Filatex India (NSE:FILATEX) Has Announced That It Will Be Increasing Its Dividend To ₹0.20

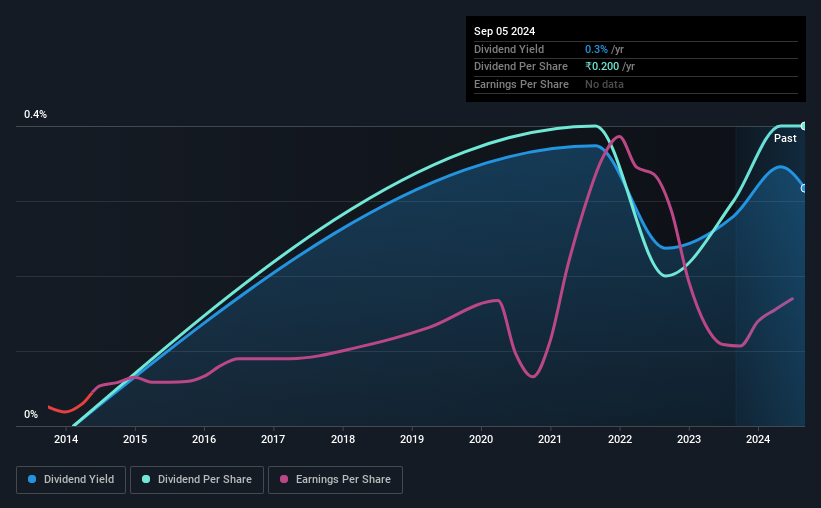

Filatex India Limited (NSE:FILATEX) will increase its dividend from last year's comparable payment on the 27th of October to ₹0.20. This takes the annual payment to 0.3% of the current stock price, which unfortunately is below what the industry is paying.

Check out our latest analysis for Filatex India

Filatex India's Projected Earnings Seem Likely To Cover Future Distributions

If it is predictable over a long period, even low dividend yields can be attractive. However, prior to this announcement, Filatex India's dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS could expand by 7.7% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 6.6% by next year, which is in a pretty sustainable range.

Filatex India's Dividend Has Lacked Consistency

Looking back, the company hasn't been paying the most consistent dividend, but with such a short dividend history it could be too early to draw solid conclusions. There hasn't been much of a change in the dividend over the last 3 years. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Filatex India Could Grow Its Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that Filatex India has grown earnings per share at 7.7% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

Our Thoughts On Filatex India's Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 2 warning signs for Filatex India (of which 1 is potentially serious!) you should know about. Is Filatex India not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FILATEX

Filatex India

Manufactures, sells, and trades polyester filament yarn, and synthetic yarn and textiles in India and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives