Here's Why We Don't Think Vardhman Acrylics's (NSE:VARDHACRLC) Statutory Earnings Reflect Its Underlying Earnings Potential

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Vardhman Acrylics (NSE:VARDHACRLC).

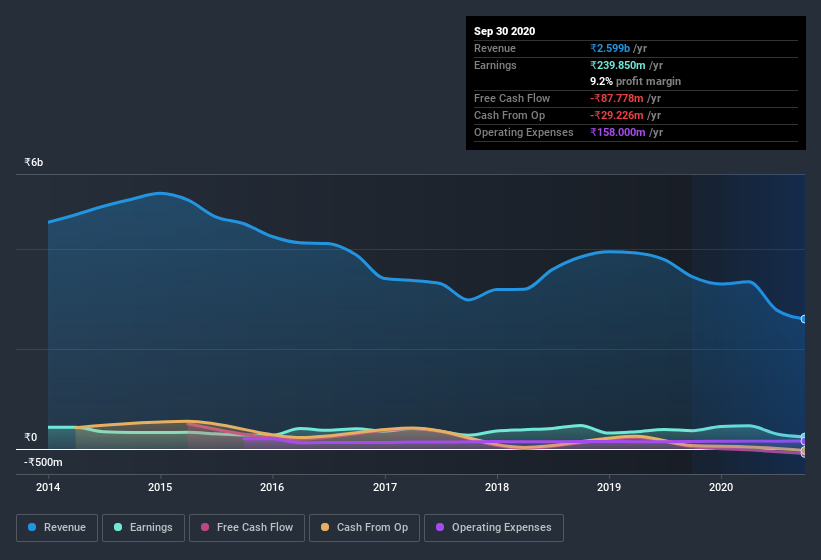

We like the fact that Vardhman Acrylics made a profit of ₹239.9m on its revenue of ₹2.60b, in the last year. Below, you can see that both its revenue and its profit have fallen over the last three years.

Check out our latest analysis for Vardhman Acrylics

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. So today we'll look at what Vardhman Acrylics' cashflow, tax benefits and unusual items tell us about the quality of its earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Vardhman Acrylics.

Examining Cashflow Against Vardhman Acrylics' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Vardhman Acrylics has an accrual ratio of 0.38 for the year to September 2020. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of ₹88m, in contrast to the aforementioned profit of ₹239.9m. We saw that FCF was ₹44m a year ago though, so Vardhman Acrylics has at least been able to generate positive FCF in the past. Having said that it seems that a recent tax benefit and some unusual items have impacted its profit (and this its accrual ratio).

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by ₹200m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Vardhman Acrylics had a rather significant contribution from unusual items relative to its profit to September 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Vardhman Acrylics received a tax benefit of ₹4.5m. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Vardhman Acrylics' Profit Performance

In conclusion, Vardhman Acrylics' weak accrual ratio suggests its statutory earnings have been inflated by the non-cash tax benefit and the boost it received from unusual items. For all the reasons mentioned above, we think that, at a glance, Vardhman Acrylics' statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Our analysis shows 2 warning signs for Vardhman Acrylics (1 is a bit unpleasant!) and we strongly recommend you look at these before investing.

Our examination of Vardhman Acrylics has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Vardhman Acrylics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:VARDHACRLC

Vardhman Acrylics

Manufactures and supplies acrylic fibers and tows in India.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives