Some Goenka Diamond and Jewels (NSE:GOENKA) Shareholders Have Taken A Painful 94% Share Price Drop

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Imagine if you held Goenka Diamond and Jewels Limited (NSE:GOENKA) for half a decade as the share price tanked 94%. Unfortunately the share price momentum is still quite negative, with prices down 33% in thirty days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Goenka Diamond and Jewels

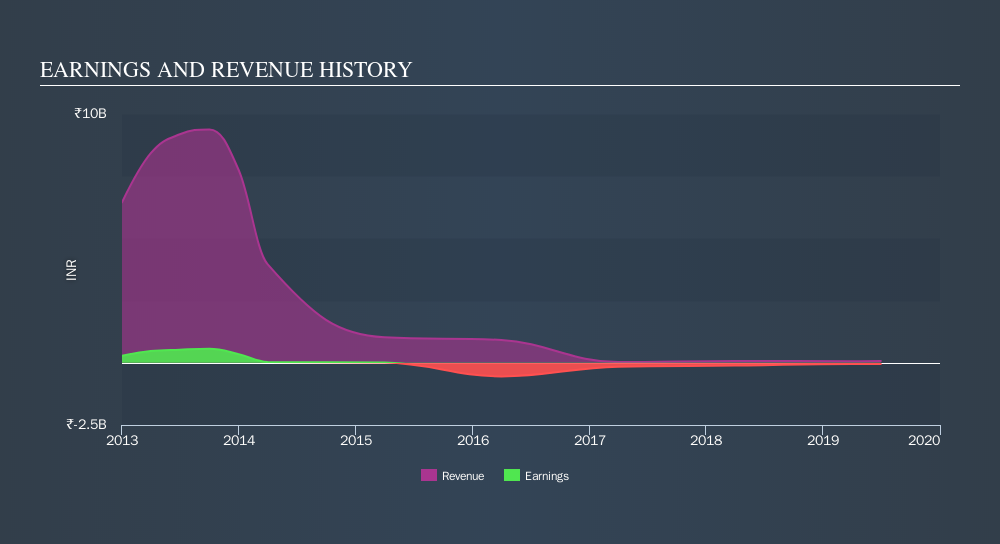

Given that Goenka Diamond and Jewels didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

The graphic below depicts how earnings and revenue have changed over time.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Goenka Diamond and Jewels's earnings, revenue and cash flow.

A Different Perspective

Investors in Goenka Diamond and Jewels had a tough year, with a total loss of 20%, against a market gain of about 8.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 44% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Goenka Diamond and Jewels better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:GOENKA

Goenka Diamond and Jewels

Engages in cutting and polishing of diamonds, color stones, and precious and semi-precious stones in India and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives