- India

- /

- Professional Services

- /

- NSEI:BLS

Discovering 3 Undiscovered Gems In India With Strong Financials

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 4.0%, but it has risen by 40% over the past year, with earnings expected to grow by 17% per annum in the coming years. In this dynamic environment, identifying stocks with strong financials can provide stability and growth potential; here are three such undiscovered gems in India worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pearl Global Industries | 54.72% | 19.34% | 38.59% | ★★★★★★ |

| Kokuyo Camlin | 21.96% | 11.97% | 59.14% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.70% | 9.76% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 20.60% | 62.92% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Innovana Thinklabs | 4.53% | 12.52% | 19.93% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

Overview: BLS International Services Limited specializes in outsourcing and administrative tasks for visa, passport, and consular services to various diplomatic missions, with a market cap of ₹158.48 billion.

Operations: BLS International Services Limited generates revenue primarily from outsourcing and administrative services related to visas, passports, and consular activities for diplomatic missions. The company has a market cap of ₹158.48 billion.

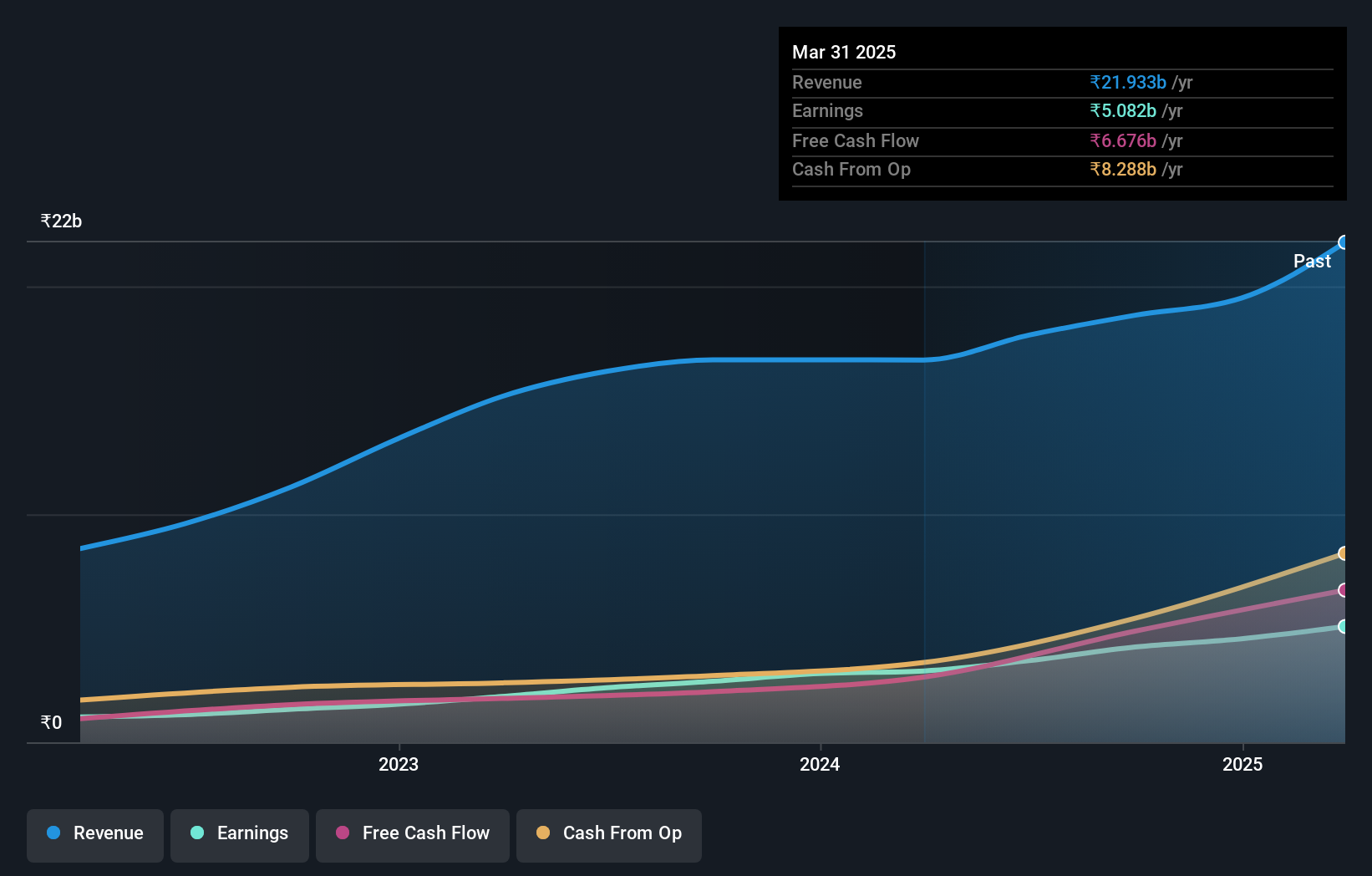

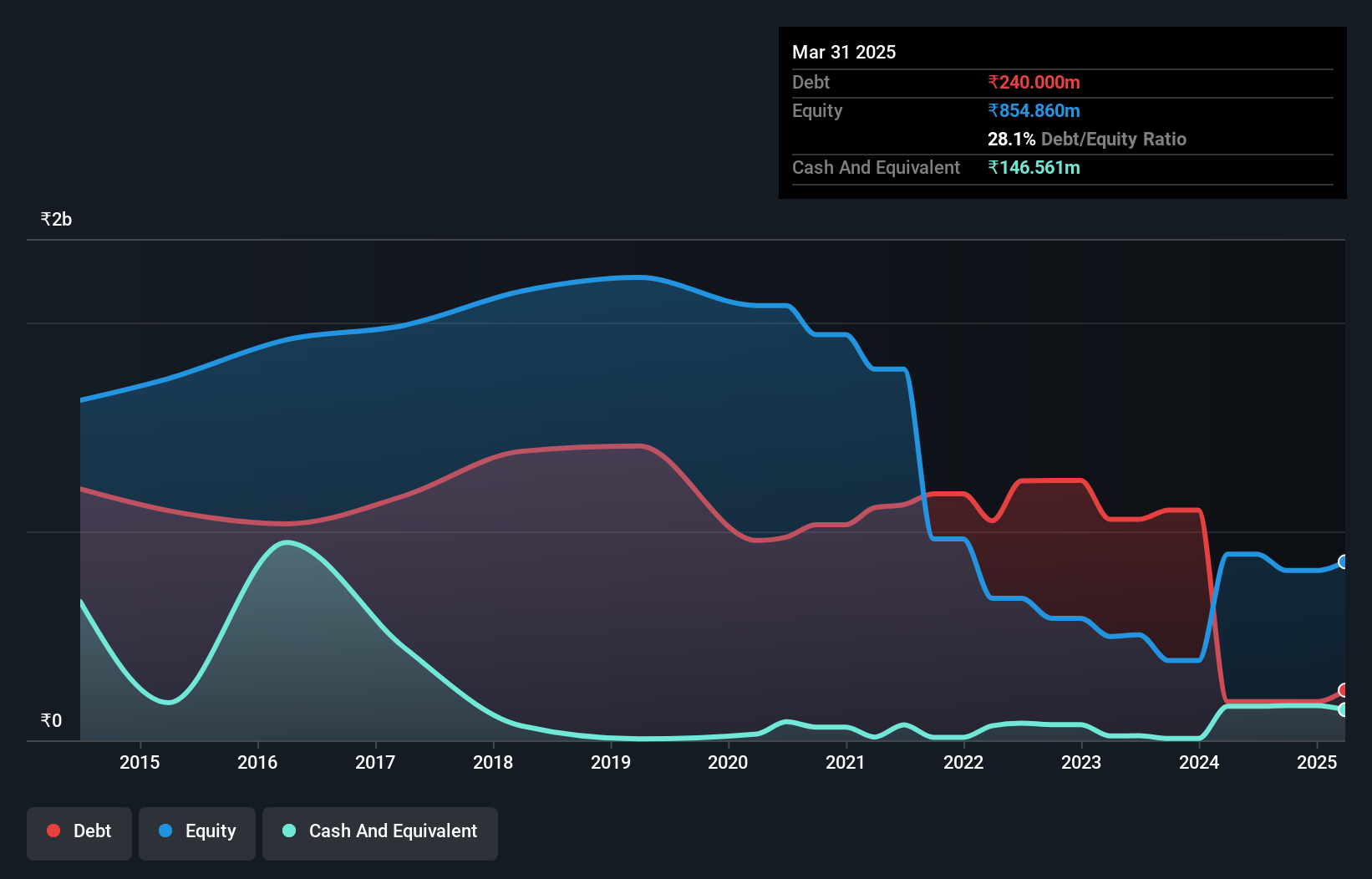

BLS International Services has shown impressive financial health, with its debt to equity ratio dropping from 7.8% to 2.1% over the past five years and earnings growing by 49.8% last year, outpacing the industry average of 10.4%. The company recently reported Q1 sales of INR 4,926.69 million compared to INR 3,834.88 million a year ago and net income rising to INR 1,141.84 million from INR 689.13 million previously, reflecting strong operational performance and high-quality earnings

IFB Industries (NSEI:IFBIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: IFB Industries Limited, together with its subsidiaries, manufactures and trades in home appliances in India and internationally, with a market cap of ₹78.22 billion.

Operations: The company's revenue streams primarily consist of Home Appliances (₹36.32 billion), Engineering (₹8.55 billion), Steel (₹1.65 billion), and Motors (₹670.70 million).

IFB Industries has shown remarkable earnings growth of 612.7% over the past year, far outpacing the Consumer Durables industry average of 17.4%. The company's interest payments on its debt are well covered by EBIT at a ratio of 7.5x, indicating solid financial health. Additionally, IFB's net income for Q1 2024 was INR 375.4 million compared to a net loss of INR 6.2 million a year ago, with basic earnings per share from continuing operations rising to INR 9.26 from a loss per share of INR 0.15 in the previous year.

- Delve into the full analysis health report here for a deeper understanding of IFB Industries.

Gain insights into IFB Industries' historical performance by reviewing our past performance report.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited operates in the generation of solar power in India with a market cap of ₹40.75 billion.

Operations: Ujaas Energy Limited generates revenue primarily from its Solar Power Plant Operation (₹297.31 million) and the Manufacturing and Sale of Solar Power Systems (₹172.52 million). The company also has a smaller revenue stream from EV-related activities (₹45.84 million).

Ujaas Energy, a small cap in the renewable energy sector, has shown significant financial volatility. Recent earnings for the fourth quarter ended March 31, 2024, reported sales of ₹68.44M and revenue of ₹319.94M with a net loss of ₹41.44M. The full year saw revenue jump to ₹528.73M from ₹312.79M while net income reached ₹289.56M compared to last year's loss of ₹180.57M; basic EPS was INR 1.84 versus -0.9 previously

- Click to explore a detailed breakdown of our findings in Ujaas Energy's health report.

Explore historical data to track Ujaas Energy's performance over time in our Past section.

Key Takeaways

- Delve into our full catalog of 458 Indian Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BLS International Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BLS

BLS International Services

Provides outsourcing and administrative task of visa, passport, and consular services to various diplomatic missions in India.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion