Pearl Global Industries' (NSE:PGIL) Promising Earnings May Rest On Soft Foundations

Pearl Global Industries Limited's (NSE:PGIL) stock was strong after they recently reported robust earnings. We did some analysis and think that investors are missing some details hidden beneath the profit numbers.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Pearl Global Industries expanded the number of shares on issue by 5.4% over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Pearl Global Industries' historical EPS growth by clicking on this link.

How Is Dilution Impacting Pearl Global Industries' Earnings Per Share (EPS)?

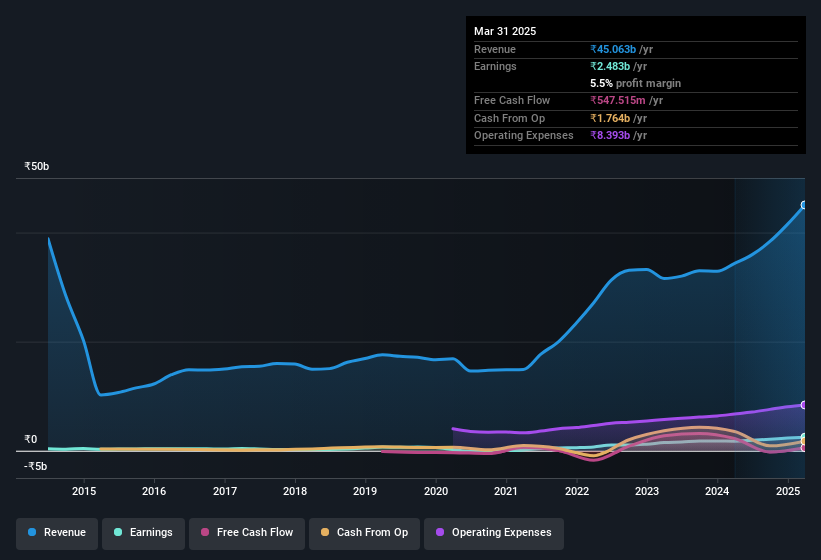

As you can see above, Pearl Global Industries has been growing its net income over the last few years, with an annualized gain of 264% over three years. But EPS was only up 249% per year, in the exact same period. And the 42% profit boost in the last year certainly seems impressive at first glance. But in comparison, EPS only increased by 37% over the same period. So you can see that the dilution has had a bit of an impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Pearl Global Industries shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Pearl Global Industries' Profit Performance

Each Pearl Global Industries share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Therefore, it seems possible to us that Pearl Global Industries' true underlying earnings power is actually less than its statutory profit. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Pearl Global Industries as a business, it's important to be aware of any risks it's facing. When we did our research, we found 2 warning signs for Pearl Global Industries (1 is concerning!) that we believe deserve your full attention.

Today we've zoomed in on a single data point to better understand the nature of Pearl Global Industries' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PGIL

Pearl Global Industries

Manufactures and sells readymade garments in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success