- India

- /

- Professional Services

- /

- NSEI:BLS

Undiscovered Gems In India To Watch This August 2024

Reviewed by Simply Wall St

Following a rise of over 1 per cent, which ended a three-day losing streak, the Indian stock market benchmark Nifty 50 experienced a nearly 1 per cent drop during intraday trading on Thursday, August 8. The market trend reflects buying on dips and profit booking at higher levels, driven by heightened geopolitical tensions and concerns over US economic growth. In such volatile times, identifying fundamentally strong companies with robust business models can offer resilience and potential for long-term gains.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pearl Global Industries | 54.72% | 19.34% | 38.59% | ★★★★★★ |

| Macpower CNC Machines | NA | 20.01% | 23.61% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.70% | 9.76% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Indo Amines | 82.32% | 17.09% | 18.35% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.78% | 39.75% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| Genesys International | 10.57% | 13.38% | 27.53% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.07% | -10.66% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

Overview: BLS International Services Limited specializes in outsourcing and administrative tasks related to visa, passport, and consular services for various diplomatic missions, with a market cap of ₹164.63 billion.

Operations: BLS International Services generates revenue primarily from outsourcing and administrative services for visa, passport, and consular tasks. With a market cap of ₹164.63 billion, the company focuses on providing these services to various diplomatic missions.

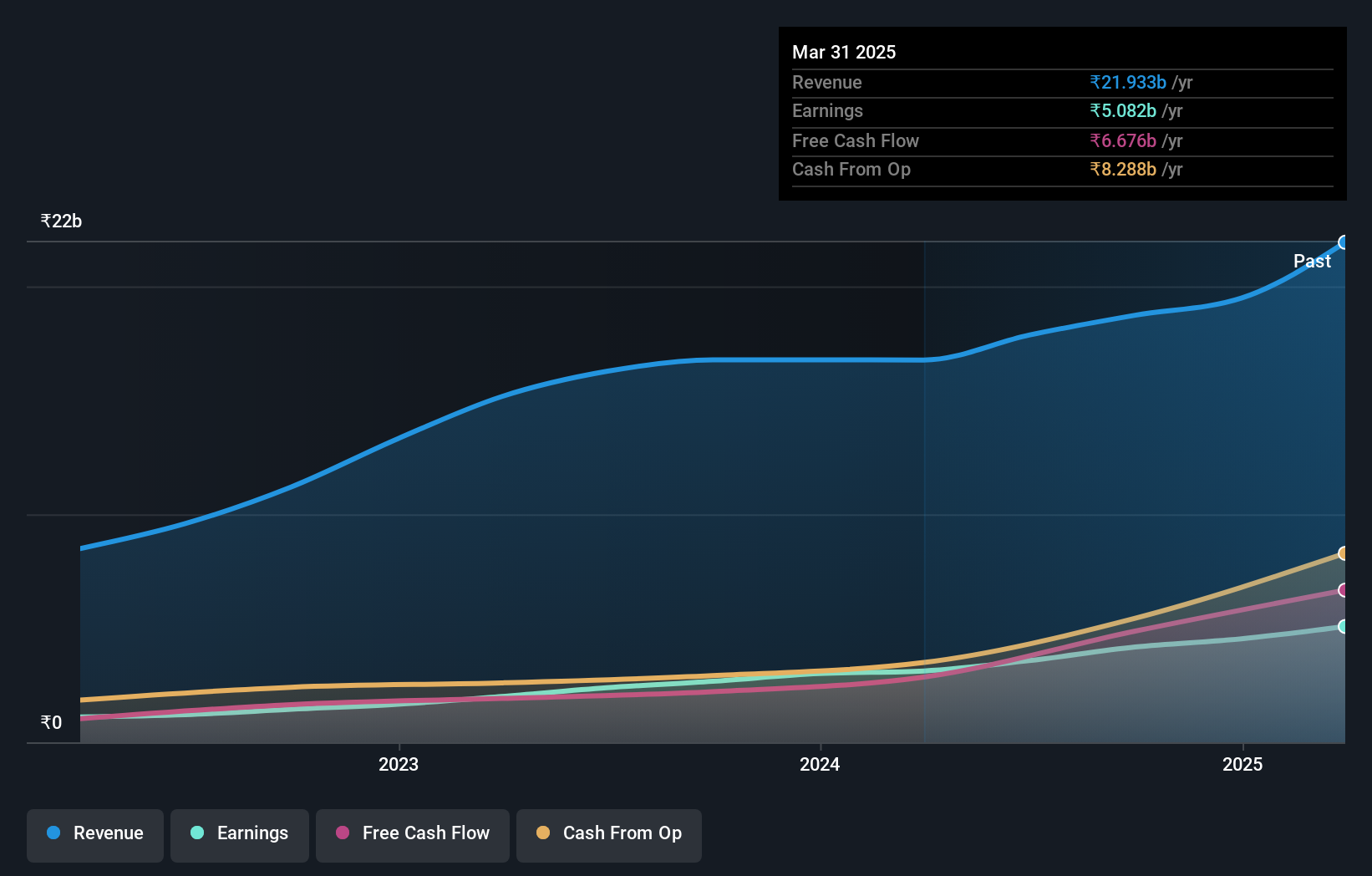

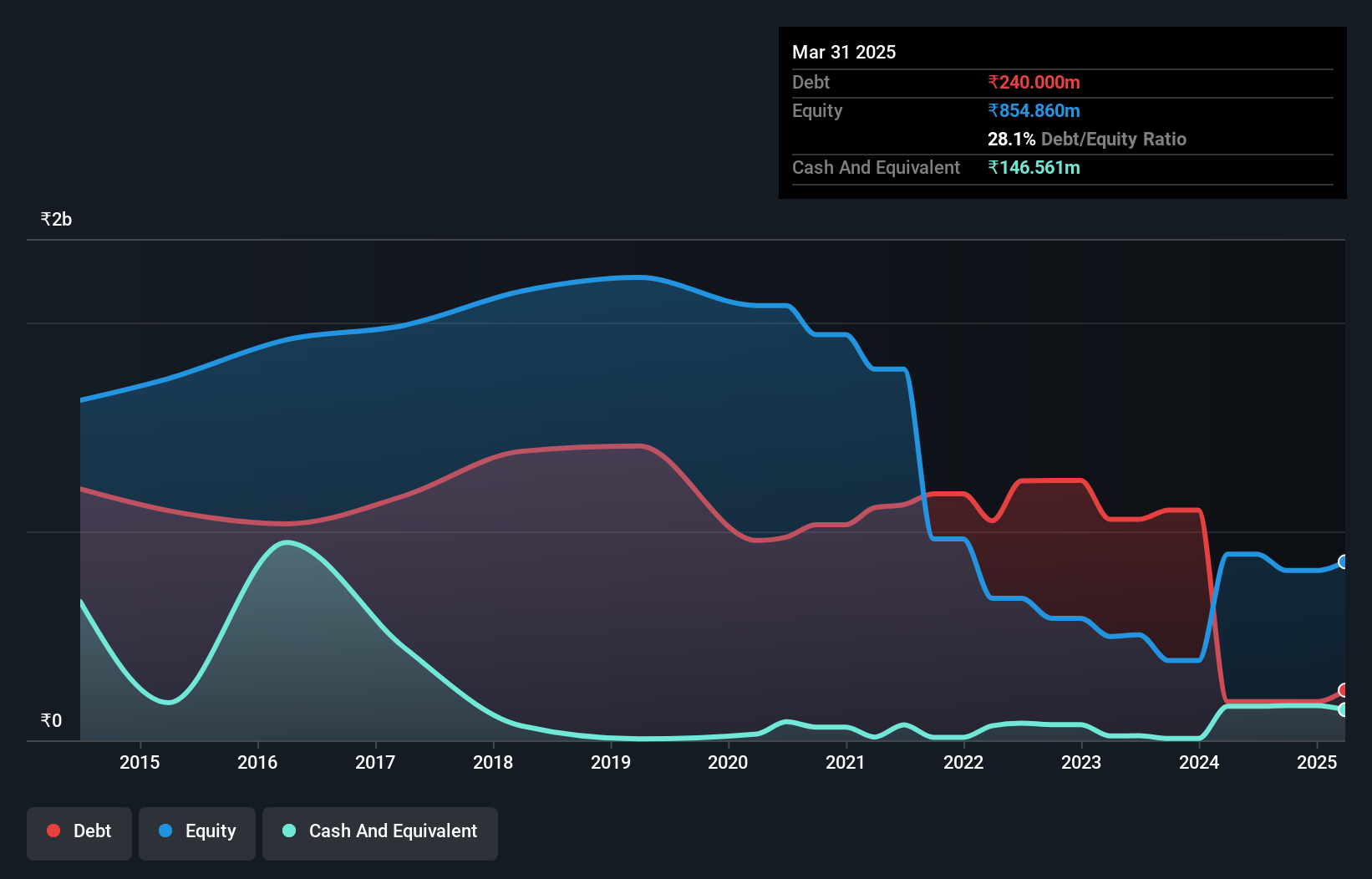

BLS International Services has seen its debt-to-equity ratio drop from 7.8% to 2.1% over the past five years, indicating improved financial health. Recent earnings growth of 49.8% outpaced the Professional Services industry's 10.4%, showcasing robust performance. The company reported Q1 revenue of INR 5,101.92 million and net income of INR 1,141.84 million, up from INR 3,905.12 million and INR 689.13 million respectively a year ago; basic EPS rose to INR 2.77 from INR 1.68 last year.

IFB Industries (NSEI:IFBIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: IFB Industries Limited, along with its subsidiaries, manufactures and trades in home appliances both in India and internationally, with a market cap of ₹84.59 billion.

Operations: The company generates revenue primarily from Home Appliances (₹36.32 billion), Engineering (₹8.55 billion), Steel (₹1.65 billion), and Motor segments (₹670.70 million).

IFB Industries has shown remarkable growth, with earnings skyrocketing by 612.7% over the past year, far outpacing the Consumer Durables industry’s 20.7%. The company reported Q1 2025 sales of INR 12.69 billion, up from INR 10.86 billion a year ago, and net income of INR 375.4 million compared to a net loss of INR 6.2 million previously. IFB's debt-to-equity ratio increased from 11.6% to 22.9% over five years, yet it holds more cash than total debt, reflecting strong financial health and high-quality earnings with EBIT covering interest payments by a factor of 7.5x.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited engages in the generation of solar power in India, with a market cap of ₹44.92 billion.

Operations: Ujaas Energy Limited generates revenue primarily from its Solar Power Plant Operation segment (₹297.31 million) and the Manufacturing and Sale of Solar Power Systems segment (₹172.52 million). The company also has a smaller revenue stream from EV-related activities, contributing ₹45.84 million.

Ujaas Energy, a small-cap company in the renewable energy sector, has shown significant financial shifts recently. The firm reported a net income of ₹289.56M for the year ending March 31, 2024, compared to a net loss of ₹180.57M the previous year. Despite this turnaround, it faced a large one-off loss of ₹93.8M impacting its last 12 months' results. Additionally, UEL's debt to equity ratio improved from 63.6% to 20.8% over five years and is trading at 67% below estimated fair value.

- Navigate through the intricacies of Ujaas Energy with our comprehensive health report here.

Evaluate Ujaas Energy's historical performance by accessing our past performance report.

Taking Advantage

- Access the full spectrum of 455 Indian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BLS International Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BLS

BLS International Services

Provides outsourcing and administrative task of visa, passport, and consular services to various diplomatic missions in India.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion