- India

- /

- Consumer Durables

- /

- NSEI:JCHAC

Johnson Controls-Hitachi Air Conditioning India (NSE:JCHAC) Shareholders Have Enjoyed A 38% Share Price Gain

It hasn't been the best quarter for Johnson Controls-Hitachi Air Conditioning India Limited (NSE:JCHAC) shareholders, since the share price has fallen 15% in that time. But that doesn't change the fact that the returns over the last five years have been pleasing. After all, the share price is up a market-beating 38% in that time.

View our latest analysis for Johnson Controls-Hitachi Air Conditioning India

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

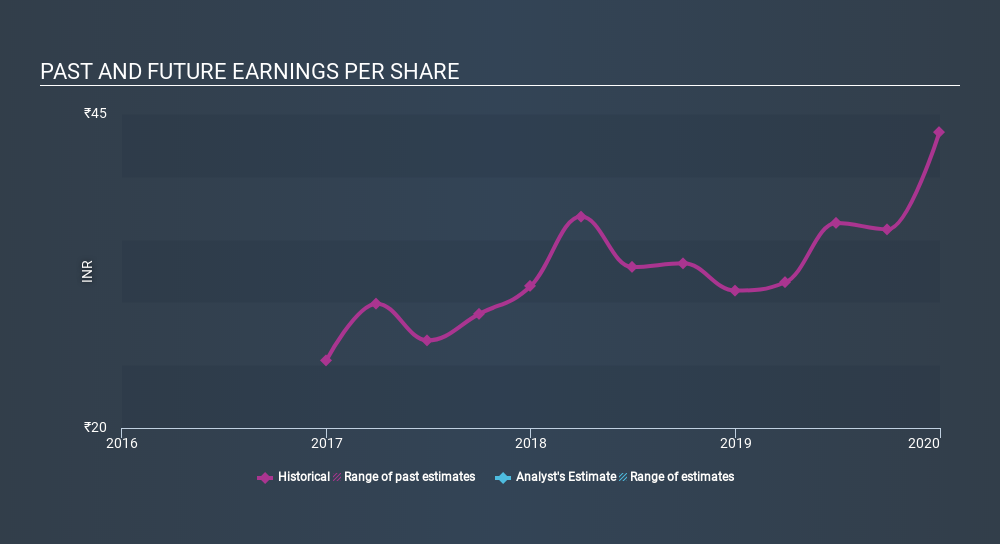

Over half a decade, Johnson Controls-Hitachi Air Conditioning India managed to grow its earnings per share at 14% a year. This EPS growth is higher than the 6.7% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We're pleased to report that Johnson Controls-Hitachi Air Conditioning India shareholders have received a total shareholder return of 9.0% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 6.8%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Johnson Controls-Hitachi Air Conditioning India better, we need to consider many other factors. For instance, we've identified 1 warning sign for Johnson Controls-Hitachi Air Conditioning India that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:JCHAC

Bosch Home Comfort India

Manufactures and distributes air conditioners, chillers, refrigerators, air purifiers, and variable refrigerant flow systems in India and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion