- India

- /

- Consumer Durables

- /

- NSEI:IFBIND

IFB Industries Limited's (NSE:IFBIND) Share Price Is Still Matching Investor Opinion Despite 28% Slump

IFB Industries Limited (NSE:IFBIND) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Indeed, the recent drop has reduced its annual gain to a relatively sedate 6.8% over the last twelve months.

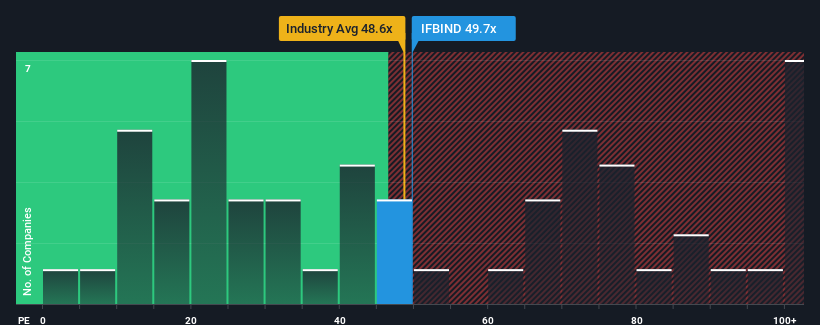

Although its price has dipped substantially, IFB Industries' price-to-earnings (or "P/E") ratio of 49.7x might still make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 29x and even P/E's below 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for IFB Industries as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for IFB Industries

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as IFB Industries' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 294% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 69% during the coming year according to the two analysts following the company. With the market only predicted to deliver 26%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that IFB Industries' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From IFB Industries' P/E?

IFB Industries' shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of IFB Industries' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for IFB Industries with six simple checks.

If you're unsure about the strength of IFB Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IFBIND

IFB Industries

Manufactures and trades in home appliances in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives