Market Might Still Lack Some Conviction On Pearl Global Industries Limited (NSE:PGIL) Even After 26% Share Price Boost

Pearl Global Industries Limited (NSE:PGIL) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 143% following the latest surge, making investors sit up and take notice.

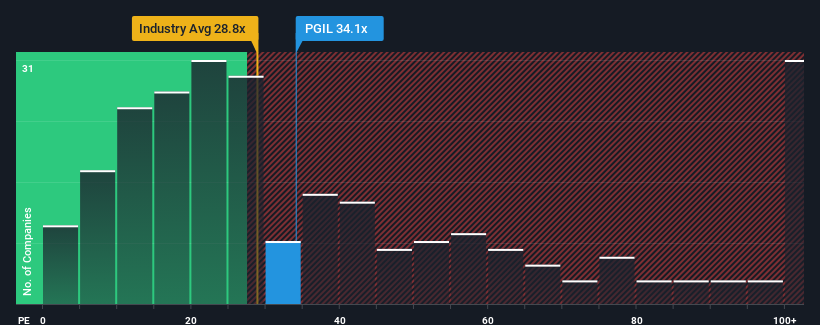

In spite of the firm bounce in price, there still wouldn't be many who think Pearl Global Industries' price-to-earnings (or "P/E") ratio of 34.1x is worth a mention when the median P/E in India is similar at about 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, Pearl Global Industries has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Pearl Global Industries

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Pearl Global Industries' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 16%. The strong recent performance means it was also able to grow EPS by 294% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 31% per year over the next three years. With the market only predicted to deliver 20% each year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Pearl Global Industries is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Pearl Global Industries' P/E?

Its shares have lifted substantially and now Pearl Global Industries' P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Pearl Global Industries' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Pearl Global Industries you should be aware of, and 1 of them can't be ignored.

You might be able to find a better investment than Pearl Global Industries. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PGIL

Pearl Global Industries

Manufactures and sells readymade garments in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives