Axita Cotton Limited (NSE:AXITA) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Axita Cotton Limited (NSE:AXITA) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

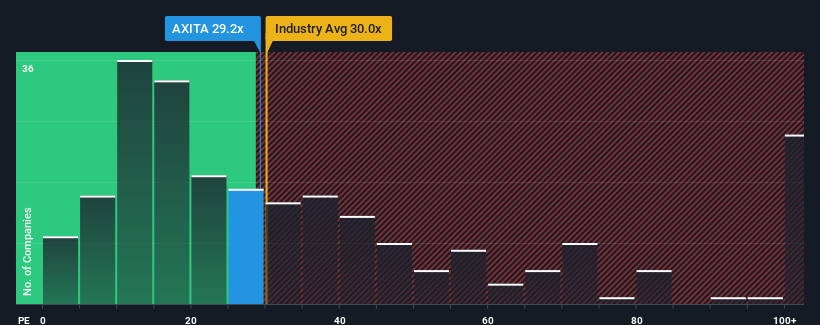

Although its price has dipped substantially, it's still not a stretch to say that Axita Cotton's price-to-earnings (or "P/E") ratio of 29.2x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Axita Cotton certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Axita Cotton

Is There Some Growth For Axita Cotton?

The only time you'd be comfortable seeing a P/E like Axita Cotton's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 58% last year. Pleasingly, EPS has also lifted 1,014% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that Axita Cotton is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Axita Cotton's P/E

Axita Cotton's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Axita Cotton currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Axita Cotton has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AXITA

Axita Cotton

Engages in manufacturing, processing, finishing, and trading of cotton bales, yarns, seeds, and agri commodities in India.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives