Investors Still Aren't Entirely Convinced By Pearl Global Industries Limited's (NSE:PGIL) Earnings Despite 28% Price Jump

Those holding Pearl Global Industries Limited (NSE:PGIL) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last month tops off a massive increase of 104% in the last year.

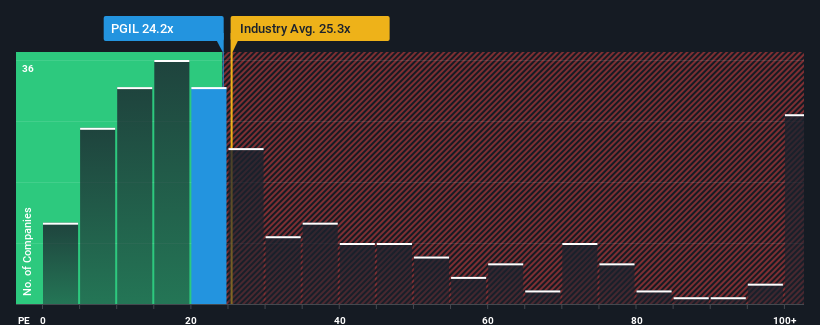

Even after such a large jump in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 28x, you may still consider Pearl Global Industries as an attractive investment with its 24.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Pearl Global Industries as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Pearl Global Industries

How Is Pearl Global Industries' Growth Trending?

In order to justify its P/E ratio, Pearl Global Industries would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 37% last year. The latest three year period has also seen an excellent 244% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 30% per year over the next three years. That's shaping up to be materially higher than the 21% each year growth forecast for the broader market.

With this information, we find it odd that Pearl Global Industries is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Pearl Global Industries' P/E

Pearl Global Industries' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Pearl Global Industries currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You need to take note of risks, for example - Pearl Global Industries has 2 warning signs (and 1 which is significant) we think you should know about.

If you're unsure about the strength of Pearl Global Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PGIL

Pearl Global Industries

Manufactures and sells readymade garments in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives