Imagine Owning AYM Syntex (NSE:AYMSYNTEX) While The Price Tanked 56%

AYM Syntex Limited (NSE:AYMSYNTEX) shareholders should be happy to see the share price up 17% in the last month. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 56% in that time. So it is really good to see an improvement. While many would remain nervous, there could be further gains if the business can put its best foot forward.

See our latest analysis for AYM Syntex

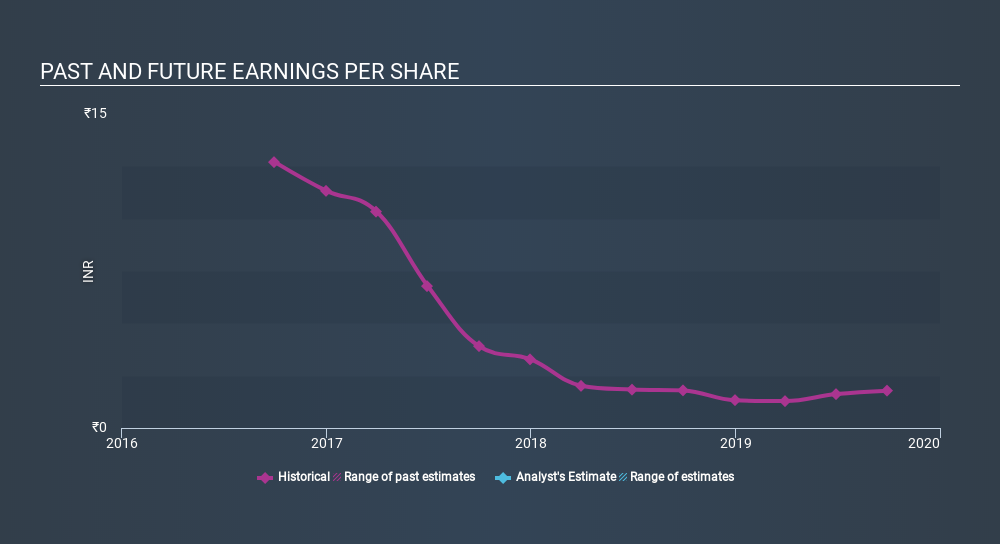

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

AYM Syntex saw its EPS decline at a compound rate of 48% per year, over the last three years. This fall in the EPS is worse than the 24% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on AYM Syntex's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for AYM Syntex shares, which cost holders 12%, while the market was up about 9.3%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 24% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with AYM Syntex (including 2 which is don't sit too well with us) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:AYMSYNTEX

AYM Syntex

Manufactures and sells polyester filament, nylon filament, and bulk continuous filament yarns for the textile and floor covering industries in India and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives