Fast Growing Indian Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SOLARA

Solara Active Pharma Sciences

Manufactures, produces, processes, formulates, sells, imports, exports, merchandises, distributes, trades in, and deals in active pharmaceutical ingredients (API) in India, Asia Pacific, Europe, North America, South America, and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives