- India

- /

- Professional Services

- /

- NSEI:BLS

Undiscovered Gems in India to Watch This August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.7%, yet it remains up by an impressive 43% over the past year. In this dynamic environment, identifying stocks with strong growth potential and solid fundamentals is key, especially as earnings are projected to grow by 17% per annum over the next few years.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Voith Paper Fabrics India | NA | 10.97% | 9.70% | ★★★★★★ |

| Macpower CNC Machines | NA | 20.01% | 23.61% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Liberty Shoes | 33.72% | 3.01% | 17.85% | ★★★★★☆ |

| Genesys International | 10.57% | 13.38% | 27.53% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.41% | 6.90% | 11.82% | ★★★★☆☆ |

| Sanstar | 50.30% | 37.73% | 58.24% | ★★★★☆☆ |

| Apollo Micro Systems | 38.17% | 10.59% | 11.93% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

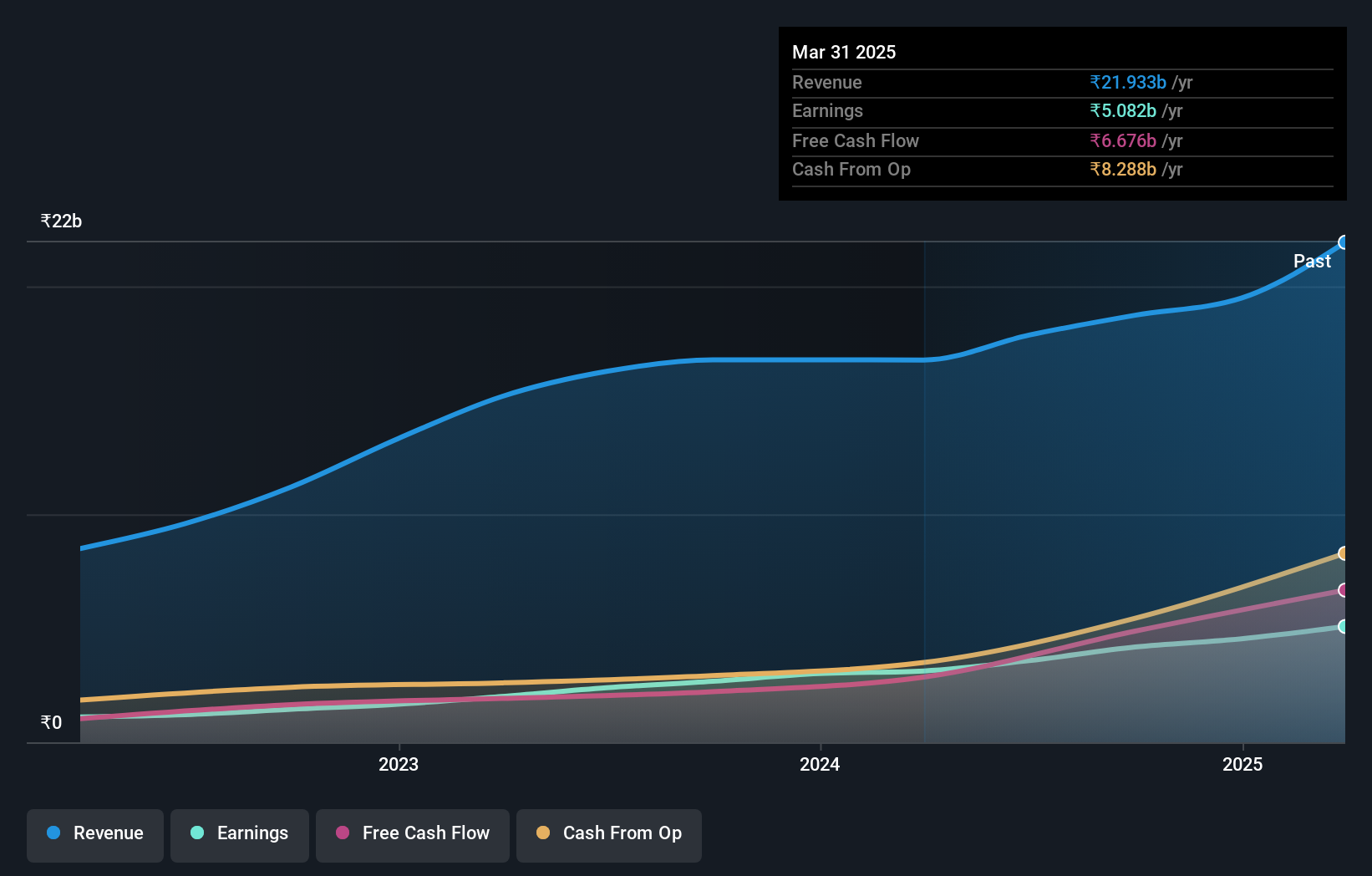

Overview: BLS International Services Limited specializes in outsourcing and administrative tasks for visa, passport, and consular services to various diplomatic missions, with a market cap of ₹160.45 billion.

Operations: BLS International Services Limited generates revenue primarily from Visa and Consular Services (₹14.71 billion) and Digital Services (₹3.34 billion).

BLS International Services has shown impressive growth, with earnings rising by 49.8% over the past year, outpacing the Professional Services industry’s 10.4%. The company reported Q1 sales of INR 4.93 billion and net income of INR 1.14 billion, significantly higher than last year's figures. BLS's debt-to-equity ratio improved from 7.8 to 2.1 over five years, and its interest payments are well-covered by EBIT at an impressive 86.8x coverage ratio.

IFB Industries (NSEI:IFBIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: IFB Industries Limited, along with its subsidiaries, manufactures and trades in home appliances in India and internationally, with a market cap of ₹86.18 billion.

Operations: IFB Industries Limited generates revenue primarily from its Home Appliances segment, which accounts for ₹36.32 billion, followed by the Engineering segment at ₹8.55 billion and Steel at ₹1.65 billion. The Motor segment contributes ₹670.70 million to the total revenue.

IFB Industries, a growing player in the Consumer Durables sector, has seen its earnings surge by 612.7% over the past year, outpacing industry growth of 17%. With a debt-to-equity ratio rising from 11.6% to 22.9% in five years, it remains well-covered with EBIT at 7.5x interest payments. Recent quarterly results show sales hitting ₹12,691 million against ₹10,859 million last year and net income reversing from a loss to ₹375 million.

- Unlock comprehensive insights into our analysis of IFB Industries stock in this health report.

Examine IFB Industries' past performance report to understand how it has performed in the past.

Tips Industries (NSEI:TIPSINDLTD)

Simply Wall St Value Rating: ★★★★★★

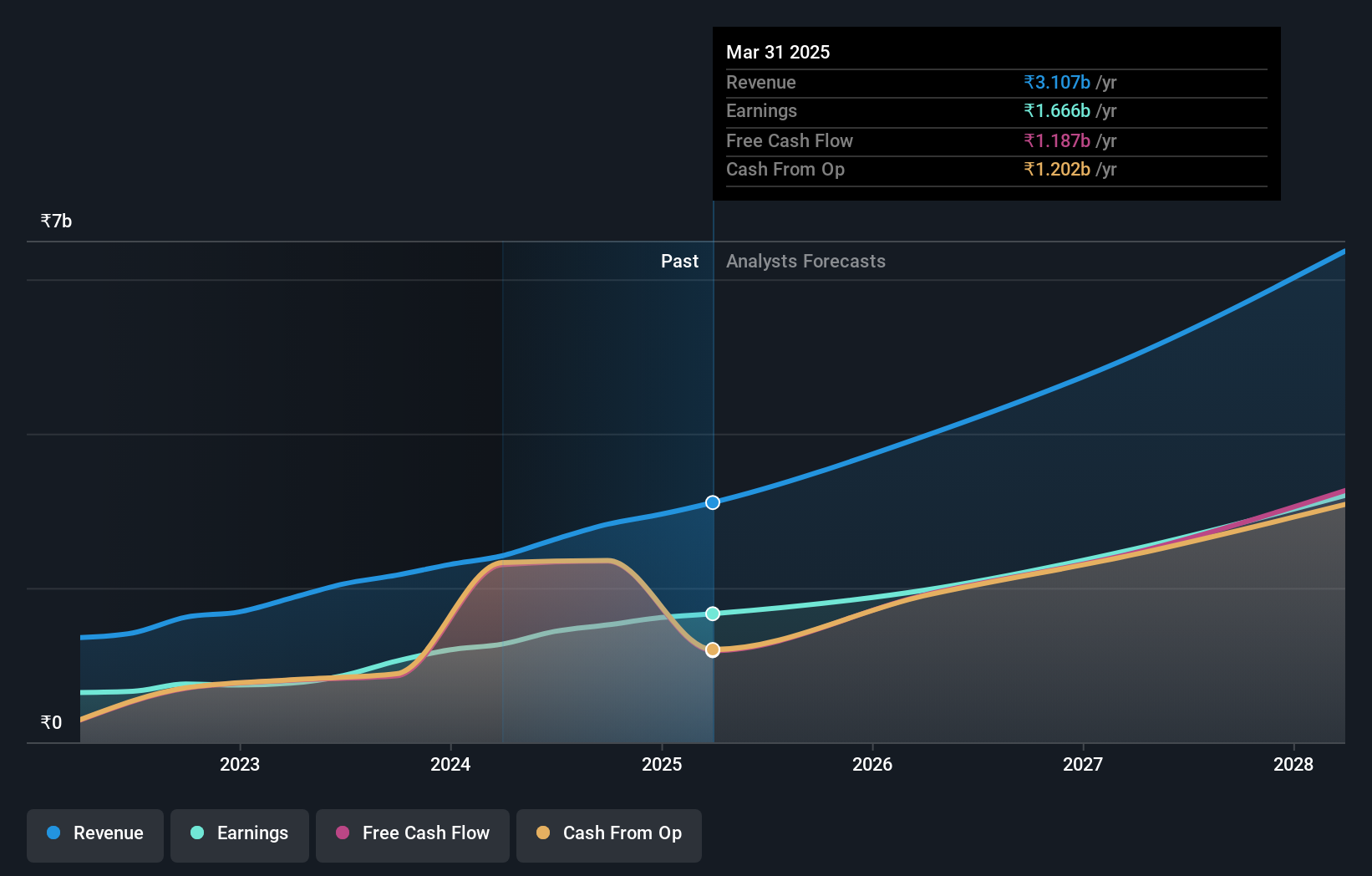

Overview: Tips Industries Limited specializes in the acquisition and exploitation of music rights both in India and internationally, with a market cap of ₹91.57 billion.

Operations: Tips Industries Limited generates revenue primarily from its music segment, amounting to ₹2.63 billion.

Tips Industries, a promising player in the entertainment sector, has shown impressive earnings growth of 66.2% over the past year, outpacing the industry's 11.6%. The company’s debt-to-equity ratio has significantly improved from 12.1 to 2.8 over five years, reflecting better financial health. Recent quarterly results reported sales of INR 739.16 million and net income of INR 435.63 million, up from INR 271.01 million last year. With high-quality earnings and positive free cash flow, Tips Industries is positioned well for future growth prospects.

- Click here to discover the nuances of Tips Industries with our detailed analytical health report.

Understand Tips Industries' track record by examining our Past report.

Make It Happen

- Click through to start exploring the rest of the 454 Indian Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BLS International Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BLS

BLS International Services

Provides outsourcing and administrative task of visa, passport, and consular services to various diplomatic missions in India.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion