- India

- /

- Consumer Durables

- /

- NSEI:JCHAC

More Unpleasant Surprises Could Be In Store For Johnson Controls-Hitachi Air Conditioning India Limited's (NSE:JCHAC) Shares After Tumbling 26%

Johnson Controls-Hitachi Air Conditioning India Limited (NSE:JCHAC) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 60% in the last year.

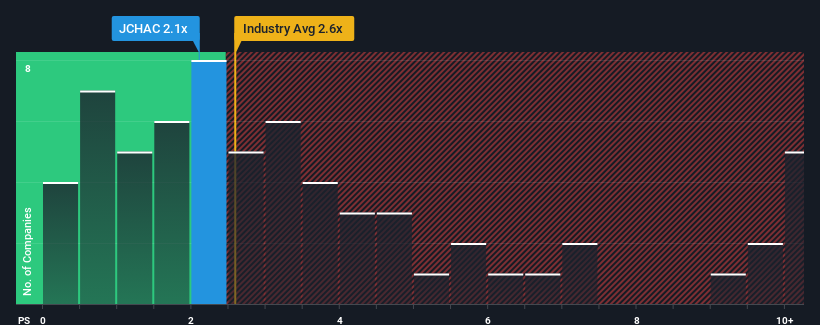

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Johnson Controls-Hitachi Air Conditioning India's P/S ratio of 2.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in India is also close to 2.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Johnson Controls-Hitachi Air Conditioning India

How Has Johnson Controls-Hitachi Air Conditioning India Performed Recently?

Johnson Controls-Hitachi Air Conditioning India could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Johnson Controls-Hitachi Air Conditioning India.How Is Johnson Controls-Hitachi Air Conditioning India's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Johnson Controls-Hitachi Air Conditioning India's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. As a result, it also grew revenue by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 21% over the next year. That's shaping up to be materially lower than the 31% growth forecast for the broader industry.

With this information, we find it interesting that Johnson Controls-Hitachi Air Conditioning India is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Following Johnson Controls-Hitachi Air Conditioning India's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Johnson Controls-Hitachi Air Conditioning India's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 2 warning signs we've spotted with Johnson Controls-Hitachi Air Conditioning India.

If you're unsure about the strength of Johnson Controls-Hitachi Air Conditioning India's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JCHAC

Johnson Controls-Hitachi Air Conditioning India

Manufactures and distributes air conditioners, chillers, refrigerators, air purifiers, and variable refrigerant flow systems in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives